Venture capital funding at the start of 2023 may not have been as bad as many thought according to new analysis from Perth-based investment data company Techboard.

Releasing its March quarter Funded report this week, Techboard identified $1.01 billion in capital deployed across 111 deals. That figure is 50% higher than the $661 million across 82 deals in the Cut Through Ventures analysis released at the start of April.

Techboard CEO Peter van Bruchem declined to comment on the reasons why there could be such a stark different between the findings of the two venture data firms.

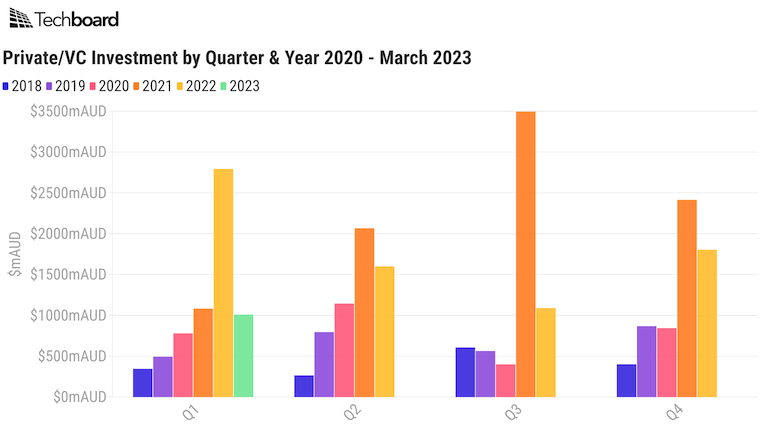

Based on the Funded figures Q1 2023 was the slowest quarter for investment since $844 million in Q4 2020, and only marginally behind Q1 in 2021, but van Bruchem says that prior to that period, the only other time funding cracked the $1bn mark in a quarter was Q2 of 2020.

“March funding levels were quite subdued in part due to the fallout of the recent collapse of the Silicon Valley Bank as well as a number of other factors such the increase in interest rates and cost of living pressures,” the Funded report says.

“In March 2023 Australian startups announced they had collectively raised $204m from 36 private rounds. This was less than half the amount announced in February which saw $432m from 47 deals and even down from the usually slow January which saw $372m from 28 deals.”

The Australian result suggests that local startups are actually faring better when in comes to investment than their international counterparts, with US-based CB Insights finding that global VC funding hit its lowest quarterly total since Q4 2019.

But van Bruchem says local private funding on a month by month basis tells less positive story. While January’s funding levels were the second highest on record, behind January 2022, the results for February and March were significantly worse, with February having the lowest level of funding since 2020 and March having the lowest level since 2021, but lower than that recorded in 2019.

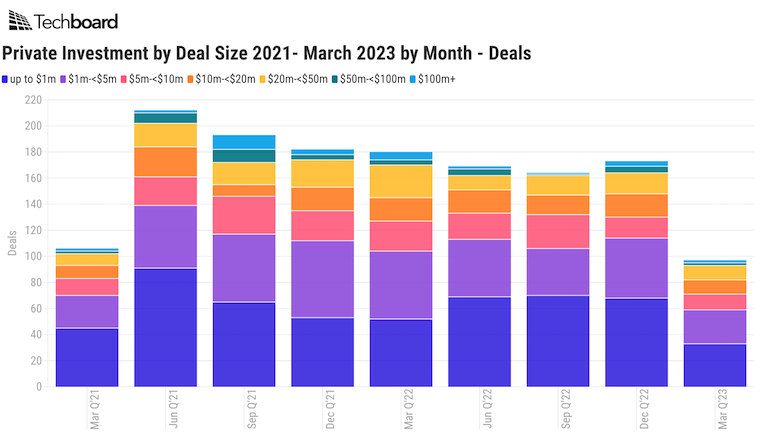

“Analysis of deal data by deal size reveals a number of insights. Firstly the profile of deals by deal size for the March Q in 2023 is almost identical to March Q in 2021 but an analysis by deal label reveals much fewer later stage deals in the March Q 2023,” he said.

“Comparing the current quarter to immediately preceding quarters shows drop in the number of rounds across all deal labels, with the largest proportional drops being in pre-seed and Series A. Drops were recorded across all deal sizes but were most notable in the $1m-$5m and $20-$50 ranges.”

Quarterly deal size over the last four years. Source: Techboard

There was a general drop in deal size across the board in stark contrast to the 2022 December quarter, when the average Series A and Series B round sizes increased on the previous September quarter.

Drops were recorded across all deal sizes but were most notable in the $1m-$5m and $20-$50 ranges.

The good news in the Techboard report is that women-led ventures secured a significantly higher proportion of overall funding compared to the appallingly low figures in Techboard’s Funding for Women-Led Ventures report last September 2022, which found that in FY22, women-only-led companies landed just 0.73% of all private funding with 14.9% of funding going to startups with at least one female founder.

The Funding Update reveals that for the March Q 2023, 4.64% of private funding went to companies with an all female founding team and 25% went to teams with at least one women founder.

Four “megadeals” helped bolster the start of 2023. They were climate change agtech startup Loam raising $105 million Series B; fintech Till Payments banks $70 million in a Series D, just weeks after shedding 120 staff (founder Shadi Haddad stepped down as CEO straight after the capital injection): the US-based music licensing marketplace Songtradr, which is backed by WiseTech Global founder Richard White, pocketing $68.7 million in a Series E; and carbon exchange marketplace Xpansiv pocketing $181 million at a reported $2 billion valuation.

Those investments were notable because historically March has attracted fewer megadeals than other quarters.

But as the world grapples with how to deal with climate change, it seems investors have decided to back the sector, with climatetech startups, spanning agritech, cleantech, clean energy and eMobility accounting for $354 million – 35% – of funding for the March quarter.

Fintech accounted for $192m (19%) with healthtech startups raising $123m (12%) of the total funding in the quarter

The full March quarter report is available at techboard.com.au

Quarterly deal size. Source: Techboard

Trending

Daily startup news and insights, delivered to your inbox.