Welcome to Monday. Here’s the latest news from here and overseas.

Don’t forget to tune in for the Startup Daily show on Ausbiz.com.au every weekday, 2-2.45pm. Watch online, download the ausbiz app or via 7Plus.

Government pulls Facebook ads

Facebook may have blocked media and a bunch of other organisations from promoting themselves for free on the $1 trillion global giant’s platform, but it’s still happy to take everyone’s money if they’re prepared to advertise what they want to say.

And while sites might be missing readers, it seems Facebook is missing a chunk of the $2.5 million a day it reportedly banks in advertising, with the Morrison government pulling its ads, the SMH reports amid calls for a wider ad boycott.

Finance minister Simon Birmingham didn’t mince words on ABC radio saying “We will pull back from advertising on Facebook while they undertake this type of terrible activity, pulling down sites inappropriately of seeking to exert power or influence over our democratic systems.”

And with the government’s $20 million ad campaign to support the roll out of the coronavirus vaccine also hitting the road, health minister Greg Hunt telling the ABC’s Insiders program that his department has a Facebook fatwah.

“On my watch until this issue is resolved there will not be Facebook advertising” he said, calling the company “sovereign bullies”.

Facebook’s ad metrics

Meanwhile, it’s worth noting that Facebook is once again in trouble for dodgy ad metrics, with Business Insider reporting that as part of a California lawsuit against the social media giant, the judge has unredacted a report that shows Facebook executives knew for years its “potential reach” advertising metric was inflated and overruled an employee warning to adjust it to avoid a revenue hit.

The previously blacked out document alleges Facebook’s chief operating officer, Sheryl Sandberg, acknowledged problems with the potential reach metric in a 2017 internal email. The lawsuit claims Facebook discovered removing duplicate or fake accounts from the total number would cause a 10% drop in potential reach numbers.

The employee who proposed the fix said: “It’s revenue we should have never made given the fact it’s based on wrong data,” according to the filing.

In response, a Facebook spokesperson said “These documents are being cherry-picked to fit the plaintiff’s narrative.”

It’s worth remembering that Facebook settled a lawsuit in 2019. with The Wall Street Journal revealing the company disclosed inflating viewing times for video ads due to metrics errors.

XTX turns 1

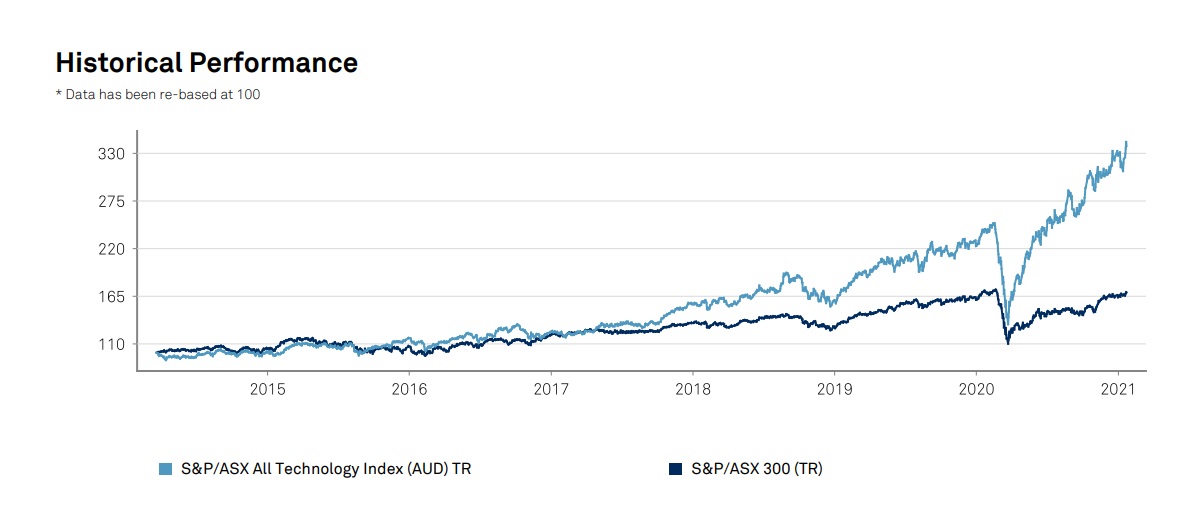

Happy anniversary to the S&P/ASX All Tech Index (ASX: XTX), which turns one today.

Cast your mind back 12 months to its launch and marvel at what’s happened since. When it launched, Afterpay (ASX:APT) had a market cap of $9.878 billion. It’s now more than $40 billion.

The index is rebalanced quarterly and when it launched, New Zealand-born Xero topped the list, followed by Computershare and Afterpay.

At the December rebalance, Afterpay was well and truly top dog.

The initial ATI had 46 list companies with a combined market cap of $100 billion. There are now 69 companies on the S&P/ASX All Technology Index (XTX) with a total market cap of more than $170 billion.

How come it keeps getting bigger? Well, to make the cut, an ASX-listed company needs a market cap of more than $120 million, with more than $120,000 of shares traded daily (over a 3-month period), among other criteria, including 30% of shares being available for trade.

In the December quarter, the number of listed “unicorns” (worth more than $1bn) had grown from 38 to 40.

Investing in the XTX in 2020 would have delivered you returns of around 39%. Not bad.

Another BNPL to IPO

Buy now pay later fintech Butn has raised $12.5 million in a pre-IPO round, signing a partnership with food delivery service Easi along the way. The six-year-old business is a B2B fintech rather than a consumer one.

Butn was founded three years ago and previously raised $5.5 million in late 2020. Canaccord Genuity led this latest round and will guide the company to listing.

Air purifier raises $6m

An Australian-designed air purifier and detoxifier that says it “reduces the threat indoors by encapsulating and suffocating airborne viruses, mould and bacteria” as well as being able to detect smoke, mould, carbon monoxide and harmful PM2.5 particles in the air which can all be observed and warn you via an app has raised $6 million in its latest round.

VBreathe, which also claims to reduce a strand of coronavirus, has previously raised $5.5 million. The device, which looks more like an Alexa speaker than an air purifier, uses medicalgrade HEPA-filtration and a specially designed gel to tackle airborne pathogens.

Tweet of the Day:

225 final applicant interviews for @moonshotspaceco about to kick off. Stoked about the opportunity to help a cohort of space tech startups accelerate! pic.twitter.com/PawBmz9uyA

— alan jones (the good one) (@bigyahu) February 21, 2021

Trending

Daily startup news and insights, delivered to your inbox.