The NSW government is getting rid of the board tasked with investing $190 million in startups and SMEs with $70 million of the funds still unallocated.

The Jobs for NSW board, led by CSIRO chair David Thodey, and other senior business leaders, including Sydney tech hub Stone & Chalk chair, Craig Dunn, Navitas exec Helen Zimmerman, and former Cochlear boss Dr Chris Roberts, was meant to provide a quick response to a rapidly changing economy to 2020, and set a path to job creation over the next 20 years.

The board oversaw the Sydney Startup Hub, which received $36 million in funding, as well as multiple funding programs, ranging from grants to loans, as well as investing in businesses, to the anger of some rival ventures.

Jobs for NSW was created in 2016 in response to the government’s Jobs for the Future report and given $190 million “to support the expansion and growth of NSW businesses on a competitive basis”.

The agency’s stated role is to provide “financial support to startups and emerging and fast-growth small to medium enterprises (SMEs) to scale and grow new jobs in NSW”.

Jobs for NSW was merged with Treasury portfolio as part of a review into the agency, The Sydney Morning Herald reports, citing an internal Treasury briefing paper, titled “Repurposing the Jobs for NSW Fund”, which revealed the department is moving to close down the current funding programs and exit its investments.

A Treasury spokesperson told The SMH that: “The new structure means Jobs for NSW has been integrated into NSW Treasury and therefore an independent board is no longer necessary.”

Two agricultural investments of $3.3 million each, made through the $150 million GO NSW Equity Fund, jointly funded by Jobs for NSW, industry fund First State Super and Sydney-based private equity venture ROC Partners, appeared to attract the most concern from government bureaucrats, as well as the ire of agricultural rivals.

The scheme was designed to target high-growth companies lacking access to capital.

Controversial investments

The first investment was in Stone Axe Pastoral, a Western Australian cattle business as it expanded into NSW buying a 2145 hectare Northern Tableland property to run around 2000 full-blood wagyu, the world’s most expensive beef. The business is aiming to become the country’s biggest wagyu beef producer,

Deputy premier John Barilaro hailed the deal in February 2018 saying it was expected to create 76 full-time jobs over the next five years.

“[The] equity deal is a co-investment of $3.3 million from the NSW Government, together with $6.7 million from First State Super, that will give Stone Axe Pastoral the capital it needs to ultimately breed the largest full-blood wagyu cattle herd outside of Japan,” he said at the time.

First State Super Chief Investment Officer Damian Graham called the Stone Axe Pastoral investment “strong and sound” when it was made, praising the fund as “all about delivering positive social benefits, while also maximising the growth potential of small to medium-sized businesses to deliver good returns to our members”.

But the deal sparked controversy when it emerged that ROC Partners, who acted as advisers on it, had already invested in the venture in 2017, becoming majority shareholders.

The second investment was in an oyster collective known as Australia’s Oyster Coast, based on the state’s south coast, which counts more than 45 NSW oyster growers among its shareholders. Producers who were not part of the collective, including the NSW Farmers Federation Oyster Committee chair, Caroline Henry, criticised the deal, which totaled $20 million, including $10 million from ROC Partners and $6.7 million from First State, as “not a good look for the industry”.

The Treasury paper said the two investments had “attracted negative publicity and many parliamentary questions”, recommending the government’s involvement in GoNSW Equity Fund should cease and they should exit the existing investments.

Treasury’s review took the view that “it is not the role of government to pick winners”. Treasury also wants to put an end to loans and any further guarantees for them. The loans ranged from $200,000 to $1.2 million, and included a program designed to create jobs in regional areas. Loan guarantees were offered up to $5 million.

The review is not yet complete. but the changes put the future of multiple grants for the startup sector under a cloud. Just last month, Jobs for NSW was offering up to $25,000 to startupslooking to develop their idea to Minimum Viable Product (MVP) status.

The briefing paper says the outstanding $70 million “could be used to support the broader development and jobs growth agenda across NSW.”

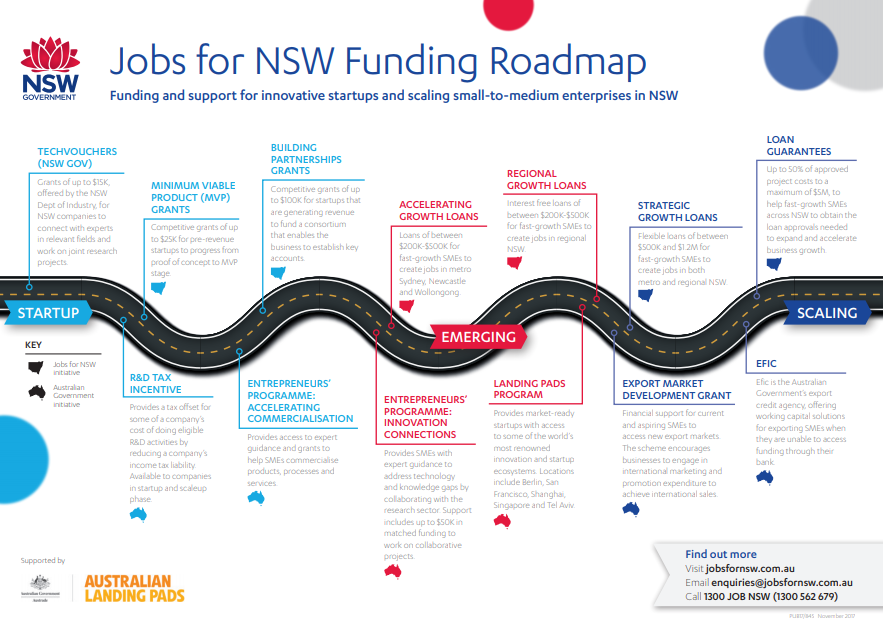

Here’s a chart of the various ways Jobs for NSW offered funding and loans to help the SME and startup sectors.

The Jobs for NSW funding options. Source: Jobs for NSW

You can read the full SMH story here.

Trending

Daily startup news and insights, delivered to your inbox.