Shares in PPK Group spin-off battery tech company Li-S Energy skyrocketed by 175% on listing on the ASX today, pushing the company’s market cap to unicorn levels on debut.

At one stage Li-S Energy shares (ASX:LIS) were up more than 250% to a peak of $3.05 before closing at $2.33.

The company raised $34 million at 85¢ a share for a valuation of $544 million its IPO. The business ended the day worth around $1.5 billion.

Li-S Energy is a joint venture between PPK Group (ASX: PPK), which has a 45% stake in the business, Deakin University (13%) and manufacturer BNNT Technology (4.69%).

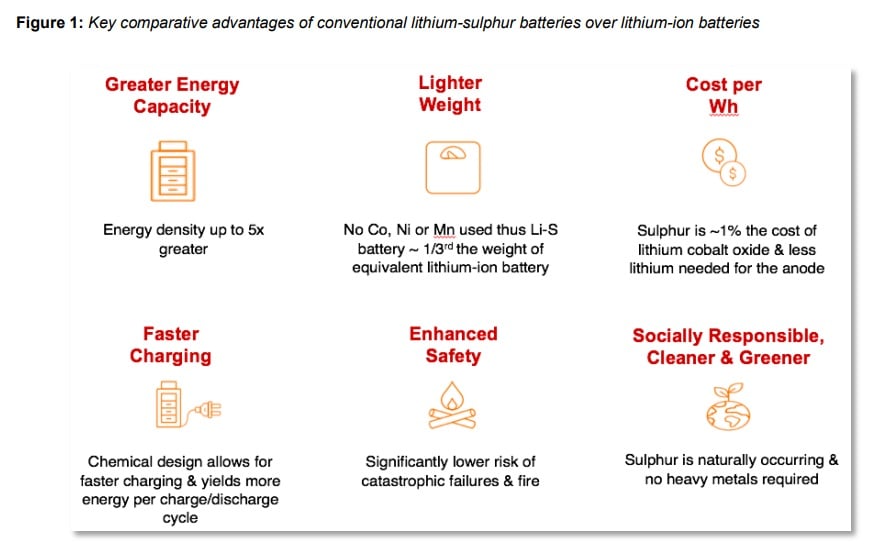

While not yet at commercial production level because of technical constraints – issues Li-S Engery is working on – lithium-sulfur (Li-S) batteries are seen as the next generation to the current technology of lithium-ion (Li-ion) batteries.

They have a theoretical maximum energy density more than 5 times Li-ion batteries, meaning a EV could potential travel from Melbourne to Sydney on a single charge.

Li-S Energy now has a war chest of around $53 million as pro forma cash balance following the raise, with the majority of the funds earmarked for commercial scale-up of new technology as well as ongoing research and development.

Two key breakthroughs

The venture has made two key breakthroughs to dramatically improve the cycle life of lithium-sulfur batteries, which currently degrade quickly with each charge.

Working with Deakin University, they’ve developed boron nitride nanotubes (BNNTs) as a nano-insulator, adding it to the battery’s cathode to help stabilise it and protect it during charge and discharge.

Deakin’s nanotechnology research team found they could vastly improve the performance of lithium sulfur batteries by introducing interlayers of BNNT. That meant the batteries would retain the high energy capacity while avoiding significant degradation (a major issue making the batteries unviable).

CEO Dr Lee Finniear said the success of Li-S Engery’s IPO was testament to the market’s enthusiasm for technology breakthroughs.

“Ours is a genuine Australian technology success story with global application and the realistic potential to allow EVs to drive further, drones to fly longer and mobile devices to last for days instead of hours,” he said.

“We continue to make strong technical progress. Our initial testing on a single layer BNNT protected pouch cell as detailed in our prospectus has reached 900 charge/discharge cycles while retaining more than 60% of its initial specific capacity. We are now scaling our technology with the construction and testing of multi-layer lithium-sulfur cells.”

Source: Lis-Energy

Dr Finniear said the company has also been working on a new nano-composite, called Li-Nanomesh, created to protect the battery anodes. Initial testing show it prevents dendrite formation – metal crystalisation on electrodes that can short circuit or damage the batteries and is also behind some battery fires – for up to 1,000 charge cycles.

“We believe Li-Nanomesh could be an excellent solution for other battery types including lithium metal batteries that suffer similar dendrite problems. This could significantly expand our addressable market, and we are now preparing to test this extended use-case,” he said.

“We are in an enviable financial position to pursue commercialisation of our technology into a global market looking for alternatives to lithium-ion batteries – a mature

technology that is essentially ‘maxed out’ in terms of opportunities to materially improve its operating performance.”

The business is not planning to manufacture batteries but rather license out its technology and sell BNNT and Li-Nanomesh.

BNNT costs around $1000kg and the company is looking at ways to drive down the cost to make it more competitive with li-ion batteries.

Ironically for Lis-Energy’s biggest shareholder, which saw the value of its stake in the newly listed company rise by around $188 million to $428 million, PPK stock fell around 1% today to close at $17.70.

Trending

Daily startup news and insights, delivered to your inbox.