Nothing excites investors and markets more than an emerging technology predicted to transform the way we live and work.

Cloud accounting, NFC payments, mobile phones and social networking have all been this transformational force.

Others have been hailed as the next big thing, to then plateau abruptly, or even fade into obscurity.

Amazon’s Kindle is considered by some to be an innovation that failed to live up to the hype. In 2009 the Kindle became the most gifted item in the history of Amazon in what many thought to be the death knell for paper books.

Rick Click Capital’s Benjamin Chong

But this was not to be the case and in the US today, fewer than one in five people own an e-reader such as a Kindle. Kindle was not a failure, but an example of technology that didn’t have as the impact that was expected.

Some technologies will eventually achieve mass adoption but take a little longer. Indeed very few technologies transcend the hype to transform entire industries overnight. Blockchain and driverless vehicles are examples of a slower burn in take up than what was initially anticipated.

Blockchain has been “the next big thing” for years but we haven’t seen it take off in the business world in any meaningful way. In a survey from Gartner, only 1% of CIOs were planning any kind of blockchain adoption and only 8% planned to experiment with it.

This lack of adoption is not necessarily a signal that an innovation is destined for the technology scrapheap. It is instead Amara’s law at play.

Coined by Roy Amara, past president of The Institute for the Future, Amara’s law says that, “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

For blockchain, the barriers to adoption are significant – it is slow, requires new skills and often involves costly replacement of legacy technology. Over the long term, blockchain still has enormous potential but it is now apparent that it will take longer for businesses to get on board the blockchain train.

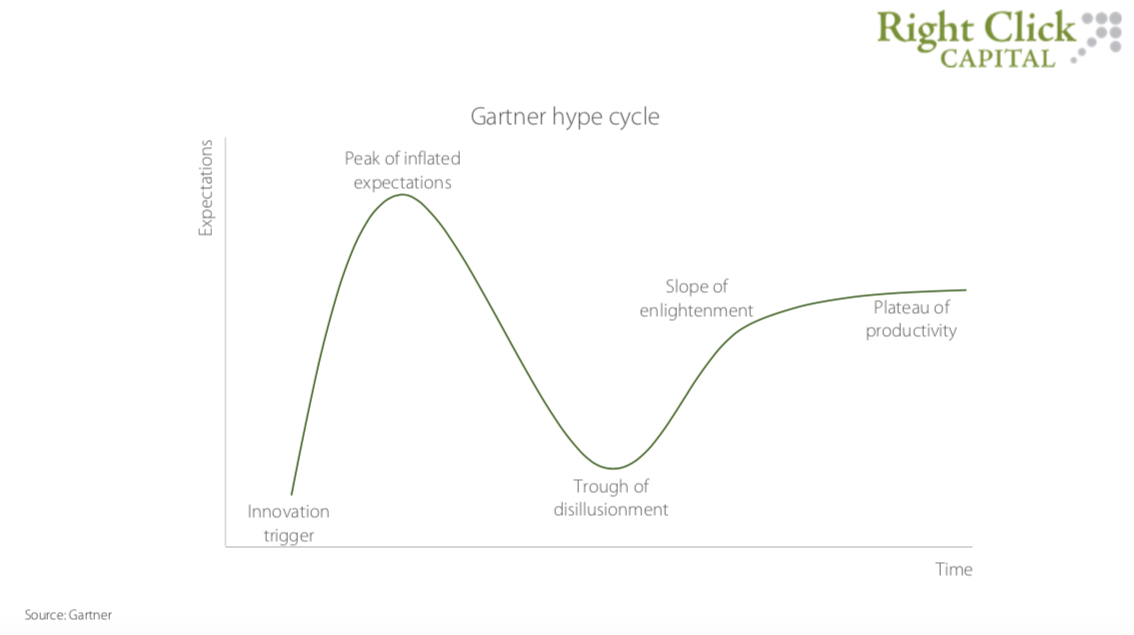

The Gartner hype cycle.

Gartner’s Hype Cycle (pictured above) is a visual representation of this roller coaster ride of emerging technology, charting the first rumblings of public excitement to the point of wide adoption, social application of technology and a sustainable proposition.

The hype cycle has five phases; the technology trigger, the peak of inflated expectations, the trough of disillusionment, the slope of enlightenment and the plateau of productivity.

Most technology has some kind of hype cycle, although the peaks and troughs may vary depending on whether the technology lives up to the hype and whether mass adoption occurs quickly.

Blockchain is likely to feature a large trough of disillusionment whilst cloud accounting may have barely dipped at all. At the peak it is not uncommon to see a raft of copycat businesses emerge which may threaten the success of original innovators.

The Gartner process focusses on emerging technologies, however, listed equities are influenced by hype cycles as they create volatility in the stocks exposed to these technologies.

One of the most talked about examples is the tech bubble of 1999 to 2000, when public markets held high expectations for ecommerce. It was much later with the introduction of 3G and broadband, smartphones and Software as a Service (SaaS) solutions that ecommerce really came of age after a deep trough of disillusionment and share price falls.

Next generation technologies often become overhyped as the market overestimates the speed of change and the impact on legacy technology in the short term. Many expected 3D printing technologies to change manufacturing overnight. Prices of listed stocks such 3D Systems (NYSE:DDD) and Stratasys (NASDAQ:SSYS) reflected this enthusiasm initially.

Share prices surged but quickly fell as it became evident that the applications were limited and 3D printing would not fundamentally change manufacturing overnight.

The hype cycle is of great interest to venture capital investors. Chances are that if technology is already dominating the headlines, then VC investors are likely to be onboard. VC investment typically flows into startups bringing the technology to market, at the beginning of the hype cycle.

This happens well before valuations surge and marketing departments generate excitement. If an investment is made too close to the peak, there is a greater chance of competitors entering the market and valuations are higher.

Gartner recently released a prediction of five trends that will significantly drive the Hype Cycle over the next five to ten years.

In its Hype Cycle for Emerging Technologies, 2020 Report, Gartner suggests that formative AI, digital me, composite architectures, algorithmic trust and beyond silicon are the key trends working their way up the hype cycle.

These areas of technology may not be an overnight success story but early investors in startups operating in these areas may be well placed to enjoy the long-term success, given the significant size of the opportunities.

VC investors look for other applications or use cases of technology to increase the chances of success if the original use case is unsuccessful. They also factor in the size of the market as this influences hype and is an indicator of potential adoption.

In the Gartner report, “digital me” health passport apps are showcased for the enormous potential arising from their growing penetration in densely populated countries such as India and China. Health passport apps have 5% to 20% market penetration in these markets, something that is rarely seen in technology just entering the hype cycle.

By skilfully navigating hype cycles, investors can spot patters that indicate the growth potential of new technology. This helps them to better predict which technologies will transform industries at an early stage and which will mature over time.

The long-term nature of VC investment gives investors the best possible chance for success and an opportunity to ride out any downturn in the short term until the technology reaches its full potential.

- Benjamin Chong is a partner at venture capital firm Right Click Capital, investors in bold and visionary tech founders.

Trending

Daily startup news and insights, delivered to your inbox.