Banking fintech Constantinople pockets $50 million Series A

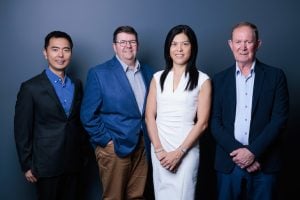

Banking-in-box fintech Constantinople has raised $50 million in a Series A. The round was led by Dutch internet investment firm Prosus Ventures, with support from existing Australian backers Square Peg and AirTree. The Sydney startup, founded in 2022 by former Westpac managers Macgregor Duncan and Dianne Challenor, previously raised US$23 million (A$32m) in a Seed… Read more »