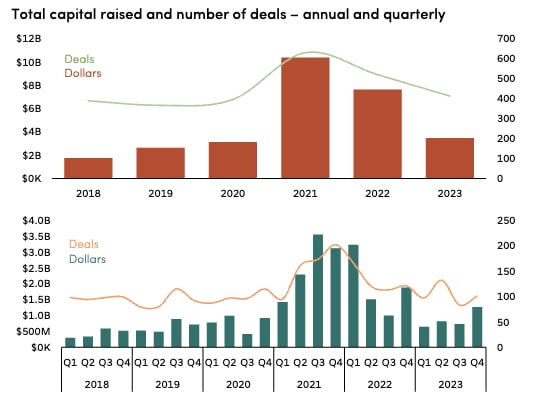

Venture capital funding in Australia plunged 53% in 2023 on the previous year, returning to the level seen at the startup of the Covid pandemic in 2020.

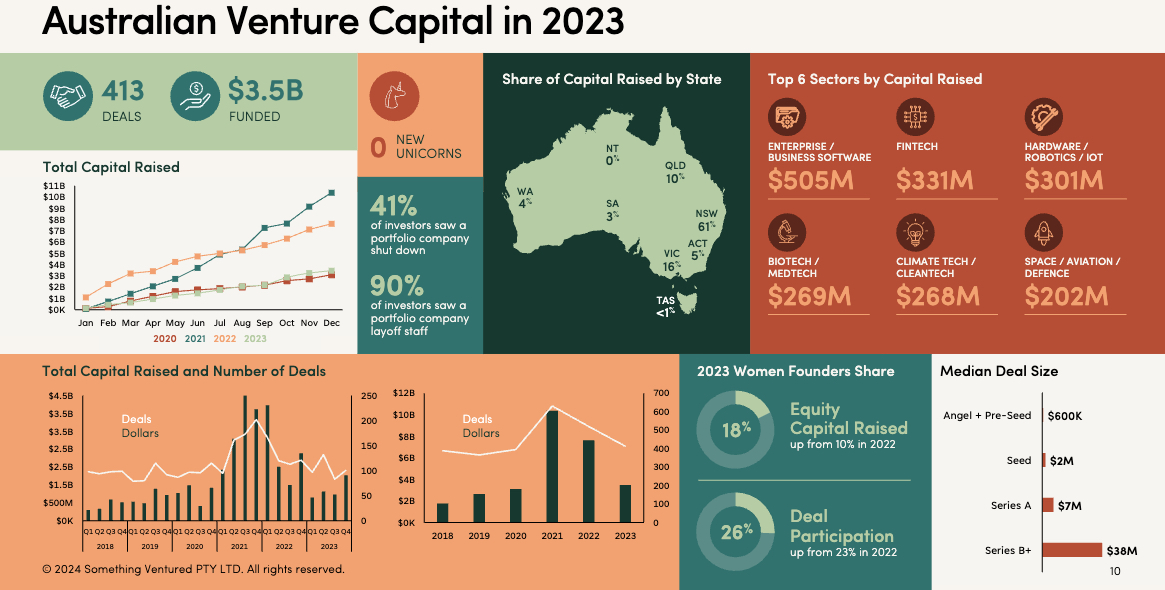

The year saw 413 reported deals totalling $3.5 billion (down from $7.4B in 2022) according to the third annual The State of Australian Startup Funding Report by Cut Through Venture and Folklore Ventures.

It was still the third highest level of annual funding recorded for local startups, behind 2021 and 2022.

Yet the drop in cash deployed was greater than the global VC funding reduction of 38%. Interestingly, 42% of the 2023 Australian deals had at least one international investor, while the report says 70% of local investors are expecting more overseas capital on local shores in 2024.

But last year a third of investors said at least 40% of their investments were allocated to portcos, with more than a third admitting that ensuring they were well-capitalised constituted their primary focus for the year.

VC capital deployed and deals 2018-23. Image: State of Australian Startup Funding.

But the good news if you’re a woman founder is that you’re getting a much larger, but still very thin slice of the VC pie.

Thanks to the likes of Loam, Fleet, Silicon Quantum Computing, Constantinople and Secure Code Warrior bumping up the numbers – 5 of the 413 deals – 18% of capital deployed went to startups with women among the founders.

But there’s as massive howler in the report data, with Constantinople’s $32 million Seed round, led by Square Peg, with support from Airtree and Great Southern Bank, actually completed in May 2022, but only revealed 12 months later, as Startup Daily reported at the time.

And for context on how much the other four raises bump up the figures for women, Loam’s $105 million Series B, Fleet’s $50m Series C, Silicon Quantum Computing’s $50 million Series A (after hoping to raise $130m), and Secure Code Warrior’s $72m Series C are more than a quarter of the 15 deals worth more than $50m in 2023. That number in itself is nearly half of 2022’s 29 $50m+ deals and a long way from 2021’s 54.

All-women founders in 2023? 4%. Of $3.5 billion. Thanks for playing ladies.

We can’t be bothered fact checking at this point, but bet it’s less than the funding deployed into Web 3.0 onanism in the last few years. Please tell me I’m wrong.

The good news amid all-bloke teams nailing 62% of all deals is that all-women founded startups landed 12%, and and when there’s at least one female founder on board, it’s 26%.

For perspective in the lead up to everyone painting the town Dale Spender purple in the lead up to International Women’s Day, women are now represent around a third of Australian business owners. The report calls it a five-year peak. That it’s not an all-time high should alone give pause for thought.

When it comes to cheque size, the Australian Startup Funding Report says the median for a mixed gender team was $1 million in 2023. That’s a third of the bloke median of $3m. All women? Here’s $700k. Did you say thank you?

You may remember that last year leading VCs committed to reporting on their investments in startups with women involved. Perhaps that’s helped focus everyone’s minds, because last year 58% of the top 50 most active investors backed a startup with women involved, in a massive leap from 28% in 2022, so it’s not all Scalare Partners, the Alice Anderson fund, OneVentures, Flying Fox and Aussie Angels shifting the dial.

Down downers

The data from around 1,000 investors and founders reveals that in 2023, 41% of backers saw a portfolio company (portco) shut down, while 90% had layoffs in portcos.

VC are now pinning their hopes on artificial intelligence as their new startup goose laying golden eggs, with two-thirds (66%) of investors surveyed by the report saying they plan to up their capital deployment in 2024

But supply may not meet the demand of thirsty founders when their cash wells run dry, with 92% saying they intend to raise capital in the next 1-2 years. Reflecting the eternal sunshine of the founder mind, 86% are confident that they’ll be successful.

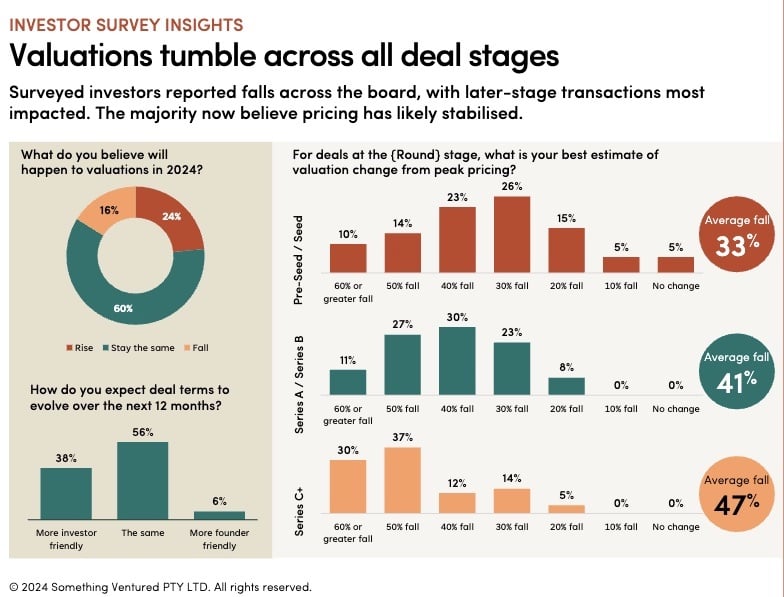

The Australia funding results reflected global trends with deal sizes, valuations and numbers all declining, however, the picture was rosier for early-stage startups with pre-Seed and Seed stages seeing less impact than Series A and B.

Early-stage investments reported an average valuation drop of 33%, while it was 41% for Series B+ and 47% for Series C+ valuations. Investors said strong competition for deals remained at the early stage. Meanwhile, the number of Series B and later deals fell significantly.

54% of investors reported participating in a down round.

Valuations Image: State of Australian Startup Funding

No local startups hit unicorn status (a $1B+ valuation) in 2023, according to the report, although Startup Daily did hear a few founders mumbling about it in their sleep during investment conferences.

AI is the new Web3.0

Remember a couple of years ago when everyone was going to become millionaires thanks to their NFT collections and live happily ever after in the metaverse?

Well that interest from VCs lasted about as long as a Vegas wedding and now their new BFF is artificial intelligence (AI).

Nearly a third (30%) of investors listed AI/big data as the sector they’re most excited about in 2024, followed by enterprise/business software at 22% and climate/clean tech. at 19%.

Enterprise software and climate tech combined both attracted a total of $505m and 41 deals, respectively.

Amanda Price, Head of KPMG High Growth Ventures argued it was back to business 101 for the startup sector.

“Founders have been forced to pivot to prioritise profitability over growth as investors sharpen their focus on their existing portfolios,” she said.

“However, good ideas and promising founders continue to attract investment with sectors like climate tech, artificial intelligence and medtech defying the downturn.”

Startup funding snapshot. Image: State of Australian Startup Funding

Trending

Daily startup news and insights, delivered to your inbox.