Atlassian’s market capitalisation has topped A$50 billion after revealing its latest quarterly earnings.

Despite increased losses on last financial year, the Sydney-based tech giant impressed market analysts with its accelerated push into cloud computing to shift its revenue base from licensing fees to subscriptions.

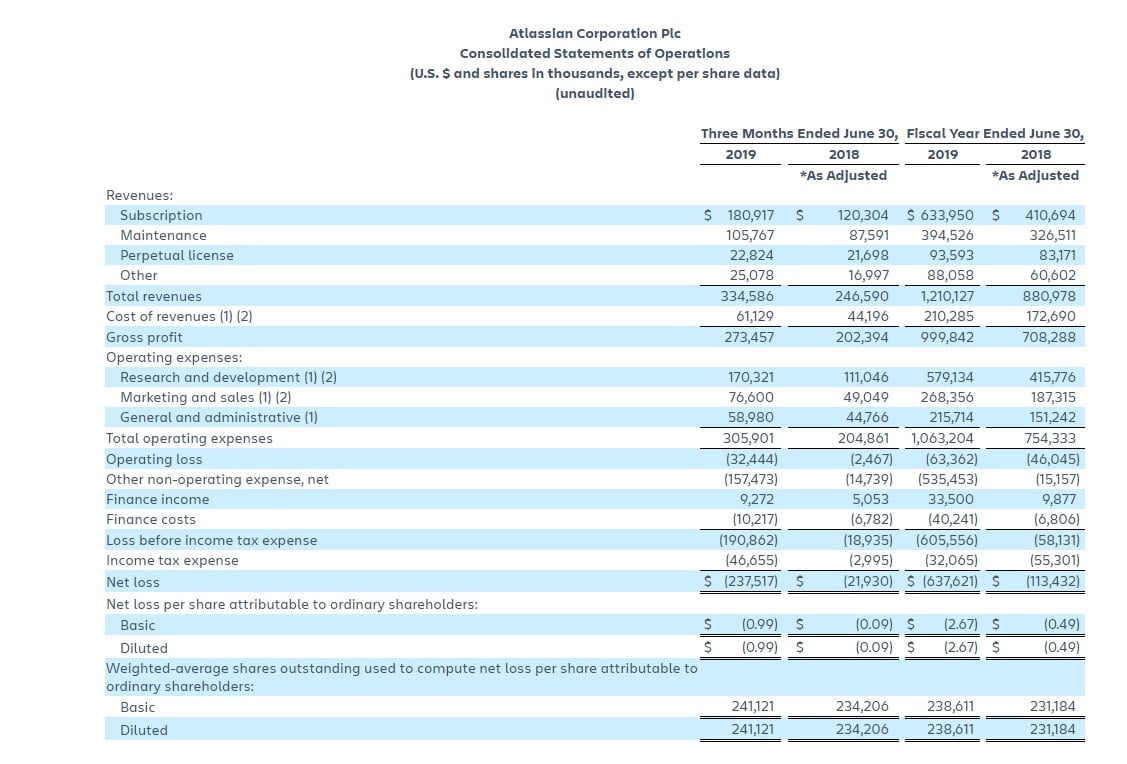

Total revenue hit US$1.21 billion for financial year 2019, beating FY18’s $881 million by 37%, the company revealed late last week in its fourth quarter and 2019 fiscal year results.

Earnings beat expectations and while the shares dropped initially in reaction to the increased losses, the market responded to the company’s increased shift to the cloud in the year ahead and its shares jumped nearly 10% to as high as US$149.80 before settling down around $146.

That gives the company a market cap of US$35.2 billion – more than A$50bn. Atlassian floated in December 2015 at US$21 a share, valuing the business at that point at $US4.4 billion ($6.1 billion).

Atlassian’s co-founder and co-CEO Scott Farquhar said the 2019 fiscal year “was another outstanding year” for the company.

“We surpassed 150,000 customers during fiscal 2019 – a remarkable achievement for Atlassian and triple the audacious 50,000 customer target we set when we founded the company,” he said. “

This propelled us past the $1 billion revenue mark for the first time in a fiscal year.”

His co-founder Mike Cannon-Brookes, affirmed the growing push to cloud-based services for the 17-year-old project management and collaborative software tech business.

“We are a Cloud-first company, with more than 125,000 of our customers using our Cloud products and more than 90% of our net new customers each quarter choosing a Cloud product,” he said.

“In fiscal 2020, we will continue to invest in our Cloud business to serve the needs of the Fortune 500,000 and drive our long-term growth.”

Subscription revenue is predicted to grow by more than 40% year-on-year in FY20.

The company, using international financial reporting standards (IFRS), posted a full year operating loss for FY19 of US$63.4 million, up from FY18’s US$46 million operating loss. The net loss hit $637.6 million, up from $113.4 million last financial year.

The Q4 operating loss was $32.4 million, a 12-fold increase $2.5 million for the previous corresponding period. The Q4 FY19 net loss was $237.5 million compared to a $21.9 million net loss in the corresponding quarter a year earlier

While Atlassian shares fell initially on the US Nasdaq, they bounced back dramatically following the management earnings call, with some analysts putting a $150 valuation on the shares.

Atlassian’s ambitions for FY20 are to repeated this year’s growth, with total revenue predicted at between $1.54 bn to $1.556 bn, up around 28% on the previous year.

Total revenue is expected to be in the range of $349 million and $353 million in Q1 FY20.

Cash flow from operations is expected to be in the range of $495 million to $505 million and free cash flow is expected to be in the range of $465 million to $475 million, which factors in capital expenditures that are expected to be approximately $30 million.

More than two-thirds of Atlassian’s revenue is derived from the Jira project-tracking tools and Confluence document collaboration software.

Atlassian’s operating statement for the 2019 financial year. Source: Atlassian

Trending

Daily startup news and insights, delivered to your inbox.