Xero CEO Steve Vamos.

- Operating revenue rose 32% to NZ$338.7 million in H1 FY20

- 30% growth in annualised monthly recurring revenue to NZ$764.1 million

- 30% growth in total subscribers to 2.057 million

- NPAT increased by NZ$29.9 million to NZ$1.3m

Business is booming for cloud accounting software business Xero, with the NZ-born startup topping two million subscribers globally for the first time and posting its first positive H1 net profit result in its 13-year history.

The news saw Xero (ASX: XRO) jump nearly 10% to a new record high of AU$74.54 before closing the day up 9.42% at AU$73.86, having doubled in price on 12 months ago. The business now has a market capitalisation of around A$8.4 billion.

Releasing Xero’s half year financial and operating results to 30 September 2019 (H1 FY20) today, the company announced 30% growth in total subscribers to 2.057 million. It’s taken just 30 months to double that number after taking more than a decade to hit one million.

That result leaves Xero streets ahead of local rival MYOB, which says it is on target to hit a million subscribers next year.

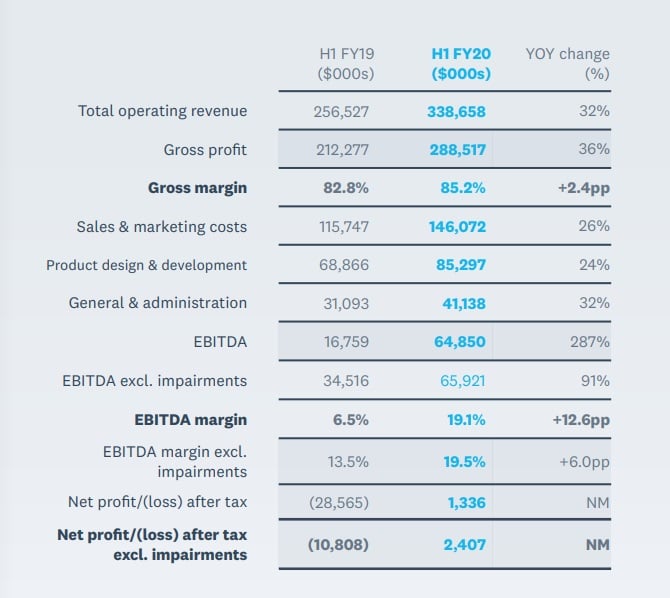

Net profit after tax (NPAT) increased by NZ$29.9 million to NZ$1.3 million – the company’s first H1 NPAT, while operating revenue was up 32% to $338.7 million – 33% in constant currency (CC) terms – and annualised monthly recurring revenue also rose 30% to $764.1 million.

The best news for investors was free cash flow at $4.8 million, compared to free cash outflow of $9.8 million in H1 FY19. That’s equivalent to 1.4% of operating revenue for the period. Free cash flow to 31 March, 2020, is expected to be of a similar proportion to total operating revenue in the same previous period, the company said.

Total subscriber lifetime value grew by 37% (38% in CC) to NZ$5.4 billion, with more than $1 billion added in the half. Gross margin improved by 2.4% over the previous period to 85.2% in H1 FY20.

EBITDA excluding impairments of $65.9 million almost doubled from $34.5 million in H1 FY19.

Australian subscribers grew by 28% compared to the same period last year, with the number of subscriber numbers hitting 840,000. Revenue was up 26% (29% in CC). The company said the implementation of the Australian Taxation Office’s (ATO) Single Touch Payroll initiative contributed to continued strong demand for cloud accounting.

New Zealand subscribers increased by 13% compared to the same period last year to 367,000, with revenue rising by 22%.

Source: Xero

Chairman Graham Smith and CEO Steve Vamos said a number of significant trends are contributing to Xero’s global expansion including industry, regulatory and technology shifts in their report accompanying the results.

“These include the increased use of cloud technology by small businesses, the digitisation of tax and compliance systems, and the disruption of traditional financial services, whether it be new payment methods or technology such as e-invoicing,” they said.

“Our platform currently provides customers with more than 200 connections to banks and financial services partners around the world, and we reached a new

benchmark of more than 800 apps in our ecosystem during the half.”

The company also announced it was committed to having a net zero carbon footprint, offsetting 100% of its carbon emissions from 31 March, 2019 onwards.

The business is calling the program Net Zero @ Xero.

“We are actively developing Xero’s social and environmental initiatives that we believe can have a positive impact on our communities and the environment,” Vamos said.

“These initiatives include enhanced employee volunteering and support for non-profit and for-purpose organisations. Xero takes sustainability seriously and we see our commitment to Net Zero @ Xero as a positive step for our business.

- Editor’s note: This story has been amended after MYOB contacted Startup Daily to say its total ANZ subscriber numbers were >800,000 at the end of July, adding that the figure was “comparable to the 1.2m Xero disclosed for ANZ (840k + 367k)”. The company says it is on track to hit 1 million subscribers in ANZ in mid-2020.

Trending

Daily startup news and insights, delivered to your inbox.