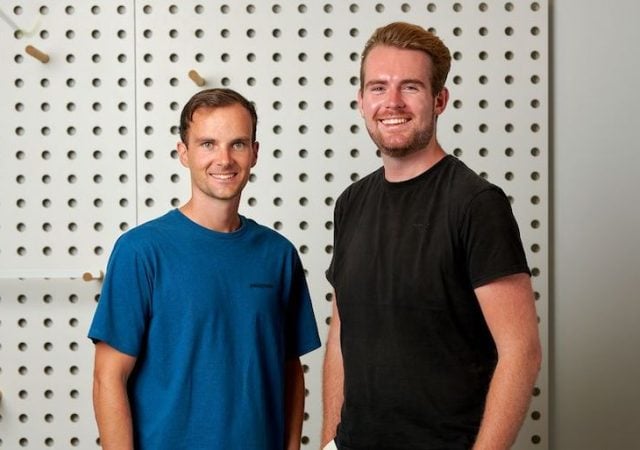

Rayn Ong is the Taylor Swift of Australian venture capital.

The Archangel Ventures partner has made more than 100 investments. A Startmate mentor, Blackbird limited partner and poker shark, Ong works with angel investors and venture fund mangers to co-invest in 1st and 2nd rounds for early stage tech startups.

His fans, known as Ongies, send him startup swag, hoping he’ll like it enough to invest (he’s a size M). Their LinkedIn accounts are filled with photos with Ong, his presence a talisman for future success.

With so much experience, and inspired by the Wall Street Journal bestseller Venture Deals and Peter Thiel’s startup bible Zero to One, Ong decided it was time to share the lessons he’s learnt as an angel investor over the past decade, writing an ebook, Memoirs of a dumb VC.

When he read the opening chapters to guests at a 361 Angel Club gathering in Sydney recently, the response inspired Ong to complete the book for release

361 Angel Club organiser and Aussie Angels founder Cheryl Mack said the Ong shared that he was writing a book, she “knew it was going to be juicy”.

“Rayn has walked an incredible path and has such a unique story, from how he got into VC, to his YOLO fund, to how he creates exceptional diversification with ginger in his portfolio. You get to hear it all in this ebook,” she said.

“We weren’t sure what to expect from the first two chapters, but the reading at 361 Angel Club was outstanding, everyone was riveted, and that’s saying a lot for people who were mostly there to drink and chat to each other.”

While many in venture capitalists end up in the job because they failed the Myers-Briggs test for a role at Goldman Sachs, Ong is an exception. An eternal optimist, and inspired by the entrepreneurial vision of Softbank CEO Masayoshi Son, Ong rejects any suggestion that “dumb VC” is a tautology.

“Most people don’t understand that over 90% of the VCs are actually in the top quartile,” he told Startup Daily.

“You can be dumb and still make a lot of money, if you are lucky like me.”

Ong takes aim at the media for painting “a very bleak picture” of the local venture capital scene, which led to him pondering his future in the sector.

“I was worried about my future as a VC fund manager, so I started exploring some side hustles as an insurance plan,” he said.

“I have considered a few potential pivots: futurist, strategist, motivational speaker, or stand-up comedian. I settled on something more on brand and on trend – content creator. This is my wheelhouse as I am already on a weekly self promotion routine on LinkedIn, this is something I know I can do well.”

But as he spoke to colleagues, Ong realised sharing his wisdom would deliver the biggest ROI for the local ecosystem.

“I tested the market (test 1, test 2), and the community engagement was extremely strong, about 20x the normal rate, so I knew I had product-market-fit,” he said.

“The idea of an eBook to talk about my observations and learnings as a VC fund manager then became very obvious.”

One of the lessons he shares in Memoirs of a dumb VC is the importance of holding on – HODL, he calls it.

While many funds with Australia’s prestigious Tier One VCs are reaching the end of the 10-year life and investors have their fingers crossed for an exit, Ong is prepared to wait.

“I am a long term investor managing patience capital, so I don’t normally think about exit that often,” he said.

“Additionally, most of my 2021 investments are underwater so it is unwise to lock in a loss by exiting right now.”

Like many successful local VCs, Rayn Ong has a slice of Canva.

“Canva is a very special company, I will continue to hold it until it doesn’t make sense for me to,” he said.

“But I suspect the real question to ask is how much allocation I can get my hands on, given the demand.”

OK. So given Canva’s current valuation, if he had $45 billion, would Ong spend it on a majority stake?

“I would keep $9 billion for fees. Then I would set up an iceberg buy order on IPO day with the remaining $36 billion,” he said.

“I have friends who know how to set up an iceberg buy order. I may park the cash via our portfolio company Primary.so to earn good interest between now and then.”

Among the more fascinating insights in Memoirs of a dumb VC is Ong’s views on the local venture ecosystem.

The Archangels boss believes Australian investors are not spending enough money at high enough valuations to support local founders.

“Australian investors are too conservative and risk averse. They are also very price sensitive, like me,” he said.

And Australian VCs don’t charge enough in management fees compared to their international counterparts.

“Absolutely not. We have smaller fund sizes too, so most managers are still on ramen salary,” Ong said.

In the presence of the Great Man, Startup Daily felt like now was our chance to pitch an idea to Rayn Ong is the hope that he’ll invest. We thought our “Uber for an AI-based co-working rapid delivery buy now pay later marketplace” with a total addressable market of everyone had massive potential and asked how much cash, or Solana, he’d invest, pre-revenue.

“There’s not enough blockchain so I will sit out for now,” Ong said.

The ebook of Memoirs of a dumb VC by Rayn Ong is available today. The price is $65 + a t-shirt. Contact Rayn on the former Twitter or via LinkedIn. An audiobook version will be released once Ryan Reynolds has finished the reading.

Trending

Daily startup news and insights, delivered to your inbox.