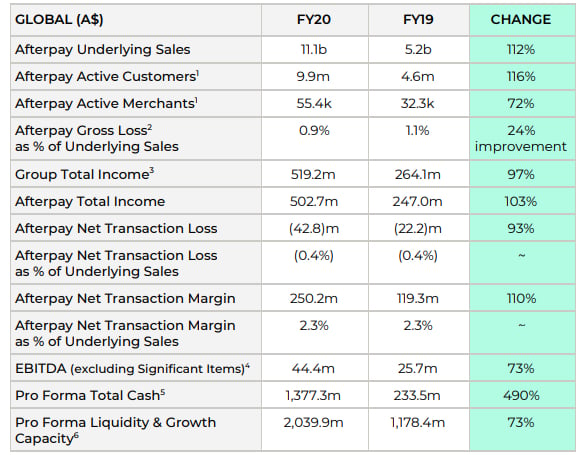

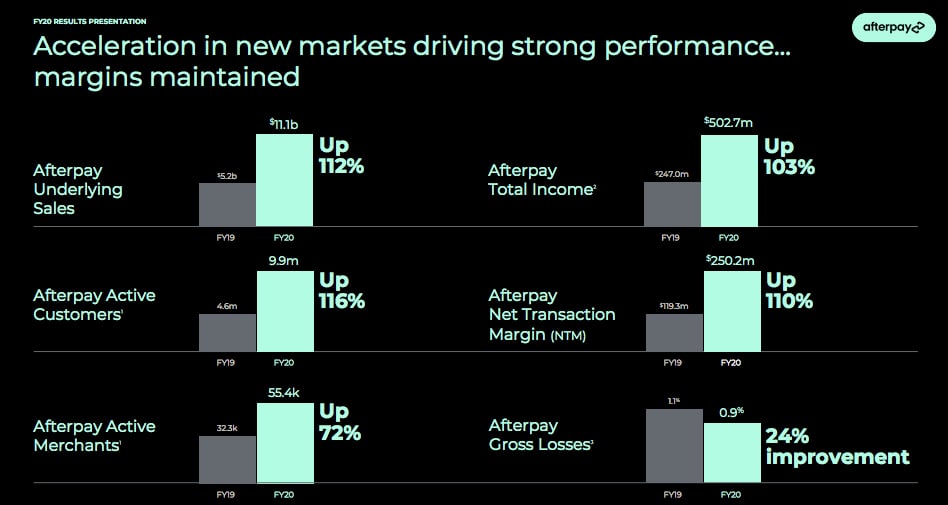

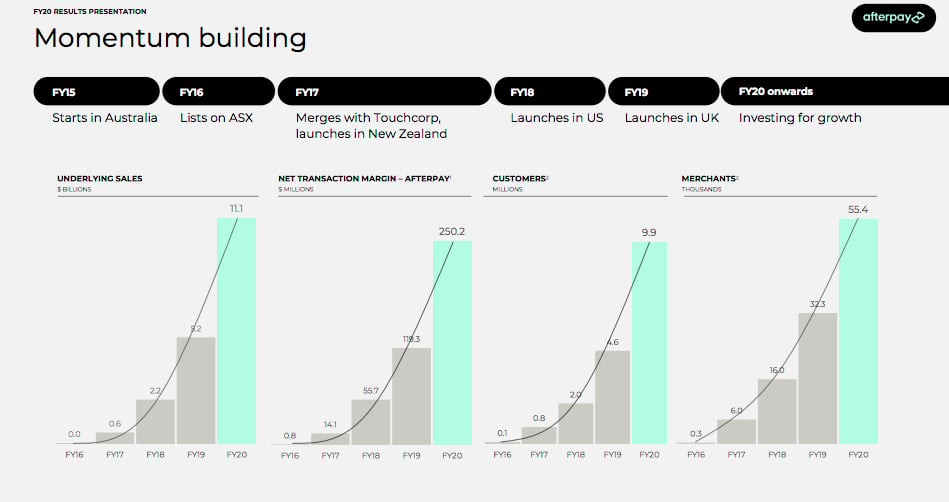

- FY20 global Underlying Sales increasing 112% to $11.1 billion

- Run rate of over $15b per annum (based on Q4 trading).

- EBITDA $44.4m, up from Fy19’s $25.7m

- Net transaction loss $22.2m, down 48% on $42.8m in FY19

- Gross loss as a % of underlying sales improved to 0.9% from 1.1%

- Underlying sales contribution from international markets now 41% in FY20, up from 18%.

- Active customers more than doubled in FY20 to 9.9m (exceeding 9.5m target)

- 17,300 new customers added per day during FY20

- 20.5k per day in Q4 FY20.

- ~ 90% of monthly sales come from repeat customers

- Average order value is low at $153

Afterpay’s growth continues at an astonishing rate, with the buy-now-pay-later fintech adding 20,500 new customers a day in the fourth quarter of the 2020 financial year.

Releasing its annual results today, the ASX-listed star performer, which has seen its share price rise 1000% in five months, declared “It’s not pay in four, or BNPL, it’s Afterpay. We are the verb and our own category” in its investor presentation.

The results were as expected the company revealing headline numbers last week.

An average of 17,300 new customers joined the platform daily in FY20, with that figure accelerating to 20,500 daily in Q4. Active customers jumped 112% 9.9 million, beating the 9.5m target, while the number of active merchants hit 55,400, up 72% on FY19.

Customer numbers in the US hit 5.6 million and in the UK, 1 million.

Global sales more than doubled to $11.1 billion, up 112% year-on-year, with the run rate now at $15bn. Total income hit $502.7 million, up 103%. Group Total Income was $519.2m, up 97%.

Earnings before interest, tax, depreciation and amortisation (EBITDA) rose 73% to $44.4 million from $25.7m. The statutory net transaction loss was $42.8 million compared to a loss of $22.2 million the previous year.

Gross loss as a percentage of underlying sales improved to 0.9% from 1.1%, however, the gross loss was $94.5 million, up 61%.

“Gross loss improved notwithstanding the impact of the COVID-19 pandemic and increased underlying sales contribution from the newer US and UK markets, which have higher losses relative to ANZ, due to their earlier growth phase,” Afterpay said.

The growth of the US and UK markets has seen the contribution from international markets rise to 41% from FY19’s 18%.

Underlying sales in Australia and New Zealand rose 52% to $6.6 billion.

Afterpay announced Asian expansion plans following the “small acquisition” of EmpatKali, a Singapore-based company operating in Indonesia, with a small in-region team to be established.

The company is also “exploring opportunities to leverage Tencent’s network and relationships to expand into new regions in Asia”. Tencent took a 5% stake in Afterpay in May.

Afterpay’s bad debt loss jumped from $58.7m to $94.5m over the past 12 months. Gross loss is at 0.9% of underlying sales.

The net transaction margin was $250.2 million, more than double FY19’s $119.3 million. The net transaction margin as a proportion of underlying sales was steady at 2.3%. The metric takes into account processing and funding costs along with late fees and bad debts, and actually rose 0.25% from the 2.05% estimate when it raised $1 billion in capital last month.

Updating its regulatory challenges, After said it continues to cooperate fully with AUSTRAC as it considers the Independent Auditor’s Report into money laundering breaches investigated last year.

Afterpay said feedback from public consultation on the BNPL Code of Practice is being considered by the industry working group, and engagement with ASIC on the Code is continuing.

The company also cooperated with ASIC in a follow-up review of the BNPL industry and expects a public report from ASIC in September 2020.

Source: Afterpay investor presentation

The company’s share price has been on a tear since plunging below $9 on March 23 as uncertainty about the impact of Covid-19 hit markets. Last night it finished down slightly at $90.72 at Wednesday’s close, having hit yet fresh record of $92.48 on Tuesday.

Afterpay floated in June 2017 at $2.95 a share. It’s made co-founders Nick Molnar and Anthony Eisen billionaires. The business now has a market cap of around $25 billion – roughly the same as Coles, putting it in the top 20 ASX companies.

Afterpay’s share price jumped more than 10% this week after announcing plans to acquire Spanish BNPL Pagantis for €50 million (A$82m) to expand in the European Union through its Clearpay brand.

Carl Capolingua, Market Analyst, at ThinkMarkets Australia told Startup Daily that the BNPL space is hot.

“Investors love growth stories. This sector has it in spades,” he said.

“To be fair, what a great product. Compared to credit cards – and all the negative connotations there – it helps millennials get the stuff they want without blowing their cashflow to pieces.”

Afterpay’s FY19 annual results saw a $43.8 million loss. Net revenue, at $251.6 million, was more than double FY18’s $113.9m.

Carl Capolingua from ThinkMarkets says that huge growth potential remains in the sector and what everyone will be looking at in the results will be the run rate since June 30, details on any further expansion plans, and guidance.

Trending

Daily startup news and insights, delivered to your inbox.