Perth-based angel investor Greg Riebe has been named the Angel of the year for his contribution to and impact on angel investment in the startup community in the annual Techboard 2020 Australian Angel Investment Awards.

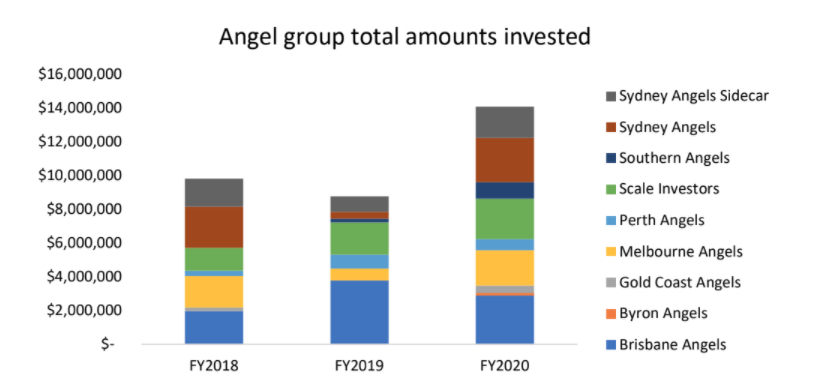

Despite fears that it would be a lean year for angel investment, Techboard found that total funds deployed by the main Angel groups increased by close to 50% from FY19 to $14 million in FY20, despite a drop off in activity in the last quarter following Covid-19.

Riebe, a founding member of Perth Angels (originally the WA Angel Investors), has been involved with the group since 2010 and said the awards was especially pleasing as the group marked 10 years.

“It’s a wonderful reward for the vision that I and my co-founders Jim Tweddle and Ray Hart shared, and the incredible effort by my Perth Angel colleagues who are tirelessly growing the awareness, participation and growth in early stage high growth ventures in WA, and across Australia,” he said.

“Western Australia is generating some amazing emerging technology ventures and there are real opportunities for the WA private investment community to participate in the value they present, as well as grow jobs and diversify our economy.”

Among the other awards, Most Active Angel Group award once again went to the Brisbane Angels with 37 qualifying investments (up from 2019’s 29) in 30 companies.

Brisbane Angels founder and chairman John Mactaggart said they managed to get 40 deals across the line worth a total of $2.9 million, with the group also launching a new ‘Members Portal’ to streamline investment transactions and portfolio management.

“The new portal and existing bare trust investment platform put Brisbane Angels at the forefront of investment execution and management for our members,” he said.

Mactaggart said the group remained as active as ever during the COVID-19 pandemic with meetings held via zoom.

“We’re now back to having face-to-face meetings and both member participation and deal flow are as active as ever. Indications so far are that the 20/21 year will be a strong one for Brisbane Angels.”

While the Queenslanders were busy, the total amount invested was a closer call between the top four Angel groups: Scale, Brisbane, Sydney and Melbourne.

Source: Techboard

Victorian investor Bill Grierson was awarded Most Active Angel Investor for the third year running, with 17 investments over the year, up on last year’s 13, despite previously saying he’s winding down.

“Most Active is an honour that is clearly dubious, one part dedication balanced with an equal measure of lunacy. It is a Black Art at best,” Grierson quipped.

“But if you do enough of it, and do it consistently, in between the mandatory failures (usually with no fanfare, and sometimes not even a forwarding address) and the water-treaders with limited prospects (confirmed by their equally limited communication with their long forgotten shareholders), there are going to be a few investments that could make you feel downright smug if you dare.

“Sitting on a couple of 20X plus uplifts and a nice bundle of 4X to 8Xs do not necessarily mean you know what you are doing… but at least they keep you interested enough not to stop!”

According to Grierson’s tally, these latest deals now form part of a portfolio of 110 separate investments into 50 different companies, accumulated since 2014.

Byron is best regional

Byron Angels won the Most Active Regional Group award with 7 qualifying investments over the year, an increase on the 2019 winners the Fraser Coast Angels.

The awards are organised by startup and tech company data consultancy Techboard.

Australian Angel Awards founder and Techboard co-founder Rafael Kimberley-Bowen said there was an encouraging number of entries in a tough year, with nominations from almost all states

“This is only the third year we’ve held the awards and it’s a particular challenge to attract the most worthy nominations from Angel investors who sometimes prefer to shun the spotlight,” he said.

“But with fantastic support from a collaborative community of Angel groups around the country, we’ve managed to draw out another impressive shortlist of nominations. This is an encouraging sign, and signals that the awards are maturing.”

Melbourne Angels took out the award for Best Angel Exit of the Year, with a 4x return on its investment in Rome2Rio made back in 2013.

Kimberley-Bowen said it’s the award that creates the most excitement, because it’s why they invest in the first place.

“People talk about Angel investing being about supporting the community and giving back, and that’s all true to an extent, but the sought-after exit is really what it’s all about. Celebrating these successes helps boost interest in Angel investment as an asset class, which ultimately is good for startups, good for future job creation,” he said.

“It was a particularly tricky category to judge this year, as we had a lot of great entries, but some of them unfortunately failed on technicalities, for example where liquidity had been achieved through an IPO but the investor hadn’t yet sold their shares, or where an investor had sold sweat equity but not their purchased shares, and so we had to get quite technical and precise about what constitutes an actual exit.”

The judging panel was led by Jordan Green, and included representatives from the seven main Angel investor groups in Australia. Green was the 2019 Angel of the Year award.

Trending

Daily startup news and insights, delivered to your inbox.