A few weeks ago, I wrote about how 4 days can be a long time in business.

A year even more so. And it was only this week I was trying to convince my friends at Tribe Global Ventures to do a 2023 wrap up of startups and tech in their excellent podcast (full disclosure, I helped them get that podcast started but they are doing amazing things on their own now).

Only to realise I was being lazy and outsourcing the content production I wanted to consume myself. Be the change you want to see in the world, Lainey.

It’s been a year hasn’t it?

After several (I think we can all agree) extremely weird years, 2023 has been a year of proving the adage that “after extreme shocks systems revert to the mean — for no other reason than the result is most likely”.

After years of claiming that the way we work will change forever, actually 90% of companies plan to implement return-to-work policies by the end of 2024. The stock market, in so far as that is a metric for the economy, has shown a repeatable trend of recovering and reverting to the average after Covid (see chart below from Fidelity). The WHO has reported that our health systems have almost recovered to pre-pandemic levels, even our national wellbeing, as measured by NAB seems to be back to pre-pandemic levels

So given all of this, why does 2023 have less of a ‘deep sigh of relief’ vibe, and more of a ‘screaming-at-the-tv-don’t-go-in-the-basement!’ vibe?

It’s the uncertainty. I think.

Rationally, one might look at this data and it should be enough to channel your inner Taylor Swift “You need to calm down”. But actually, I think the uncertainty of the last few years has caused a PTSD response, such that even when the threat is gone, you can still operate as though it’s very real.

We’ve had some tough years. People got sick, they were isolated from their loved ones for long periods of time, loved ones have died and we couldn’t attend their funerals, people lost their jobs and livelihoods, and we have had multiple wars that are still ongoing.

Despite being very far away from these wars, as a country of migrants, it means almost everyone has been affected in a personal way by them. There has been a lot of loss. And it’s hard to be too upbeat about that, even if the world has kind of returned to normal in many other ways.

So in 2023, I think we are all still just very nervous. On edge. And so in startups and tech, 2023 has kinda been a year of flight, fight or freeze mode.

Flight

Companies closing down

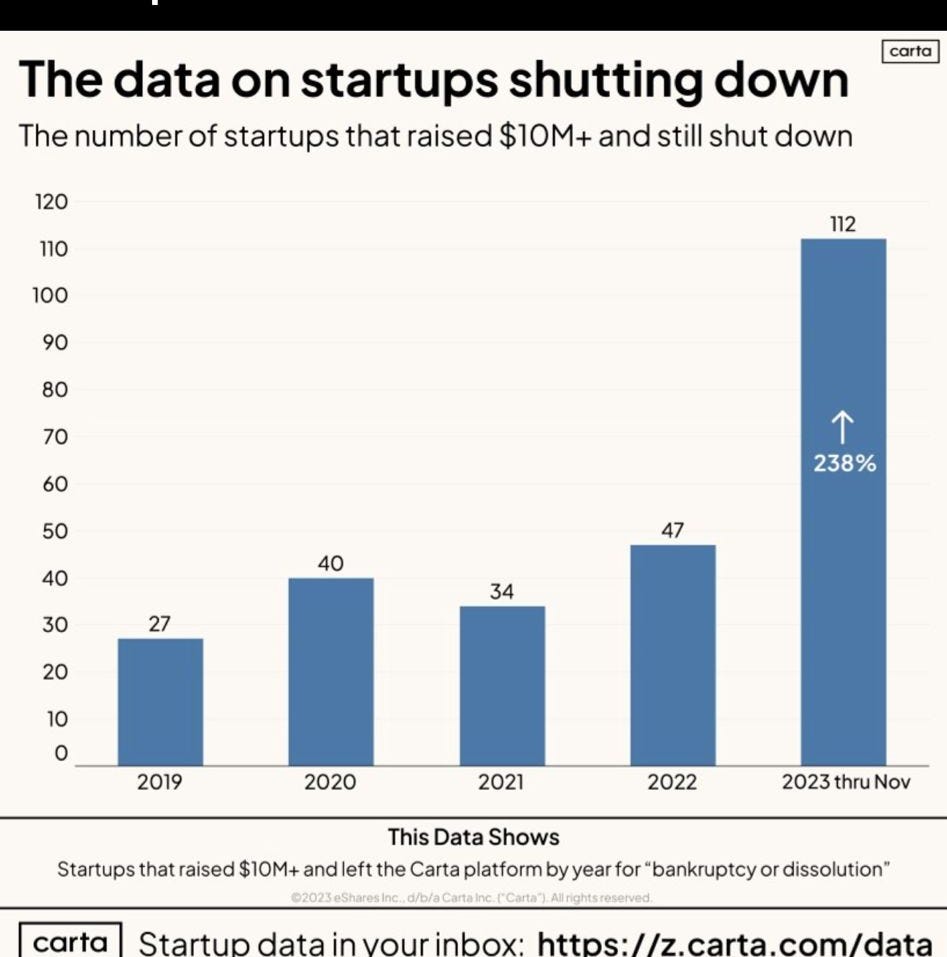

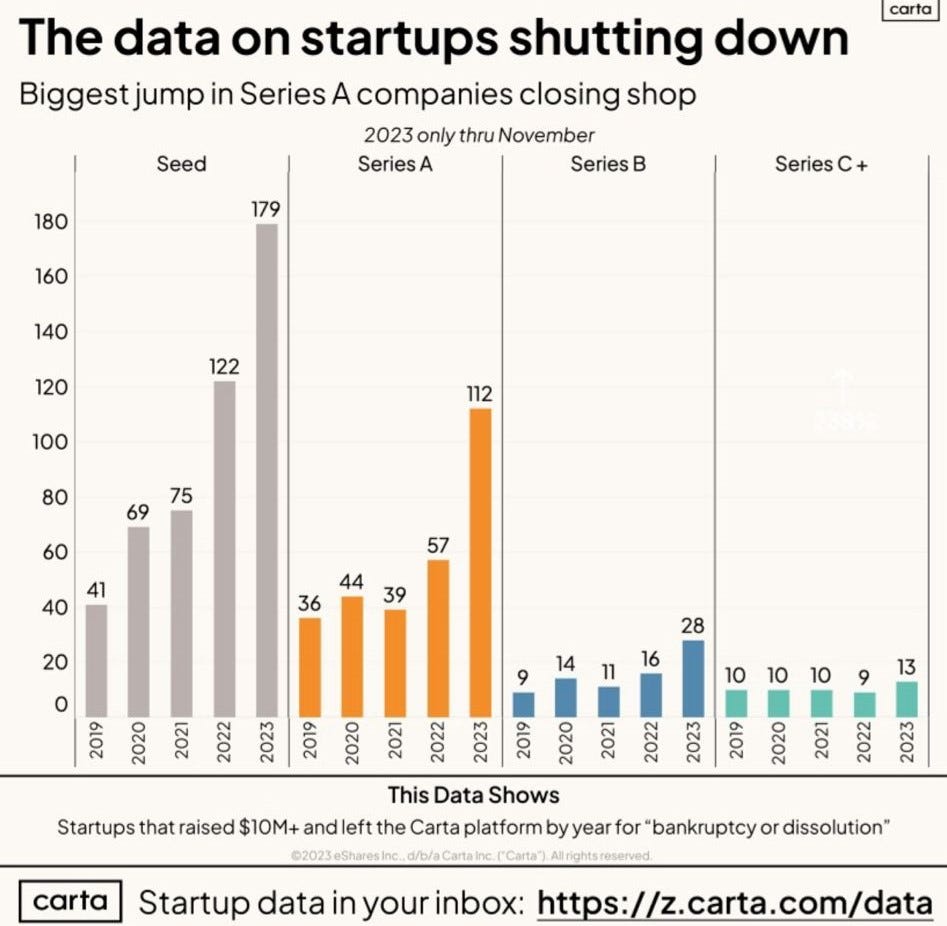

While we know the failure rate of startups is generally high (over their lifetime), the data has shown that company shut down continues to increase this year.

Recent data released by Carta has shown absolute numbers of tech company shut downs increasing and almost half the companies that have shut down having undertaken a financing (that is, they have some money, and some support). The most interesting statistic, is that we have also seen an almost 2 x jump in companies that have raised substantial funding (greater than $10m) closing down.

The reasons for the shutdowns are difficult to parse out from the data — whether it’s companies finding it difficult to raise new capital because capital is scarce, or companies with unsustainable business models are being exposed when capital became scarce, or customers falling away because the pool of discretionary income is smaller and more competitive, or all of the above.

The reality is, the attrition rate of companies that are exiting the sector is increasing, and the knock on effects of that, such as VC fund performance, will take some time to play out, but as someone who has been through several of these cycles, I’m here to tell you, it won’t be good.

Capital is flowing out of the sector

I debated whether to put this into the freeze or flight category. I can easily make a case for freeze, because nothing moves quickly in assets classes and sectors that are generally illiquid like venture capital and technology startups and investors do tend to have a wait and see approach.

However, ultimately, I landed on flight because sadly I think we may have seen the peak of LP investment for quite some time into Australian venture.

In 2023, Australia is reportedly on track to raise $4.2Bn less for technology startups than last year and the number of deals struck have declined 42% year over year. Some might say this is a very normal rebound from the pandemic era hubris of 2020/2021 and probably reflects the fact that companies have pulled back their focus on growth at all costs to favour profitability or sustainability and need to raise less, and I would agree.

And lets face it, the fact that we have several billion of dry powder in VC funds (with $2.7Bn raised in aggregate by Australian VC managers in 2022), which is captured and not going anywhere suggests there are some ‘wait and see’ strategies playing out.

The super funds in Australia are consolidating, which means they have larger pools of capital to deploy, and while many of them have made noises about increasing their allocation to private equity and unlisted assets, their increased scale means they can invest in global assets. Essentially they will move to wherever they will get the best returns and they now have the cheque writing ability to get in. And we are seeing this play out with net negative capital flows in equity.

In 2019 Australian VC was at a pivotal moment. After a range of new funds emerged in 2013–2015 (including mine), some of which have now reached escape velocity scale, and some delivering realised returns from their first vintages, it was going to be important that they show repeatable performance or persistence of performance in subsequent vintages for the fund managers.

Not just so they can continue to garner support from super funds for funds 3–6, but to provide confidence in the sector that there was sufficient deal flow, and sophistication to support allocation of more capital. I’m the first to admit that as someone who was managing $240m across four funds in 2019 before those funds were transferred to new managers when the parent company went into administration in 2019, I wasn’t able to finish my role in seeing these though to completion for the industry. A fact that will never not cause me grief (not in the colloquial sense, but in the literal sense)

However, with Australian VC arguably throwing the baby out with the bathwater in 2020/2021 in the panic to deploy capital, valuations remaining deflated in 2023 which is likely to result in longer hold times to exit, and the fact that the IPO market has not generated sufficient performance to provide a robust alternative to private capital, we are likely to see reducing VC fund returns across the sector.

Unless we see another generational company like Canva arise from that cohort. Although there may be a couple of exceptions, I see a non-zero chance that Australian VC and by default then the technology sector experiences a continued reduction or contraction of private investment capital for another 5+ years.

Freeze

Layoffs

While in 2022 we saw the beginning of the tech sector sweeping layoffs (also known as the ‘tech wreck’), 2023 has been worse, at least in the US.

We have seen layoffs of USA-based technology giants — Google, Microsoft, Meta, Amazon and X (formerly Twitter), and recently Spotify announced a shedding of 1500 jobs in it’s third round of redundancies.

In Australia, we have seen the same trend with companies like Atlassian, Microsoft Australia, and others. While many have said this is a sign that the hubris of 2020/2021 is over…. and that would be right —it’s a classic freeze response — companies are trying to make their runway last longer so they can survive.

They are no longer pursuing growth at all costs, perhaps pursuing a healthier growth trajectory if not standing still, to adhere to the number one rule of startups – DON’T RUN OUT OF MONEY.

No real progress for female founders or diversity

Look, there is no way to polish the that is the state of funding for minorities in the Australian sector. Despite the recent quarterly data from Cut Through Ventures showing that funding for women had shown a slight uptick — all women teams now get a whole 5% of the total share of capital, and teams with at least one female founder are finally on par with the average amount of capital raised by teams that are all male — this is still woeful. Lets see where the numbers fall out overall for 2023, but my guess is there will still be a ‘woman penalty’ where teams with at least one woman cofounder raise less money (as we have seen every year before in the CTV data) and a general lack of alignment of capital allocation with ecosystem representation (which if you subscribe to the thesis that neither women or men, or people of any particular race have any special entrepreneurship talent or merit, then the allocation of capital should, if being allocated without bias, reflect the general representation in the industry).

All male teams still attract between 67% and 93% of the funding, despite the data time and time again showing that mixed teams generated better performance. And with a substantial amount of attention being placed on improving diversity from groups like Blackbird, that are trying to optimise the top of funnel and increasing the participation of women in the general tech workforce, we saw Blackbirds latest data (which they should be applauded for sharing) show only 27.5% of the companies that get to their investment committee have one woman/non binary founder, and the last 11 deals announced (in a row) were male only teams.

Even if you don’t subscribe to the ‘it’s the right thing to do’ school of thought to ensure men and women have the same access to opportunity, and instead you are a capitalist beast, the data says that diverse teams perform better (I could link to studies, but there are too many).

In the era of globalisation, if we don’t fix this, our innovation and technology sector is going to struggle to compete globally, and we are already falling behind. Economically, I don’t think its dramatic to say we dont really have a back up to innovation (which is itself the backup to resources), so it’s kind of existential.

Fight

Artificial Intelligence

For those of us who are not even ‘techno-optimists’, it’s hard not to see the emergence of AI as anything but revolutionary, and 2023 was the year it burst into the general public consciousness. Because we were able to see the beginnings of it’s utility for the masses.

Sure there are concerns. Sure there is still a hell of a lot to work through and ok, the pace of technology change is exceeding the ability of institutions to keep up with conversations of how to regulate it.

Details, details.

But when we see truly revolutionary step changes in technology like this, it’s hard not to see the opportunity for reinvention for an industry which had at times become as Kara Swisher calls it “assisted living for millennials” – standing up companies that enable unnecessary conveniences such as laundry pick up and delivery or your meal delivered 2 minutes faster.

The law of diminishing returns had well and truly been proven, and was hard to see where the true productivity or investment gains were going to come from (narrator: the answer, dear reader, is always technology).

While those in the deep tech sector have seen the power of AI and machine learning in solving extremely complex data solutions for some time, we now can see how generative AI might transform the very way we do everything. In a similar way to how the internet transformed the very way we did everything.

The advent of AI, and in particular the emergence of OpenAI, has forged a fight back to relevance for the tech industry, that is nothing short of being comparable to Mohammed Ali’s fight back during the infamous Rumble in the Jungle (Please watch the documentary, it’s one of the best sports documentaries ever, perhaps even one of the best documentaries ever).

Women are claiming their place in the tech industry and fighting for respect

Against the backdrop of the seemingly perennial conversation about the lack of diversity in the tech sector, this year we saw a groundswell of women who had decided it was beyond time for them to speak up about their experiences of sexism, gender discrimination, harassment and abuse in the Australian tech sector. There have been several posts from individuals in the last few months, such as this, this, this and this, and from me here and here, among many others.

This then led to substantial media coverage and the standing up of several initiatives that are in development, which will become public in the fullness of time.

This is neither a new or rare issue that women in the sector (or any other sector for that matter) have had to grapple with. What is new is that we have seen a cohort of the next generation of women in the sector, who have neither the time nor the inclination to accept it, nor to keep it hidden.

Sunlight is the best disinfectant, and I respect and admire these young women for having the agency to step up – not just talk about it, but to use their various positions of influence and expertise to do something about it through the various initiatives they have been working on it the background. Stay tuned.

Honourable mentions

The Emperor Has No Clothes

It’s hard to do a 2023 wrap up without talking about the two biggest stories in tech this year— the absolute sh*tshow that is Elon Musk and Twitter and the Board/CEO musical chairs at OpenAI. Both of which I think represent a new era in exposing the trappings of the idolatry of the sector (whether it’s idolatry of money, idolatry of entrepreneurs, or of tech companies) which is to expose in screaming colour, the fact that the people who make these important decisions which may one day affect us all, are really just flawed humans who often don’t know what they are doing or are being driven, not by a higher purpose, but by their demons.

While there are many examples to choose from when talking about the ridiculousness of Musk and his steering of Twitter in 2023, I think in the interest of efficiency, it’s best just to point to his recent interview with his ‘friend’ Jonathon Ross Sorkin (otherwise known as ‘Andrew’).

If you haven’t yet, I encourage you to watch the whole 90 minute interview. To describe it as awkward is perhaps the most charitable thing I could say.

From Elon claiming that customers not wanting to spend their advertising dollars with twitter is ‘blackmail’ (note to self’ next time I’m raising from LPs, I’m going to reframe their decision not to invest as simply them trying to blackmail me, might be a little easier on my ego) to saying that if customers don’t spend their advertising dollars with Twitter (because they naturally and understandably don’t want an ad placed next to a white supremacist account), they will be who ‘earth’ decides has killed Twitter, it’s illuminating.

It’s hard to tell, not being a psychologist and all, whether his views are the product of a progressively insular echo chamber that extremely wealthy people, particularly in silicon valley, find themselves in, when in a position where no-one tells them the truth or pushes back, or whether it’s just a garden variety narcissistic tendency to not take accountability of their own actions. In the end it doesnt really matter. It’s an example of an extremely accomplished person, who despite helming some game changing companies (SpaceX, Tesla) can still be responsible for the most epic commercial failures. If there was any doubt how one of the worlds most loved platforms (which isn’t to say it didn’t have it’s failings) became utterly irrelevant, Elon spoke up and removed all doubt.

A runner up for the ‘Emperor is wearing no clothes’ Twitter files this year was the extremely awful (like, terrible, horrible, no good, very bad) interview his ‘CEO‘,’ Linda Yaccarino did at Code. If you would like to witness a masterclass of how NOT to participate in a straight forward interview that asked all the questions a CEO worth their salt would have expected, this is the one. Not only did she not know her basic data about the platform, she was evasive, combative and one would hope she is being paid enough to do this gig to support her into retirement, because she is never getting hired again after that performance.

Lastly, the OpenAI musical chairs, was another example demonstrating how lofty valuations ($90Bn) or their potential impact on humanity (just a company that represents the greatest potential existential threat to mankind since the atomic bomb) are no guarantee let alone a positive signal, that boards, investors and CEOs have their sh*t together. I wrote about it here, but to distil it down, the message is that it should be a warning that we place too much confidence in the competence and motivations of the people in charge of these companies, where when push comes to shove, capitalism will always trump purpose, at our peril.

Noteworthy positive developments

Let’s end on a positive note….Cosumers of media rejoice! We have seen an explosion of excellent, educational, informative and entertaining new media for the tech sector emerge this year. A few of my favourites from domestic producers:

Capital Brief— at last we have a challenger media group that are dedicated to the business and financial sector, which have a focus on long form journalism, that is well researched. There doesn’t seem to be an obsession with clicks, no baity headlines, and it’s a delight to read. By no means does this mean they are uncritical or not focussed on holding power to account, they just seem to be doing it in a way that is less sensationalist.

First Cheque— hosted by solo GP Maxine Minter and Aussie angels co-founder Cheryl Mack, I love their really focussed, almost academic approach to teasing out the thought process investors have on risk, portfolio construction and strategy. For the fund nerds out there like me, this is a must listen.

Transparent VC by Tribe Global Ventures — as I said earlier, I’m biased but i genuinely think these guys have created something different. They mix it up between founder interviews, investor interviews and discussing the news of the week to help you understand what it means for you as an investor or founder, and they do it with humour and informality.

The Advisory Board — Hosted by Megan Flamer and Alan Jones (the good one — which just quietly, is necessary to point out now more than ever) for Disrupt Radio. Megan and Alan answer listener questions about the startup world, and while it’s useful and educational, they both have the most amazing voices for audio format, so it’s easy on the ears.

Thanks for reading this year folks. See you in 2024.

- Elaine Stead is the founder and MD of Human VC and cofounder of Tribe Global Ventures.

Trending

Daily startup news and insights, delivered to your inbox.