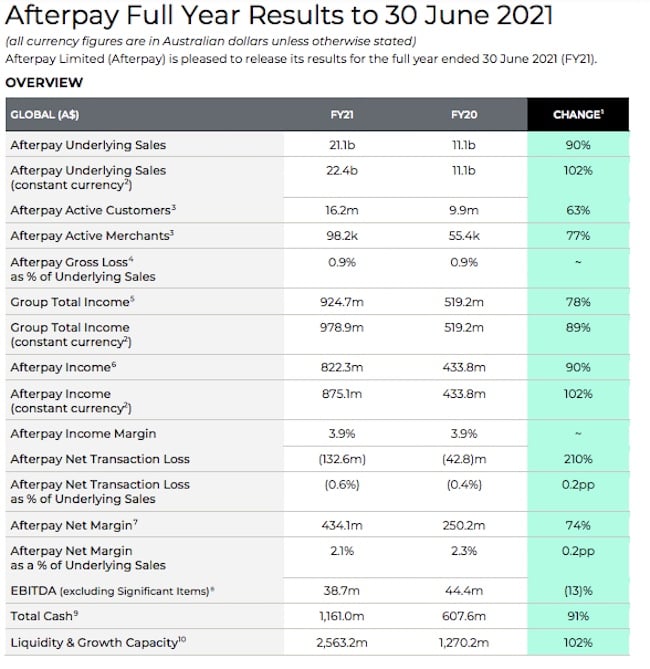

ASX-listed BNPL Afterpay helped generate an impressive $21 billion in sales in FY21, up 90% on the previous year, thanks to 16 million customers.

But the company also did a stellar job growing its losses, which jumped 600%, from a $19.8m statutory loss in FY20 to $156.3 million last financial year.

With a $39 billion acquisition deal on the table with Square, and the business in a rapid land grab for US customers with Swedish rival Klarna, the company’s overall numbers were impressive and investors were not worried by anything revealed in the annual figures – Afterpay (ASX: APT) shares ended the day down just over 1% at $133.50, still well above Square’s share-swap takeover price of $126.21.

The company said its underlying annual sales now sit at $24 billion based on the current run rate from Q4 FY21. Underlying sales were up 102% in FY21 on a constant currency basis.

Underlying sales in North America (NA) and its acquired UK business Clearpay grew by 177% and 242% respectively, with that figure pushing the overall contribution from the regions into the majority for the business, up from 41% last year to 55% in FY21. NA and Clearpay active customers finished the financial year at 10.5 million and 2.1 million respectively.

Total active customers hit 16.2 million, up 63%, with around 25,000 new customers joining the platform daily across the globe.

Back in the ANZ region, the fintech said its top 10% of consumers now use Afterpay more than 60 times per year.

The declining importance of the local business in Afterpay’s global push is reflected in the sales figures, with ANZ representing 60% of group Underlying Sales in FY20, falling to around 45% in FY21, with the second half of last financial year sitting at 41%.

ANZ nonetheless delivered a 44% rise in underlying sales to $9.4 billion, with merchant numbers rising 47% to 63,100 in the last 12 months as active customers grew by 8% to 3.6 million.

Total group income sat at $924.7 million to end FY21 up 78%. Afterpay income increased by 90% to $822.3 million.

The company said late fees contributed less than 10% of total income, down from 14% in FY20 and 19% in FY19.

The business attributed its statutory net loss after tax of $159.4 million to one-off transaction costs of $96.8 million, including share-based employee payments.

Employment expenses hit $150.9 million, up 75%. The global team nearly doubled from 665 to 1,300 people over the 12 months.

EBITDA (excluding significant items) was $38.7 million, down 13%.

Afterpay’s FY21 results. Source: Afterpay

Zip’s grows as losses rise too

Meanwhile, challenger Zip (ASX: Z1P) painted a similarly rosy picture in a results announcement titled “Zip goes global”, while also posting a major loss

The company’s transaction volumes rose 176% to $5.8 billion, with revenue up 150% on 12 months ago to $403.2 million. Customer numbers were up 248% to 7.3 million. Zip’s merchant penetration doubled to 51,300 – more than half of Afterpay’s 98,200.

The “hold my beer moment” to Afterpay was an FY21 net loss of $653 million with expenditure up more than 1,000%. Adjustments to its acquisition of the US business, Quadpay, of $306 million, alongside $142 million in share-based payments to staff made up the bulk of that figure.

The company also spent $71 million on marketing.

Its total reported loss of $653 million was just below the total amount of capital that Zip raised over the year to support its global growth plans. This included an adjustment to the acquisition price of Quadpay, its US operation, of

Customer numbers hit 7.3 million, up 248% for the year. The company said there were 5 million app downloads in FY21 with active users opening the Zip app 5.7 times a week.

The business now operates in 12 markets, including the US, UK, Canada, Mexico, Australia and regional markets such as the Europe, the Middle East and Southeast Asia.

Zip is also acquiring the remaining shares in South African BNPL provider Payflex to expand in Africa.

But given sales sit at around a quarter of Afterpay’s, with revenue nearly half of its local rival, Zip revealed it can match the business on losses as it expands globally, posting a cash EBTDA (earnings before tax, depreciation and amortisation) loss for FY21 of $22.9 million, more than double market expectations of $8-9 million.

Investors were less impressed by Zip’s result, with its share price falling 2.6% on Wednesday to $7.13.

Zip co-founder and CEO Larry Diamond said it was a transformational 12 months.

“We fearlessly started the year with a clear strategy for both local growth and global expansion, and pleasingly, 12 months later, we are delivering on this plan, with record growth across all metrics in all jurisdictions, with Zip now operating in 12 countries across five continents,” he said.

“Zip continues to accelerate in all our key markets. This global play supporting consumers and global retailers alike, provides a real point of difference as we strive to fulfil our mission to become the first payment choice everywhere, every day.”

Trending

Daily startup news and insights, delivered to your inbox.