The 25-year legacy of local payments platform BPAY and US rival PayPal count for little in the fast-moving fintech space with buy-now-pay-later market leader Afterpay now better known by a majority of Australians according to the latest Roy Morgan Digital Payments Report.

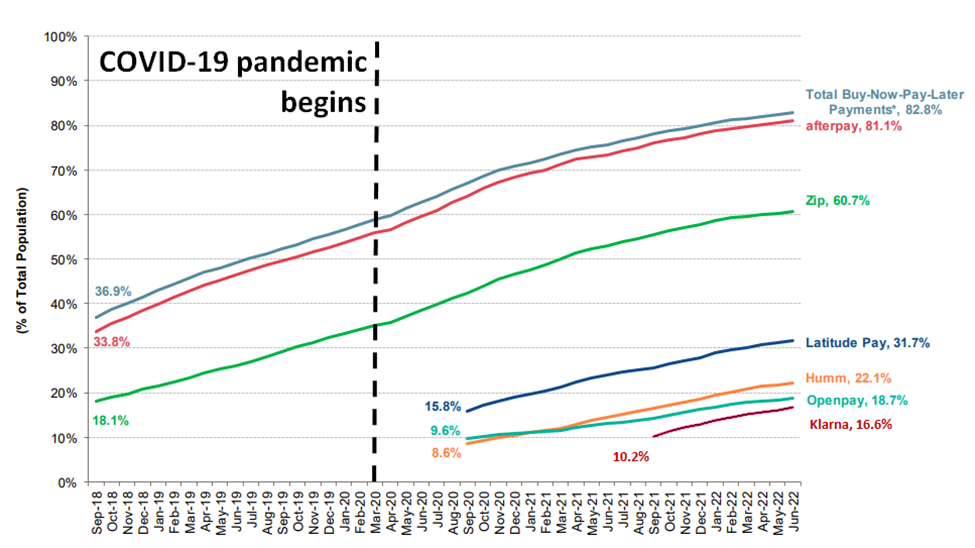

The report found that 17.5 million Australians aged 14+ (82.8%) are now aware of buy-now-pay-later services such as Afterpay, Zip, Latitude Pay, Humm and Klarna.

The puts the BNPL sector ahead of other digital payment services, with 75.6% of Australians aware of PayPal and Western Union, while 71.7% were aware of well-established bill payment services such as BPay and Post billpay.

While market leader Afterpay is now part of ASX-listed Block after Square’s A$39 billion takeover deal in December 2021, the brand is now even better known according to Roy Morgan, at 81.1%, up 7.7% points from 12 months ago. In a sign of just how rapidly Afterpay has entered the public consciousness , that figure was 47.3% less than four years ago in September 2018.

But awareness of competitors has grown more rapidly over the last year with 60.7% of Australians knowining the name, Zip, up 7.8% points, while Latitude Pay also had a 7.8% rise on June 2021 to just under a third (31.7%) recognising the brand.

In the wake of the top 3 are smaller fintech rivals such as Openpay (22.1%, up 7.6%), Humm (18.7%, up 5.7%) the rebranded Flexigroup, and CBA-backed Swedish Klarna (16.6%).

Buy-now-pay-later payment services awareness trends: 2018-2022

Source: Roy Morgan Single Source, 12 month moving average, Avg. sample = 52,731. Base: Australians 14+.

Roy Morgan CEO Michele Levine says awareness of BNPL services has continued to grow in the post-lockdown era.

“The buy-now-pay-later sector enjoyed stellar growth during the last two years as hundreds of billions of dollars of government stimulus, as well as restrictions on travel and extended lockdowns in much of Australia, led to an extended retail spending boom which continues to this day,” she said.

“General awareness is an important first step, usage of the service is the most important metric to keep an eye on. Now over 4 million Australians (19.1%) used a buy-now-pay-later service in the year to June 2022, up by around 700,000 (+3.4%) on a year ago, and up from only 6.8% of Australians in September 2018.”

Usage of Buy-Now-Pay-Later services – June 2022

|

|

Usage |

|

Buy-Now-Pay-Later |

19.1% |

|

|

15.1% |

|

|

6.9% |

|

|

1.6% |

|

|

1.5% |

|

|

1.1% |

|

|

0.7% |

Source: Roy Morgan Single Source, 12 month moving average, Avg. sample = 52,731.

Base: Australians 14+.

Levine said the most frequent users of BNPL options tend to be aged either 25-34 or 35-49 years old with different age groups clearly preferring different brands.

“Importantly, it is women who are clearly the largest users of buy-now-pay-later services indicating that men are potentially an under-served marketing opportunity,” she said

Trending

Daily startup news and insights, delivered to your inbox.