Hello and welcome to Thursday

What a time to be alive!

1. Fintech explosion

A big hello to anyone who bought BNPL Openpay and Zip Co on Monday! Now pubs are reopening, you’re buying the next round.

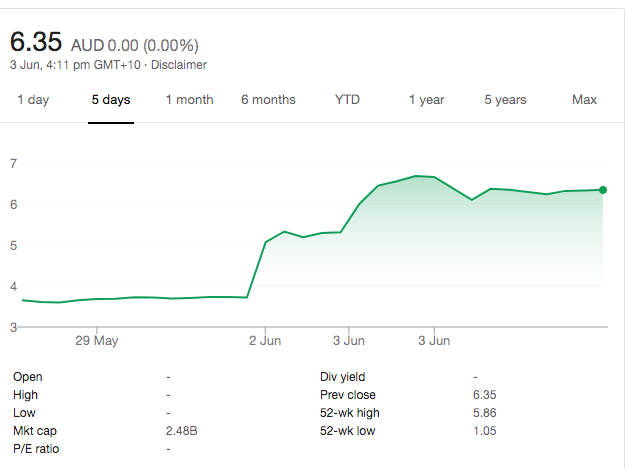

Zip shares just nearly 40% on Tuesday on news that that it was buying US BNPL QuadPay in an equity swap worth around $400 million. Read all about that here. The shares jumped a further 22% on Wednesday to new record highs, at one stage climbing above $6.50, to end the day at $6.35.

Zip’s share price on June 3

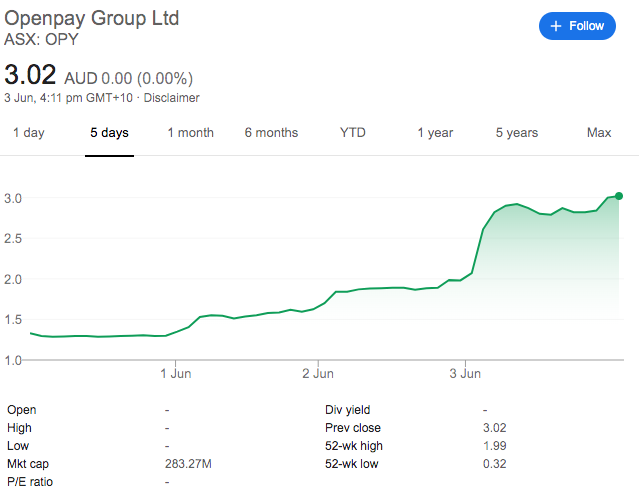

Meanwhile, Melbourne’s Openpay Group Ltd (ASX: OPY) is also setting records in something of a delayed gratification to its announcement on Monday that it secured a UK funding facility for £25 million (A$46 million) for its British business from specialist technology finance provider Global Growth Capital (GGC).

This facility has a 21-month term and adds to an existing $75 million in debt facilities already in place ($45 million remains undrawn). £10 million (A$18.4m) of the new facility is available immediately.

Openpay sat at $1.30 on Monday morning, gained 26% that day following the announcement, climbed to $1.99 by Tuesday evening and today exploded, finishing the day also at a record high of $3.02, up more than 51%. On Thursday morning, the company suspended trade pending an announcement on a capital raise.

Openpay’s share price on June 3.

2. Snapchat tones down Trump

Snapchat is the latest social media service to take on US President Donald Trump’s use of its service, saying it will remove POTUS from its Discover section and stop promoting his account in a stand against “voices who incite racial violence and injustice”.

Trump has around one million followers on Snapchat and parent company Snap says it won’t remove him from the platform.

“Racial violence and injustice have no place in our society and we stand together with all who seek peace, love, equality, and justice in America,” Snap said.

The move comes after Twitter began to add fact-checks to POTUS tweets and screened another with a warning that it was “glorifying violence” in breach of company policy.

The move infuriated the President so much he retaliated with an executive order to reduce the legal protections social media has when it comes to defamation.

3. Atlassian ups its DevOps

Atlassian has jammed a dozen new DevOps features into its products to improve workflows. In a blog post announcing the changes, Matt Ryall, the Head of Product, Jira Software, said the changes were all about less context switching and fewer meetings for more time to code

“We’re helping developers focus on their code as we uniquely connect development, IT operations, and business teams with automation that spans our products and third-party tools,” he wrote.

“We’ve built deep integrations between Jira Software Cloud and Bitbucket Cloud, GitHub, and GitLab so that issue tracking and project updates happen right where you code, automatically. No need to go back to Jira. And your project manager won’t have to ping you for updates and interrupt your coding flow, because your project board will automatically update based on your work in Bitbucket, GitHub, or GitLab.”

More here.

4. Beam lands $39 million

Singaporean e-scooter venture Beam landed a US$26 million (A$39m) Series A, led by Sequoia India and Hana Ventures this week in a sign that there still make be life in the micromobility market.

Beam’s purple scooters can be found in Australia, New Zealand, South Korea, Taiwan and Malaysia, although earlier this year, Adelaide City Council ordered their removal from the CBD, despite the company’s “virtual docked” model that offers users incentives to park them in predetermined parking spots. The company says it will use the money for expansion across all markets and accelerate the introduction of its new third-generation e-scooter, the Beam Saturn, which has swappable batteries, an aviation-grade aluminium frame, 25-cm tubeless safety tyres, rear-wheel drive, and a dual mechanical and electronic braking system.

5. VC funding webinar

Wholesale Investor is hosting a webinar tonight, June 4 at 6pm AEST, titled The Future of Capital Raising and Venture Investment, in conjunction with The Australian-UK Chamber of Commerce.

The panel includes Jonno Elliot, Managing Director, Virgin Management – Richard Branson Family Office; James Clark, Marketing Director, Draper Esprit; Nalin Patel, Private Capital Analyst, Pitchbook; and Wholesale Investor’s Steve Torso with Christian Faes, Executive Chairman, LendInvest as moderator.

In 60 minutes, they plan to cover:

- How VC and private investors are making their investment decisions

- The effects COVID-19 will have on the future of capital markets

- How start-ups must respond

- The impact of COVID-19 on the VC sector

- What you need to know about raising capital in the future

To register for the webinar, click here.

BONUS ITEM: The quieter achiever

Off Twitter for a while

— Elon Musk (@elonmusk) June 2, 2020

Trending

Daily startup news and insights, delivered to your inbox.