Melbourne-based startup Rewardle is staying ahead of the game, now offering time-poor coffee consumers the ability to order ahead through mere taps on their smartphones.

Starbucks CEO, Howard Schultz, recently announced that they would soon release “order ahead” functionality – allowing customers to beat the queue by ordering and paying for their beverage via the Starbucks mobile app before stepping foot in the store. Staying ahead of the global coffee giant, Rewardle has today launched mobile ordering to ensure local baristas aren’t left behind.

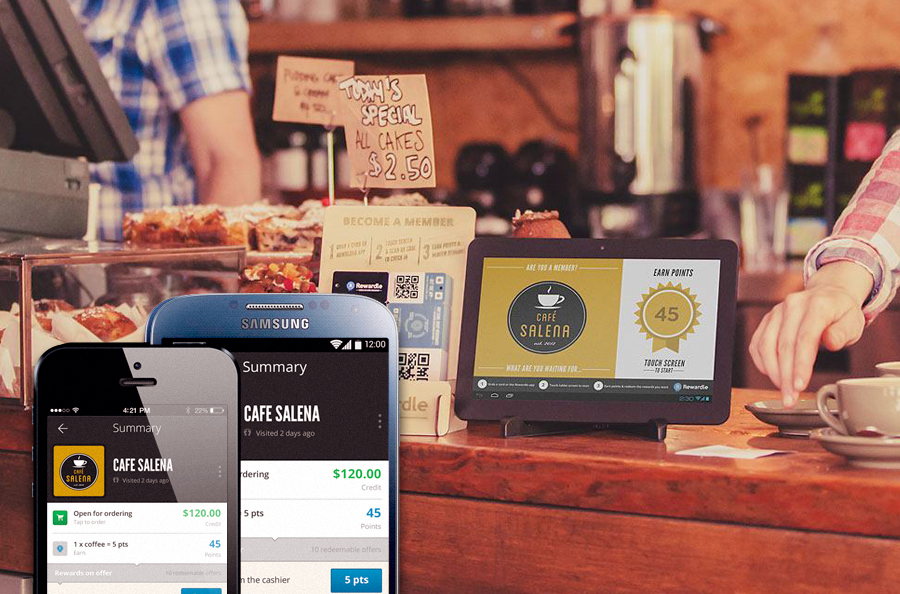

For those unfamiliar with Rewardle, it’s essentially is a digital update on the ubiquitous “buy 9, get 1 free” paper punch card and is being embraced by local businesses around the country, particularly cafes. Rewardle provides local businesses with a customer facing tablet that acts as a kiosk. During visits, customers check-in on the tablet using a card or smartphone app to collect points and redeem rewards during daily transactions at their favourite places.

Founder and CEO of Rewardle, Ruwan Weerasooriya says implementing mobile ordering and payment functionalities through the Rewardle platform was the logical next step for the startup.

“Our tablets were already acting as a currency collection and redemption platform for points. We’ve just added real dollars and goods into the mix,” he says.

There is no doubt that mobile wallet and ordering technology is being widely embraced by businesses and consumers alike. Apple CEO, Tim Cook, caused a stir in late January when he discussed mobile payments directly on the company’s earnings call, saying that it’s an area that has “intrigued” the company and that mobile payments actually figured in the company’s thinking around Touch ID.

But for all the ballyhoo around the technology, there are only a few successful examples of mobile payments being taken up by merchants and consumers. Major companies like Google, Intuit, PayPal and various telcos have all thrown their hats in the ring with mixed results.

Recently, the Australian Financial Review reported that Square, the mobile payments company lead by Twitter Founder Jack Doresy, is expected to launch in Australia later this year. If so, Square will join domestic banks and startups tackling mobile payments in Australia.

Weerasooriya is undaunted by the competition from both big and small players, saying, “Mobile is a new challenge for everyone. The big guys are still trying to figure it out and the startups certainly haven’t crack the nut.”

“A number of local startups have attempted mobile payments and order ahead, a handful specifically targeted cafes, but when you cut through the hype, break down the numbers and chat with business owners, they have resoundingly failed to gather critical mass or evolve their business models.”

Weerasooriya believes Rewardle’s lean startup approach and focus on execution will ultimately lead the company to success. He says a key differentiator of the Rewardle approach is that they have developed a transaction-fee-free approach for merchants.

“Rewardle offers merchants the opportunity to offer the convenience of mobile ordering and payments to their customers without costly transaction fees. We’ve been playing with order ahead and payment functionality for a number of months and have taken on loads of feedback. What’s really obvious is High St merchants are facing tighter margins and they don’t need another provider picking their pocket on every transaction,” Weesooriya explains.

“I’m pretty confident our breakthrough of offering transaction fee free mobile ordering and payment will see us become Australia’s largest order ahead coffee service in coming weeks.”

For more information on Rewardle, visit www.rewardle.com.

Trending

Daily startup news and insights, delivered to your inbox.