Payments fintech mx51 has raised $32.5 million in a Series B.

The lead backer was not disclosed by the startup, which described them only as as “global fintech investor”. Major existing investors, including Mastercard, Acorn Capital, Commencer Capital, Rampersand and Artesian joined the latest raise.

The white-label payment technology provider, spun out of Assembly Payments in 2020, previously raised $25 million in a Series A in May last year, and has since doubled its global headcount to more than 100.

mx51 will use the funds for local scale and international expansion, doubling down on core in-store, online payments and merchant dashboard solutions, as well as bolstering capabilities to assist with fraud prevention and data-driven customer insights.

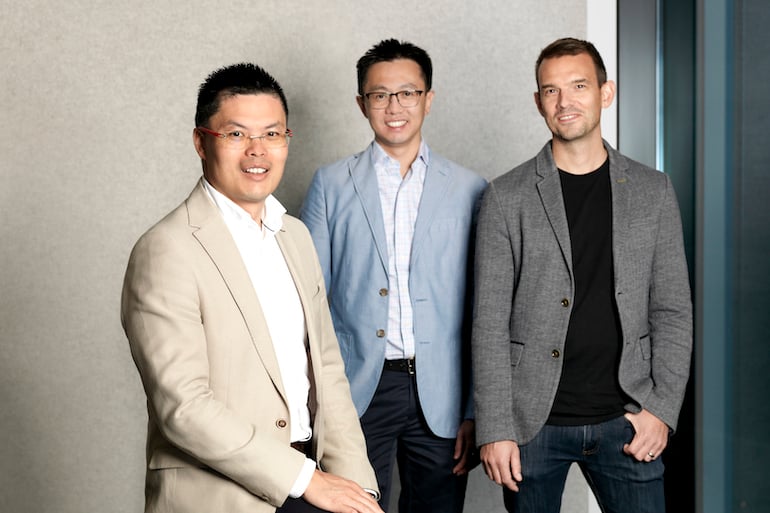

CEO and co-founder Victor Zheng said mx51 empowers banks, acquirers and merchants to keep ahead of rapidly evolving shifts in payments technology and the business is on track to more than double revenues this calendar year.

“Thanks to our partnerships to date, we estimate we now have the means to access a significant share of Australia’s merchant market. With this new capital, we’re poised for an aggressive rollout over the next few years, first in Australia and then abroad,” he said.

“We’ve succeeded on the back of our sharp focus on simplifying the merchant payment experience, and empowering banks and acquirers to innovate around legacy technology and to keep pace with changes in the payments sector.”

“This capital raise is also in spite of global macro headwinds. This is because our primary customers, banks and acquirers, are well positioned to deepen collaboration and co-invest with fintechs to deliver modern payment experiences to their merchants.”

Rampersand managing partner Paul Naphtali has backed mx51 since pre-seed said the fintech has the potential to be another Australian-made global fintech success story.

“Mega rounds in this market cycle may well be rare, but mx51 is a rare case. The tenacity and daring to build bank-grade core infrastructure with relatively little funding shows how the Australian founder mindset is critical – build more with less,” he said.

Acorn Capital CEO Robert Routley said: “mx51’s payments technology has a compelling value proposition that has been validated by a rate of customer adoption that has exceeded our expectations since our initial investment in 2021.”

Trending

Daily startup news and insights, delivered to your inbox.