Welcome to Ignition Lane’s Weekly Wrap, where they cut through the noise to bring you their favourite insights from the technology and startup world.

Ignition Lane works with ambitious business leaders to apply the Startup Mindset to their technology, product and commercialisation problems.

This wrap goes out free to subscribers every Saturday. Don’t forget you can catch Gavin Appel discussing the week on the Startup Daily show on Ausbiz every Monday at 2pm. If you miss it, you can catch up on the week’s shows here.

Here’s their review of the week.

One born every minute

We didn’t think it would happen, but… another week, another Aussie unicorn! Melbourne-founded Linktree raised $152m at a US$1.3bn valuation (up 4x from last year) led by Index Ventures and Coatue Management.

For those of you keeping track at home, that makes 5 new Australian-founded unicorns in the first quarter of 2022: Linktree, Zeller, Immutable, Employment Hero and Scalapay.

In Cut Through Venture speak, we call that a 50% increase on the total Aussie unicorns roaming in 2021.

— Cut Through Venture (@cutthroughvc) March 16, 2022

Back to Linktree. Don’t be fooled by the apparent simplicity of its ‘link-in-bio’ product (a category that it created in 2016). Much more than a link landing page, Linktree’s strategy is to place itself at the centre of the creator economy:

“Everything is hyper-focused on this idea that if we add value to users, if we help them win, perhaps they’ll pay for adding value to their lives by way of reaching their audience, converting more, getting better results or saving them time,” [cofounder] Zaccaria said. “We’re really focused on helping creatives save time and help them run their business.”

As a result, it is growing at a staggering pace. With nearly 40,000 signups per day, Linktree has grown from 4 million users at the start of the pandemic to over 24 million users today – the bulk of which are outside Australia.

Operationally, how has it managed such rapid global growth? Linktree’s VP of Strategy and Operations, Michael Stocks, recently shared a few insights at an AirTree COO forum. Our favourites:

- Be purposeful about where you’re going to expand, when (don’t try and do it all at once): “We took a quantitative look at historical data of how each market has performed across key metrics, and then added a few qualitative layers such as ‘How difficult is it to do business in that territory if we were to hire a team there?’ and ‘Do we see a long term opportunity for the creator economy in this territory?’”

- Find brilliant, hungry generalists for your first local hires: “high-quality operators, understand marketing, local trends and growth and be in there speaking with customers.”

- Adopt a data-driven approach to localising pricing: e.g. market surveys, pricing experiments and optimisations with real customers.

So, from where might Australia’s future unicorns spawn? Chair of both Tesla and the Technology Council of Australia, Robyn Denholm, says they’re likely to come from mining tech, ed tech, gaming, distributed ledger and diversified fintech.

Who’s next?

Down rounds abound?

Valuation data from U.S. tech and startup land is not looking all that rosy.

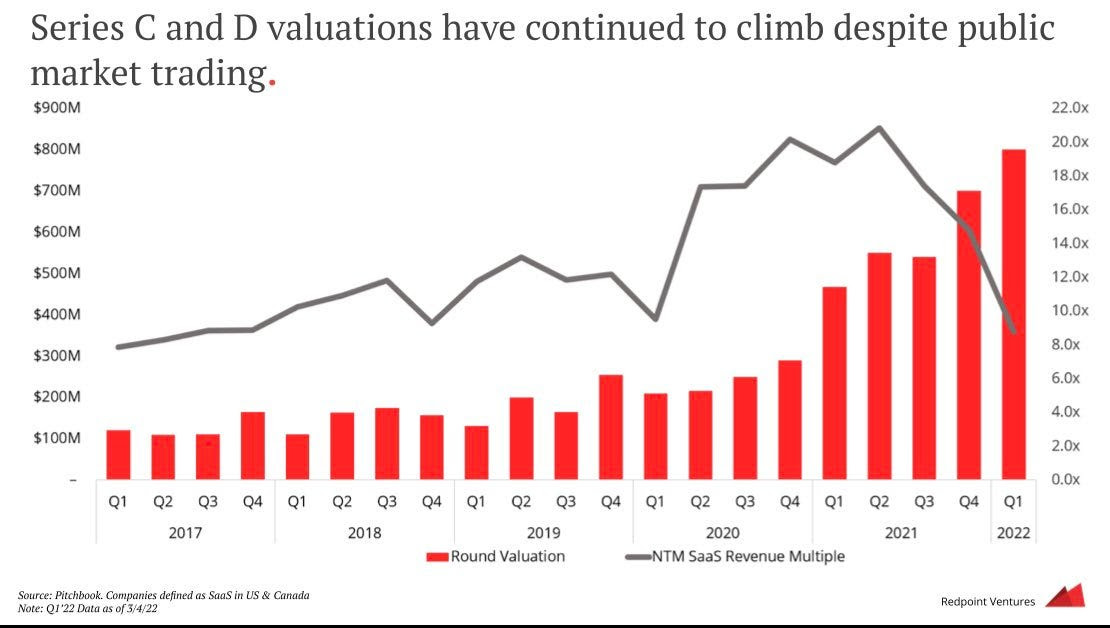

This week Redpoint Ventures’ Partner Logan Bartlett shared a presentation on the tumultuousness in SaaS valuations. Public SaaS multiples peaked around Q3 last year (20.8x next year’s revenues), but they’re now returning to pre-pandemic levels (8.8x):

|

While liquidity was at an all-time high last year (driven mostly by public listings), about one-third of US tech companies that went public in the last 4 years are now trading below their pre-IPO private round valuations. Even Zoom dropped below pre-pandemic prices this week, in spite of 5x revenue growth:

Zoom, the company that became a verb during the pandemic, is down 12% since the pandemic started.

In that period:

– Revenue is up ~5x from ~$830M to ~$4.1B

– Operating margins are up from 4% to 28% pic.twitter.com/s7bTTa6jAC— Tanay Jaipuria (@tanayj) March 15, 2022

This means we are likely to see comparatively less IPO activity in the near future, which could scare growth investors. However, for now, growth valuations continue to ride high. That might be because there’s never been more dry powder in the VC coffers. Many have raised mega, billion dollar funds recently – for example, Tiger raised US$11bn and Insight raised US$20bn in February.

For Series A to C fundraising rounds, Carta (a U.S. startup that provides cap table and valuation software) found that round sizes and valuations in the U.S. are on the decline this quarter:

SaaStr’s Jason Lemkin warns, “the next few months and quarters could be the worst time to raise growth and expansion capital in quite some time.”

We’re yet to see how this will play out in the ANZ fundraising data. Perhaps a few down rounds (when the pre-money valuation of a fundraising round is lower than the post-money valuation of the round previous) are looming?

Local raising round up

Sun Cable raised $210m from investors including Mike Cannon-Brookes and Andrew Forrest to develop the Australia-Asia Power Link (AAPowerLink) that will connect Australia to Singapore, supplying renewable electricity from resource-abundant regions to growing load centres.

EpiMinder raised $16m to expand its epilepsy monitoring device trials. Founded off the back of Bionics Institute and St Vincent’s/Uni of Melbourne research, Epiminder’s implantable device monitors the brain’s electrical activity to detect epileptic seizures, paving the way for their eventual prediction.

Kinde raised $10.6m to democratise software engineering by building dev acceleration platforms for SaaS.

Medinet raised $10m from Medibank for its telehealth platform.

Mastt raised $9.5m led by OIF Ventures. Mastt gives construction managers a single view of their projects, program & portfolio’s performances.

Bridgit raised $7.7m from OIF Ventures and Perennial Partners. Bridgit is a non-bank lender focussed on bridging home loans.

Varicon raised $2.25m for its construction cost management and analytics product.

Tectrax raised NZ$2m from Movac. Tectrax has developed an electronic amphibious system for the recreational boat market.

Earlywork raised $700k in pre-seed funding led by Square Peg to build out Earlywork as the world’s go-to content resource to explore future-focused careers, helping young people chart their own path in a rapidly changing world of work.

Local launches & new things

Meta under ACCC fire. The Australian Consumer and Competition Commission (ACCC) has launched legal action against Facebook’s parent company, Meta, alleging it engaged in false, misleading or deceptive conduct by publishing scam ads. The ads promoted investment in crypto or money-making schemes alongside “endorsement” from prominent Aussie businessdudes, eg Dick Smith, David Koch, Andrew Forrest. The links often led to scam websites. Despite Facebook receiving complaints about the ads, they were not removed.

Fixing the startup gender gap. The startup funding gap for women is getting worse (great article exploring why – here).

Recognising it has a role to play in fixing this gap, Artesian became the first Aussie VC to sign up to the Beyond the Billion pledge, a global commitment to invest more than $1bn in women founders.

Over in NZ a new business accelerator for women-led businesses, the Electrify Accelerator, has launched. Applications close on 3 April.

Hungry founders. A new accelerator program for plant-based meat/dairy startups is launching. PlantForm will offer research and development assistance, co-investment opportunities and “a deep connection to the food-tech production ecosystem.”

Decarb. National Energy Resources Australia (NERA) and the Western Australian Government launched LETs Pitch WA – providing low emissions/decarbonisation tech startups pitch training and investor exposure. The winners will also receive tickets to the ONS 2022 exhibition and conference in Norway.

Helping hospo cashflow. FoodBomb launched Bombpay – a BNPL for cafes and restaurants using FoodBomb’s wholesale ordering platform. BombPay provides Foodbomb users 21-30 days’ credit and staggers invoice payments. The founders say this offering is critical for the hopso industry where “cashflow has never been tighter” thanks to supply chain issues and closures due to covid and recent floods.

Meanwhile, a consortium of consumer groups from around the world is calling for more regulation of the BNPL industry.

Looking to hire? Startmate launched its Talent Engine – a platform that enables startups to source Startmate Fellows looking for their next dream role, and to connect their teams with their peers in the community.

Thinking of expanding into Australia? Join us on next week’s UK Tech Nation APAC Webinar Series (8pm AEST 24 Mar), where we’ll be sharing insights from our recent project helping UK startups build Australian GTM strategies. Register here.

Change is in the air

A note from our wrap writer, Bex:

Unlike the public markets, I’m about to pop. Baby Bex is due to arrive very soon (despite me being in deep denial). So while I adjust to life with this new venture, we’ll be shifting the wrap to a monthly cadence.

We’ll aim to release each edition mid-month. In case your inbox deprioritises us as a result of this change in frequency, please keep an eye out for the wrap on our socials or in your spam/promotions tab.

Wish me luck!

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

Watch Gav chat all things tech with Startup Daily at 2pm on Monday!

Trending

Daily startup news and insights, delivered to your inbox.