Personal lending fintech Driva has landed a multi-year partnership with leading vehicle marketplace Carsales.com.

The Carsales (ASX:CAR) partnership will see Driva offer personalised finance options next to all privately sold vehicles, with options to pre-qualify, apply and get pre-approved for finance.

Carsales executive GM Matt Earle said the deal will mean around 45% of the automobile listings on the platform, some 120,000 vehicles, will have the finance option.

“The partnership is a key enabler for us to further digitise the entire car buying experience for Australian consumers,” he said,

“We know most Australians are financing their vehicle purchases, and partnering with Driva has been an important step for us to support a personalised finance offer for our consumers as they progress through their purchase journey.”

The Driva API toolkit being introduced to Carsales is already in wide use in the sector.

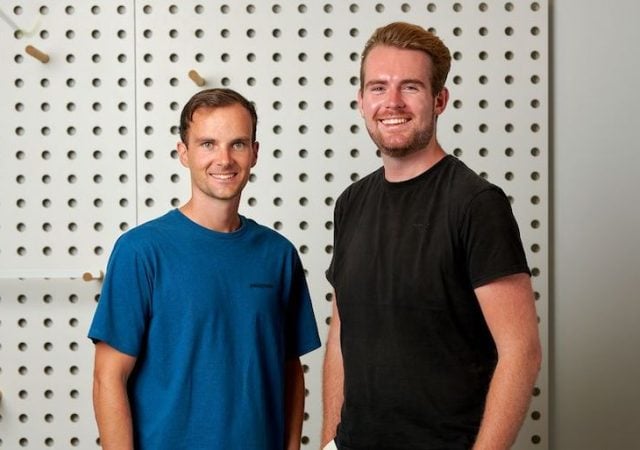

Scott Montarello and William Brown cofounded Driva three years ago, and raised $6 million last year in a round led by Carthona Capital.

Driva can offer everything from $10,000 to consolidate debt or $80,000 to buy a caravan, and offers clients the ability to provide customers with pre-qualified finance options online.

Montarello said Driva can handle volume that traditional players in the industry just wouldn’t be equipped to handle without significant resources to support it.” said Mr Montarello.

“The core value proposition for both end customers and our partners is our proprietary Driva assessment engine, which enables us to instantly match customers with their lowest repayment loan option across 40+ Australian lenders in market,” he said.

“It looks simple from a customer perspective, but in the background, we’re assessing thousands of data points for each customer to ensure we’re offering genuine approvals from our full panel of lenders, something we believe to be unique in the Australian market.”

His cofounder, William Brown, said the company continues to hit milestones despite changing market conditions and increasing interest rates.

“We were impacted like almost every Australian company in the last 12 months off the back of changing economic conditions and rate rises, but we made quick decisions as soon as we saw the warning signs, and we are now in a stronger position than ever,” he said.

“We’re hitting record numbers each month, and our continued focus on margins means we’re doing it all sustainably.”

Trending

Daily startup news and insights, delivered to your inbox.