Artificial intelligence loans assessments platform Rich Data Co has raised $28 million (US$17.5m) in a Series B as it looks to ramp up its North America expansion

The round was led by Westpac and Nasdaq-listed cloud banking firm nCino, supported by existing backer BMYG and a new investor, Singapore-based Octava Fund.

The funds will be used to help accelerate RDC’s expansion into North America. Founded in 2016, the platform uses AI to give banks deeper insights into borrower behaviour, enabling more accurate and efficient lending decisions to businesses. Westpac’s Australian business lending operations have been a key customer

Over the past 18 months, RDC has been expanding into North America, and in late 2022, established a global resale agreement with nCino, which enables the North Carolina fintech’s business and commercial lending customers to enhance the lending process with AI decisioning.

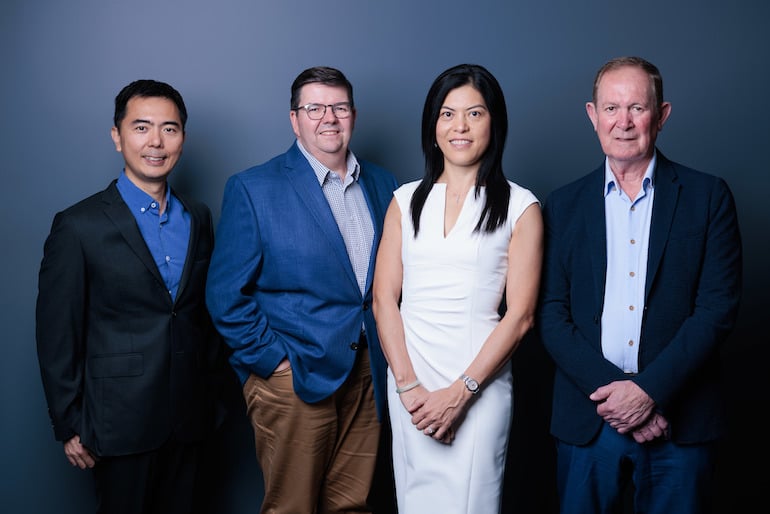

RDC CEO and cofounder Ada Guan said the investment strengthens their relationship with Westpac and deepens the nCino partnership. Westpac has been using RDC since January to make decisions on business lending.

“Securing such a significant amount of investment within challenging fundraising conditions, speaks to the opportunity that Rich Data Co’s AI Decisioning Platform offers the industry, which is pleasingly being recognised by our investors,” she said.

“Now that the B round has closed, we can get on with doing what we love to do and that is disrupt current lending approaches and grow our industry leadership in the exciting AI Decisioning space. I am incredibly proud of our people and our growing team of industry and AI experts.”

Westpac’s head of strategic investments Anthony Potts said the bank’s investment in RDC reflects our strategy to pursue meaningful capability partnerships, investments and acquisitions.

“With the rapid evolution of AI, our strategic investment not only enhances our business lending offer but also allows us to stay close to global developments as RDC scales internationally,” he said.

Trending

Daily startup news and insights, delivered to your inbox.