• FY19 global underlying sales increased 140% to $5.2 billion

• Active customers of 4.6 million at end of FY19, up 130%

• The company currently gains 12,500 new customers daily

• Active merchants of 32,300 at end of FY19, up 101%.

• US underlying sales of nearly $1 billion in FY19.

• More than 200,000 UK customers signed up in the first 15 weeks, higher than the US rate post-launch.

Buy now pay later startup Afterpay has posted a AU$42.8 million loss for the 2019 financial year, up 463%, despite underlying sales growing by 140% to AU$5.2 billion. The company says its annualised run-rate on underlying sales are in excess of $7.2 billion.

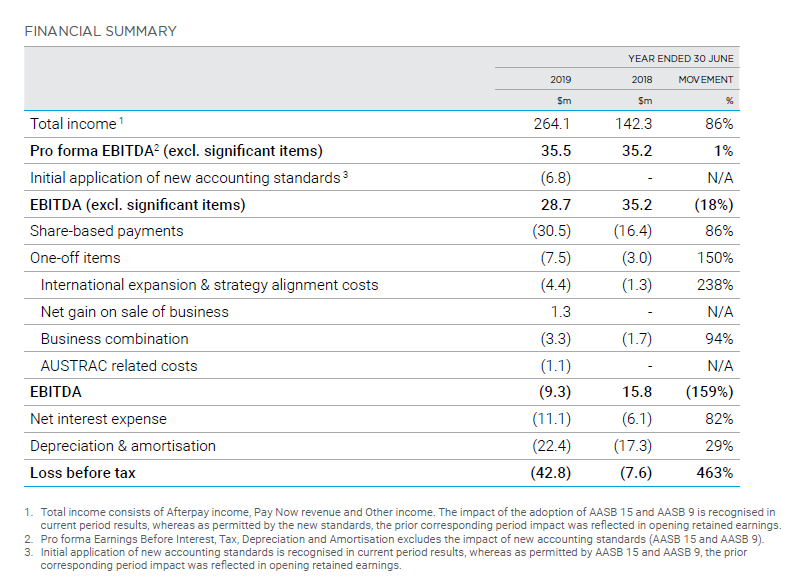

Net revenue, at $251.6 million, was more than double FY18’s $113.9m, and in line with market expectations, while the statutory loss before tax increased from $9 million in the previous year to $43.8 million which the company says “was impacted by one-off and non-cash items (including share-based payment expenses and the initial application of new accounting standards)”.

Excluding those costs, the company says it would have been profitable.

The company’s incredible growth story is a hit with investors. Afterpay Holdings Ltd (ASX:APT) shares jumped nearly 8% to $27.93 in early trade following the release of the results.

Australia and New Zealand underlying sales increased 99% to $4.3 billion, almost double FY18.

Pro-forma earnings before interest, tax depreciation and amortisation (EBITDA) was $35.5 million, (excluding significant items), more than double market expectations. The figure is in line with FY18, but since then the company has had the increased costs of expanding into the US and UK markets.

“Underlying free cash flow, adjusting for receivables funding, remains positive ($33.3 million), organically adding to balance sheet capacity, and is reflective of the high cash generative nature of the Afterpay platform,” the company said.

Afterpay believes it can hit $20 billion in underlying sales by FY22, with a net transaction margin (NTM) of 2%. The company’s NTM for FY19 was $126.1 million, up 126%.

The business announced a strategic partnership with VISA “which will form the basis of a strategic partnership to support the development of innovative new solutions and business growth in the US market”.

The company says approximately 85% of all Afterpay transactions linked to debit cards.

Afterpay’s FY19 financial summary

Late fees fall

One of the more telling figures in the Afterpay accounts was late fee income of $46.1 million, 18.7% of statutory income, although the company points that that figure is down from 24.4% in FY28.

“Late fee revenue now represents 0.9% of overall underlying sales, down 40bps on [previous corresponding period],” the company said.

“This was a pleasing result driven by the enhanced consumer protections built into our product and the benefits of our differentiated business model that is aligned to our customers.”

The drop comes in the wake of corporate regulator the Australian Securities and Investments Commission (ASIC) being granted new powers to regulate BNPL providers earlier this year amid concerns that they were skirting consumer law.

Afterpay supported the new powers, introduced following a Senate inquiry into the business and a report last November in which ASIC found a sixth of customers had became overdrawn, fell behind in payments or borrow more money meet repayments.

Bonuses withheld

An investigation into whether Afterpay breached Australia’s anti-money-laundering and counter-terrorism financing laws, launched in June by financial crime watchdog Austrac, and due in November, had an impact on the company’s executives.

Today’s results announcement revealed senior executives had requested “for their STI (short term incentive) awards to be withheld until the outcomes of the final report of the external audit are released” and the board “reserves its discretion to make any adjustments to final STI outcomes” based on the outcomes of the AUSTRAC audit.

Meanwhile, the company’s explosive growth and success since it was founded in Melbourne in 2014 by Nicholas Molnar and Anthony Eisen has made it a market darling following its ASX listing in June 2017.

In June the company raised $317.2 million via the issue of 13.8 million ordinary shares at $23 per share.

The company’s share price has now risen nearly nine-fold in the two years since listing at $2.95, and has climbed from $10.63 in November last year to peak at $28.46 in May. The company now has a market cap of more than $6.5 billion.

Rivals gather

The buy now, pay later (BNPL) market leader now has to deal with a range of competitors flooding into the market.

Flexigroup CEO Rebecca James announced a partnership with Mastercard earlier this week to introduce a “category killer” called Bundll for retailers to offer buy now, pay later without charge.

Targeting millennials, Bundll lets them combine several purchases into a single instalment payment plan.

Meanwhile, Zip Co has acquired New Zealand venture PartPay for NZ$65.8 million (A$62.4m) giving it access to the NZ, UK, US and South African markets. Zip is also taking a 15% stake in US venture QuadPay for US$11.4 million (A$16.8m).

And earlier this month, the Commonwealth Bank announced as part of its results that it was investing $100 million in the $5.5 billion Swedish Afterpay-rival Klarna to become its exclusive partner when it launches in Australia and New Zealand in 2020.

US BNPL fintech Sezzle Inc (ASX: SZL) launched on the ASX in June and made headlines when its share price rose nearly 80% in its first week of trading. Sezzle shares are also up 7% this morning.

Credit card provider Visa also has plans to introduce an instalments payment scheme in 2020.

Trending

Daily startup news and insights, delivered to your inbox.