Ignition Lane works with ambitious business leaders to apply the Startup Mindset to their technology, product and commercialisation problems.

This wrap goes out free to subscribers every Saturday morning. Don’t forget that every Monday at 2.05pm you can catch Gavin Appel discussing the week on the Startup Daily show on Ausbiz. If you miss it, you can catch up on the week’s shows here.

Here’s our review of the week.

What startup dreams are made of: becoming billionaires

DoorDash, C3.ai and Airbnb listed last week. Each saw their valuation skyrocket above their IPO price on their first day of trading – DoorDash by 83% (around US$70 billion), c3.ai by 174% ($11 billion) and Airbnb by 113% (nearly $100 billion).

That’s too many mega IPOs for one wrap to cover. Sorry, c3.ai but your measly $11 billion valuation means you’re cut from here on out (and founder Siebel was already a billionaire so 🤷♀️) – read more about c3.ai here if you like.

DoorDash’s IPO minted three new billionaires: CEO Tony Xu, aged 36 is now worth $3 billion, and fellow cofounders Andy Fang, 28, and Stanley Tang, 27, are now worth $2 billion each.

Meanwhile, news of Airbnb’s share price left its founder, Brian Chesky speechless. Chesky and his two cofounders more than doubled their net worth in one day to around $10 billion each.

Airbnb CEO & Co-Founder Brian Chesky reacts to the company's IPO price more than doubling ahead of trading ▶️ https://t.co/bCnDxeBLWU pic.twitter.com/9FGV5gYmhd

— Bloomberg (@business) December 10, 2020

Oh how far Airbnb has come. Its market cap of nearly $100 billion is more than five times its value at the start of the pandemic, when it was forced to raise debt at a $18 billion valuation and slash its workforce by around 1,800 (cancelling about $600 million worth of unvested stock awards in the process).

Another big winner in all of this is Sequoia Capital, which has been an investor in both Airbnb and DoorDash since their early days. In particular, Sequoia’s $585k Seed-stage bet on Airbnb is likely to remain in the VC hall of fame for some time. Its $260 million investment (total over 11 years) is now worth nearly $5 billion.

What investors first paid for $DASH (IPO $102, trading at $180)

$0.15, @CRV/@saarsaar, @khoslaventures/@rabois

$0.73, @sequoia/@Alfred_Lin

$5.68, @kleinerperkins/@johndoerr

$5.51, @SoftBankVC/@jtbold

sources: Pitchbook/S-1— Rolfe Winkler (@RolfeWinkler) December 9, 2020

The listings are also a great result for Y Combinator, of which both companies are alumni.

Do things that don’t scale (but also things that do)

Both Airbnb and DoorDash came up with some ingenious ways to grow their startups.

Airbnb

What began as an idea between two friends as a cheaper way for designers to find a reasonably priced place to stay when traveling for conferences soon turned the hotel industry on its head.

The email that started it all:

brian,

I thought of a way to make a few bucks – turning our place into “designers bed and breakfast” – offering young designers who come into town a place to crash during the 4 day event, complete with wireless internet, a small desk space, sleeping mat, and breakfast each morning. Ha!

– joe

Simple website: They set up a simple website (Airbedandbreakfast.com) with pictures of their their loft, complete with three air mattresses on the floor and the promise of a home-cooked breakfast in the morning. And like that, they had their first prototype.

Cereal: The founders needed a way to raise money. It was the summer of 2008 – U.S. election time. So they came up with an idea to design and sell limited edition cereal boxes called Obama O’s & Captain McCain.

They printed 1,000 custom boxes, filled them with Cheerios and Captain Crunch and put a $40 price tag on them. The cereal somehow got featured on national TV and in 24-hours the pair had sold 1,000 cereal boxes and pocketed $30,000.

You can still find links for “Obama O’s” and “Cap’n McCains” on the Airbnb website. Airbnb’s IPO has even prompted a themed cereal revival – IPOats.

Professional photos: In 2009/10 Airbnb wasn’t gaining much traction in New York, so Gebbia and Chesky flew out and booked beds with hosts to figure out why. They found that most hosts did a good job of describing their accommodation to prospective guests, but the images—usually shot using camera phones (remember this was Blackberry/Sanyo/Nokia era)—were poorly framed with bad lighting.

The solution: Chesky and Gebbia rented a $5,000 camera and took the pictures themselves. Revenues from properties across New York doubled. They then contracted 20 professional freelance photographers to do the same for listings around the world. By 2012, the Airbnb photographer program was so popular more than 2,000 freelance photographers were working for Airbnb.

“Hacking” Craigslist: At the time, Airbnb was the underdog to Craigslist, which was popular amongst couch surfers. It turned this into its advantage. Airbnb offered hosts the opportunity to post their vacancies to both Craigslist and Airbnb. Airbnb built a bot to auto-populate the listing information on Craigslist – piggy-backing off Craigslist’s traffic to gain greater visibility.

They also poached listings by emailing hosts who had advertised on Craigslist, encouraging them to check out Airbnb.

DoorDash

DoorDash was launched by four Stanford students who came up with the delivery service business idea somewhat accidentally while talking to restaurant and food merchants about a different app idea.

Tech-lite start: Like Airbnb, the founders set up a simple website to get off the ground (www.paloaltodelivery.com), which initially was just a landing page with a phone number and a few PDF menus from local restaurants, offering delivery for $6. They picked up and delivered their first few-hundred orders themselves.

We were open a few hours per day, around dinner, and we took turns answering the phone and driving to deliver. We used Find My Friends to see each others’ locations and dispatched orders via text.

I'd start my day by taking out cash from the bank. I'd go to multiple Safeways and buy the max allowed number of Green Dot cash cards, give them to drivers to pay for food, then I'd dispatch and drive, collecting the cards at the end of the day and pay drivers in cash.

— Evan Charles Moore (@evancharles) December 10, 2020

Find the underserved: Inner cities were inundated with delivery services but suburban areas had fewer delivery options available to them. DoorDash identified a gap in the market. By targeting the suburbs, DoorDash could provide the most value, fill a need, and grow their brand.

Pizza-gate: Serving as a reminder that not all growth strategies make for good PR, Doordash fell into hot water over its pizza arbitrage in 2019. A pizza restaurant owner found that DoorDash was advertising its pizzas online for delivery when he had purposefully chosen not to offer a delivery option. What’s more, they were asking $16 for the pizzas when the actual price was $24 – DoorDash intended to create the illusion of demand for delivery services, trying to lure the restauranteur to sign up. Instead, the owner started mass ordering pizzas from its own restaurant via DoorDash, pocketing the profits from the subsidised pizzas (for which he made an even greater profit by not putting any toppings on said pizzas).

The takeaway? Perseverance, experimentation and being close to your customers will make you billions.

Australia & NZ: News that caught our eye this week 🧐

Canva’s Melanie Perkins featured on Reid Hoffman’s (LinkedIn founder) Master of Scale Podcast on the secret power of onboarding.

Showcase mocase. The 2020 Tech23 companies were announced and MAP held its Velocity showcase.

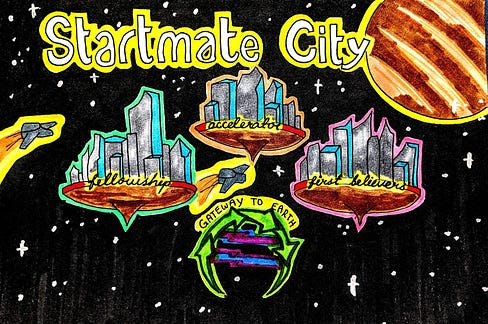

Startmate is building cities in its 10 year master plan:

We should stop at nothing to make Australia and New Zealand the first economies in the world where startups generate the majority of GDP. Imagine our kids growing up in a world where unicorns aren’t just night time stories.

Startmate is all about that culture of ambition.

We have a three-step masterplan.

- Founders — Back the most ambitious people who want to start companies

- Operators — Surround them with the right team

- Cities — Build a space that helps everyone rise together

AWS is expanding in Australia with a second Australian-based Asia Pacific cloud infrastructure region in Victoria.

IPO alert! Airtasker and WA-based internet provider Pentanet are rumoured to be talking to fund managers to prepare for IPO. You heard it here first.

Money money money money

Aussie energy tech startup Gridcogniton have closed a $675k pre-seed round from CEFC and Alberts, as well as Startmate following on from their participation in one of this year’s cohorts. The startup provides software to plan and optimise distributed energy projects using a digital twin. Gridcognition is the second energy tech startup from founders Le Gay Brereton and Tickler. The team co-founded Greensense before selling it to ERM Power, which was acquired by Shell last year.

Multitudes, a software platform to manage and improve culture and performance, has raised NZ$2.4 million (AU$2.2m) in a seed round to build their beta product. The round was led by Blackbird (investment notes here), alongside former Reddit CEO Ellen Pao, and Culture Amp Cofounder Jon Williams.

Partners for Growth has funded Fanplayr, a leader in website and ecommerce behavioural personalisation.

LegalTech startup Immediation raised $3.75 million, led by Thorney (Aussie billionaire Alex Waislitz’s fund). The startup offers an online option for resolving legal disputes, without anyone having to go to court. Between March and October, the number of users on the platform increased by 1000%.

Chrome Temple raised $5 million to launch Australia’s first luxury car fund. The tagline: “Amass a collection of yesteryear’s vehicles to create tomorrow’s nest eggs”.

Telehealth startup Coviu raised $6 million. The company saw rapid growth during the pandemic when health practitioners moved to telehealth. Daily calls jumped from 400 a day to a peak of 25,000 per day. Coviu was spun out of the CSIRO in 2018 and, last month, CEO and co-founder Dr Silvia Pfeiffer was named Founder of Year at the 2020 Women in Digital National Awards.

HealthMatch raised $18 million led by Square Peg. HealthMatch is like Tinder for clinical trials, matching researchers with patients. The Sydney-based startup uses machine learning to automate clinical trials through contract research companies.

Shippit raised $30 million in Series B funding, led by Tiger Global (giving Accel a run for its money being the most active non-Australian investor in Australia). Founded in 2014, Shippit’s technology automates tasks related to order fulfilment, including finding the best carrier for an order, tracking packages and handling returns. Shippit handles five million deliveries a month in Australia from thousands of retailers, including Sephora, Target, Big W and Temple & Webster.

Sydney-based VC, Equity Venture Partners closed a $50 million third fund.

Around the world

Zoom CEO Eric Yuan was named Time’s Businessperson of the Year.

Hyundai will acquire Boston Dynamics from SoftBank (who acquired the company from Google). The Korea Economic Daily reported the deal is worth $921 million (1 trillion won). Hyundai also has a $4 billion autonomous vehicle JV with Aptiv. In 2020, Boston Dynamics launched Spot, a quadruped robot, to the commercial market – initially selling it to U.S.-based customers for $74,500. Woof. Beep. Woof.

Robot pills. Rani Therapeutics raised $69 million to fund development of its platform that converts injectable drugs into pills:

Rani’s “robotic” capsule, which packs a built-in sensor, moves through the stomach where acids typically break down drug molecules. Once it reaches the intestine, it delivers the medicine it contains by inflating like a balloon and injecting the drug into the intestinal wall.

Google is digging a hole for itself. Last week Google fired one of the best-known Black female AI researchers in the world, Timnit Gebru over an email she sent to the Brain and Women Allies listserv. In the past week, more than 2,000 Googlers and over 3,700 supporters in academia and industry have signed a petition supporting Gebru and calling what happened to her “a retaliatory firing,” and a case of “unprecedented research censorship.” From MIT:

Online, many other leaders in the field of AI ethics are arguing that the company pushed her out because of the inconvenient truths that she was uncovering about a core line of its research—and perhaps its bottom line.

Google CEO Sundar Pichai is now pledging to investigate. But the carefully crafted memo didn’t acknowledge that the company made a mistake in removing Gebru, instead saying she “left Google unhappily”. Not surprisingly, this has further inflamed tensions.

Don't paint me as an "angry Black woman" for whom you need "de-escalation strategies" for. This thread is just the beginning of the toxicity I dealt with since before I even joined Google and I haven't said anything specific yet. 1 https://t.co/98WNgnxH6P

— Timnit Gebru (@timnitGebru) December 9, 2020

Uber is quietly doing well getting back to basics. Ridding itself of moonshot projects, this week Uber announced it will sell its air taxi business Elevate (which was set to pilot in Melbourne in 2023) to Joby Aviation, and its self-driving unit Uber ATG to Aurora Innovation. In May, Uber sold its micromobility subsidiary Jump to Lime (which it in turn invested in). Its share price is the highest it has ever been.

Meditation and sleep app, Calm has raised $75 million at a valuation of $2 billion, led by Lightspeed. The service has over 100 million downloads, up from 40 million downloads in February 2019. It also grew up from 1 million paying users to 4 million paying users in the same time period. Great Twitter thread on Calm vs Headspace growth rates – “Perhaps raising too much too early hurt Headspace ability to focus”.

Snap created a $3.5 million fund for Snapchat Lens creators and developers using the company’s Lens Studio tool to explore the use of AR technologies.

Apple is releasing AU$899 over-the-ear headphones – AirPods Max. Here’s a list of things you could buy instead. Meanwhile, ponder this:

AirPods on track for more revenue this year than Shopify, Square, TikTok, Snap… pic.twitter.com/HDCGykhcyM

— Rex Woodbury (@rex_woodbury) December 10, 2020

SpaceX’s Starship rocket had a “successful” high-altitude test, including an impressive touchdown explosion when low fuel tank pressure caused the ship to descend too quickly in the final stages. The flight was the highest yet for the rocket that may one day ship humans to Mars.

Starship landing flip maneuver pic.twitter.com/QuD9HwZ9CX

— SpaceX (@SpaceX) December 10, 2020

That’s a wrap! We hope you enjoyed it.

Gavin, Bex and the team at Ignition Lane

p.s. We love feedback – if you have any or want to continue the conversation, please reach out. Watch Gavin live on AusBiz at 2pm on Mondays, when he opens the Startup Hour of Power.

Trending

Daily startup news and insights, delivered to your inbox.