- 61% of employees find equity as an important factor in accepting a role

- Only 50% of employees know the real value of their equity

- Only 34% of founders think they communicate the value of equity effectively

- 56% of Australian companies apply a 1-year cliff with a 3-year full vesting period

- 36% of Australian startups issue equity to their global teams

Nearly two-thirds (61%) of potential startup employees consider share plans important when deciding if they’ll work for a company, according to Cake’s 2024 State of Aussie Startup Employee Equity Report.

While 18.2% are neutral about it, and 20.4% don’t see equity as a crucial factor, the findings nonetheless show employee stock ownership plan (ESOP) plays an important role in attracting talent.

Cake surveyed employees and startup founders on how they feel about their equity and it became clear that while it’s valued, there’s a material gap in understanding it.

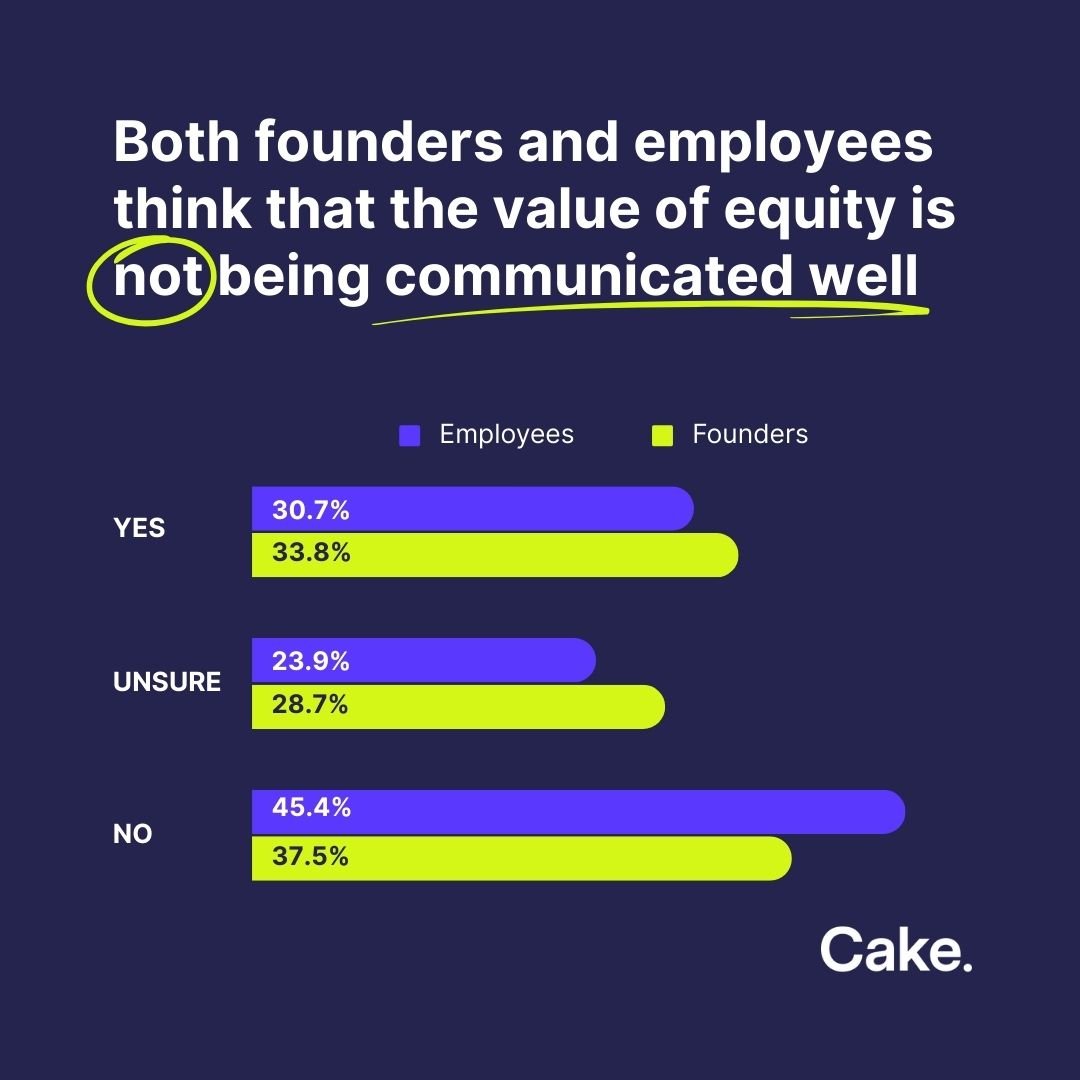

But when they have those shares in the hands, confusion appears to reign, with only half of staff with shares knowing what they’re worth and 45% believing their employers don’t communicate the value of their equity effectively.

Even founders acknowledge there’s a problem with just over a third (34%) believing they explain it effectively.

The feedback on the worker side revealed a lack of understanding around employee stock ownership plans and difficulty in accessing information about it.

When asked how motivated they are about their equity, more than half of the respondents (55%) express feeling highly motivated by it. However, nearly half of the employees (45%) still have neutral or lacklustre feelings about equity.

Cake’s analysis of how founders and staff feel about communication around ESOPs.

Think & Grow cofounder Anthony Sochan said a lack of education was the main cause of poor employee equity sentiment in Australia.

“We’ve observed a lack of employee knowledge in clearly articulating their preferences or understanding their current equity arrangements,” he said.

This, in our perspective, highlights the inadequate communication of equity schemes—a reflection of the steep learning curve individuals face in comprehending how these schemes operate.”

Alex Solo, cofounder of Sprintlaw has a simple solution – show them the money: keep your team in the loop on how the value of their equity is growing.

“One example I’ve seen is showing employees how their equity can pay off, for example, showing how the value of their equity scales with valuation of the business,” he said

“Secondly, getting employees more involved in the business and keeping them in the loop about the company’s performance and how that affects the value of their equity and being transparent about the potential timing of any planned exit or liquidity events.”

Solo has also seen that early-stage hires value their equity more than their later-stage counterparts.

Techstars MD Kirstin Hunter argues that equity is a necessary filter when finding passionate “mission-aligned generalists.”

“Early-stage founders are highly attuned to using equity as an important aspect of their compensation package,” she said.

“Key hires at these early stages tend to be mission-aligned generalists, where salary may not be as much of a factor and equity has as much of a role as a motivator as it does compensation.

“For example, the feeling of being an owner of a company whose mission you are passionate about is more important than any potential financial upside in the long term.”

Cake Equity is a platform to manage equity grants and notes, stakeholder communication, scenario modelling and other aspects of share ownership in startups.

You can read the full report here.

Trending

Daily startup news and insights, delivered to your inbox.