Welcome to Wednesday and Ramadan Mubarak to our Muslim readers.

Don’t forget to tune in for the Startup Daily show on Ausbiz.com.au every weekday, 2-2.40pm. Watch online, download the ausbiz app or via 7Plus.

Here’s the latest tech news from around the world.

Apple launch

It started with Siri dropping hints breathlessly described as “leaking” by some media – “Hey Siri, are you a Fifth columnist?” – but Apple has since emailed Australian customers to flag “a special Apple Event from Apple Park” dubbed Spring Loaded on April 21 at 3am AEST.

The product announcement is expected to include a new iPad Pro, AirTags and perhaps new Macs and AirPods3.

The whole shebang’s virtual and streamed on Apple’s website, YouTube, and even the Apple TV app.

And you can safely lock in the world’s most valuable company also raising prices and thus margins for shareholders.

Epic Games’ $1bn raise

US$200 million was a follow cheque from Sony, which signed on last year in a US$1.8bn raise, with Appaloosa, Baillie Gifford and Fidelity also chipping in.

CEO and founder Tim Sweeney said the cash “will help accelerate our work around building connected social experiences in Fortnite, Rocket League and Fall Guys, while empowering game developers and creators with Unreal Engine, Epic Online Services and the Epic Games Store.”

Degreed hits unicorn

California-based upskilling platform Degreed, which has a base in Brisbane after acquiring local startup Adepto, has raised US$153 million in a Series D to kick its valuation to US$1.4bn (A$1.8bn).

The total round, including equity and debt, was $183 million. Sapphire Ventures and Riverwood Capital co-led the round along with current investors Signal Peak Ventures, Owl Ventures, GSV Ventures, Founders Circle, Contour Investment Partners, Section Partners, and Alliance Bernstein, as well as new investor Firework Ventures.

Meanwhile, CEO Chris McCarthy is stepping down after nearly 8 years do to chronic back issuess. He’ll remain on the board. Former Box COO replaces him.

In 2020, Degreed more than doubled its active user base and increased its team by 50%, to 600 employees, across six continents.

Zero carbon crypto

As everyone rejoices at bitcoin cracking US$60,000, the dirty secret the sector doesn’t like to talk about is its carbon footprint. Put simply, all those funky crypto evangelists are melting polar ice caps.

Bitcoin, for example, generates an estimated 46.76 megatons of CO2 annually, rising fast – the carbon footprint of Finland. A single transaction chews through enough power to supply a US home for 31 days, or 951,473 credit card transactions.

So news that US-based Gryphon Digital Mining raised a US$14 million Series A to launch a Bitcoin mining operation with zero carbon footprint caught our eye. Rob Chang GDM’s CEO and co-founder, said “Our long-term strategy is to be the first vertically integrated crypto miner with a wholly-owned, 100% renewable energy supply.”

Gryphon counts nuclear among its renewable options. At least it’s a start.

Coinbase IPO

One reason Bitcoin is surging is the highly anticipated direct listing of crypto platform Coinbase on the Nasdaq, with the company expected to hit a US$100 billion valuation, making it worth more Airbnb when it went public last December.

The Nasdaq’s reference price is US$250, the company says shares sat at $375 in Q1 and some analysts have put a $600 estimate on $COIN. One thing’s for certain: like cryptocurrencies themselves, expect volatility.

DigitalX soars

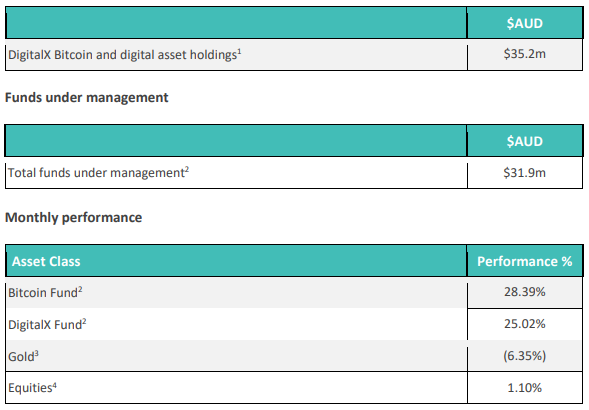

One company riding the Bitcoin wave is ASX-listed DigitalX (ASX:DCC). The company released its Bitcoin exposure this morning and its shares are up nearly 20% in lunchtime trade to $0.079. The numbers are below.

Tweet of the Day

Want to help people? Check out our challenge with @CSLBehring which launched today https://t.co/hmBJJaSr6d Tap someone you know on the shoulder who should apply

— Sally-Ann Williams (@sallyannw) April 13, 2021

Trending

Daily startup news and insights, delivered to your inbox.