‘Stupid money’ is out and smart investors are looking for opportunities in the Australian startup scene, say leading venture capital partners.

Speaking at the Melbourne Startup Bootcamp at Bay City Labs yesterday, Skalata Ventures cofounder and CEO Rohan Workman called out the ridiculous funding rounds that had given startup founders unrealistic expectations.

“It’s a great time to build a company,” Workman told the Melbourne Startup Bootcamp held at Bay City Labs’ Docklands hub this week.

“I think it’s actually a really good time, because there’s a lot of people, including the three of us sitting up here, who are probably going to make more investments this year than in any year previously so it’s actually a great time to have a raising.”

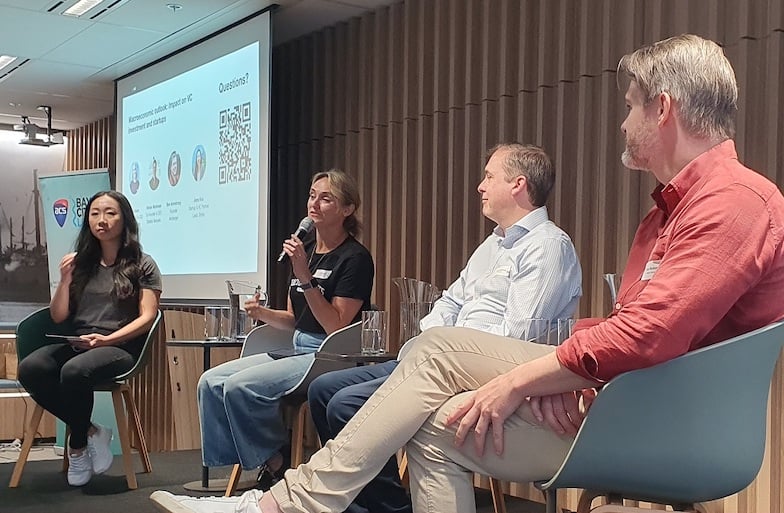

Workman was appearing alongside Tractor Venture’s Jodie Imam, Archangel Venture’s Ben Armstrong and Stripe’s Jane Kou on a panel discussing the macro economic challenges facing startups and investors.

Since interest rates started ticking upwards after historic pandemic lows, the startup community has been facing funding headwinds as investors looked for higher returns.

Coupled with a general cooling of marketing sentiment towards the tech sector in general, leading to massive job cuts among the established giants, at first glance the outlook for startups seeking funding seems to be uncertain, but Jodie Imam said that’s not the case.

“We’re actually seeing some really great opposite experiences,” said Imam.

“We had one of our founders say to us, ‘okay, I’m ready to raise’ in December of last year, and we’re like, ‘you’re crazy. You’re not going get money in December!’

“He did. He got money from TEN13 and some others – the rest is finalising at the moment – but I do think that it is a great time to get investment, if you are a business that has customers and is producing revenue and has a path to profitability.

“There is a lot of dry powder in this market, especially in Australia which is still protected from the what’s happening to an extent around the world. Our VC funds have cashed up and-a-half to invest.”

The right time to start a business

Imam’s upbeat view was shared by Archangel Ventures’ Ben Armstrong: “I think it is a great opportunity to start a business in this environment if you if you’ve got the right kind of business, and you’ve got the right kind of attitude.”

For those looking to angel investors and high valuations, the news may not be so good however with Workman warning a lot of the friends and family won’t be looking to startup investments in the near future and numbers will be much more modest.

“There were so many of these founders coming up to you saying ‘I’m turning over four thousand dollars in revenue, like a $10 million valuation, I’m gonna build a $200 million company in the next three months.’ It was just stupid. And the thing was, what was happening was there’s a rush, and there’s a lot of FOMO in the market.”

“Angel investors tend to be high net worth individuals, you have a lot of people who are maybe doctors and lawyers, people with money, who don’t necessarily understand in detail what it takes to be a successful early stage investor.

“So what you find is, some founders might find friends, maybe an uncle who works for KPMG as a partner, to put in money. As you know, that for a $10 million valuation wasn’t actually that sensible.”

“Now that those investors are starting to take a step back, the whole world, especially the seed stage, is a lot more realistic. And what you want is when you’re thinking about building a company, what you don’t want to be doing for valuation, right now, you want to be thinking about the next four or five capital raises you need to do to build the company that you want.”

The message to founders from the bootcamp was clear – if you have a business solving real world problems, then Australian VCs are prepared to talk to you.

“The boring sectors are best,” said Workman. “If you’re working in a really boring industry, then we really, really want to talk to you.”

Imam added, “we see a lot of attractive investments where our founders have started off with more traditional model like a consultant or a service provider, and then have found the technology that’s going to solve the problem and translating into a product business. And so that’s the sort of business we can happily support.”

- This story first appeared on Information Age. You can read the original here.

Trending

Daily startup news and insights, delivered to your inbox.