Atlassian co-founder and father of four Mike Cannon-Brookes has separated from his US-born wife, Annie, after 13 years of marriage.

News of the demerger emerged over the weekend in Nine newspapers, citing “sources close to the family”. An Atlassian spokesperson declined to comment.

An unauthorised source told the media: “They’re both focussed on their children as their number one priority right now. They ask that their privacy is respected.”

The pair, who have an extensive property portfolio worth more than $200 million, as well as the family venture capital fund Grok Ventures, reportedly parted ways a month ago.

They married in January 2010 after meeting in an airport lounge when she reportedly said hello after mistaking him for someone else.

She has had a long and successful career as a fashion designer as Annie Todd, with it continuing under the House of Cannon label during their marriage.

Atlassian was just eight-years-old when they met and six months after their nuptials, in July 2010, took on its first VC funding, with Accel Partners investing US$60 million. Five years later in December 2015, Atlassian listed on the Nasdaq with a US$4.37 billion market capitalisation. It’s now worth around US$45 billion.

The Cannon-Brookes family has a personal wealth of around A$20 billion, putting them among Australia’s top 10 richest people.

The end of their relationship comes just a fortnight after fellow billionaires Andrew and Nicola Forrest announced the end of their 31-year marriage.

Alongside his stake in the workplace software company he founded with his co-CEO, Scott Farquhar, Cannon-Brookes is also the largest shareholder in AGL Energy, the ASX-listed power company he made an unsuccessful takeover bid for last year.

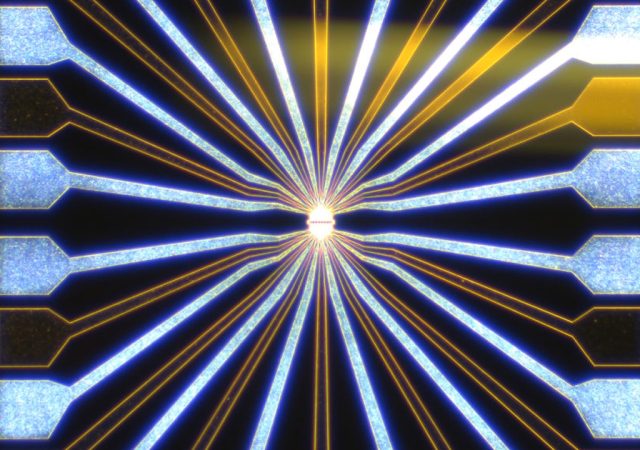

Cannon-Brookes also owns renewable energy startup Sun Cable. He invested hundreds of millions in the business alongside Andrew Forrest, backing a plan to pipe solar energy 4,200km underwater from Darwin to Singapore. But the billionaires fell out over strategic direction of the $30 billion project, which was placed in voluntary administration in mid January.

Cannon-Brookes, lent the business $65 million to keep the show on the road as the administrators looked for a buyer, then went on to win the bid to acquire Sun Cable from the liquidators via entity affiliated with Grok Ventures, their $2 billion family VC fund.

The pair also pledged in 2021 to invest $1 billion in climate tech startups. The Grok portfolio includes home renewables fintech Brighte, social impact startup Who Gives a Crap, Canberra-based battery investment fund Infradebt , customer insights platform Dovetail and nanosatellite startup Fleet Space, as well as payments fintech, Tyro, which listed on the ASX in 2019.

Mike Cannon-Brookes has a 25% stake in NRL team the South Sydney Rabbitohs alongside James Packer and Russell Crowe, as well as US NBA franchise Utah Jazz.

Then there’s an astonishing property portfolio, including the former Fairfax family mansion, Fairwater, in Sydney’s Point Piper, which they paid a record $100 million for in 2018. Scott Farquhar owns the $71. million house next door.

Annie Cannon-Brookes paid $20-25 million for the Great Barrier Reef tourism destination Dunk Island last year. They also have a $12 million house behind Fairwater, the former German consul-general’s home in Woollahra, acquired in 2020 for $18m, a 155 hectare farm in the NSW Southern Highlands that cost $15m, and two more nearby, including paying $5.35m for 45ha Rosehill Farm nearby and $3.3m for Joadja Creek.

North of Sydney there’s the former Jennifer Hawkins house in Newport, bought in 2020 for $24.5 million, a Palm Beach house bought for $8.7m in 2013, and on the other side of Pittwater, a shack at Great Mackerel Beach, snapped up for a bargain $2.3m in 2020.

Trending

Daily startup news and insights, delivered to your inbox.