‘A rising tide lifts all boats’ is a saying popularised US President John F. Kennedy. It’s a reference to everyone winning when the economy is strong.

For many investors, 2021 has been a king tide. And this month, the good ship Blackbird, the Australian venture capital firm, revealed just how rising valuations in the companies it’s backed have floated their boat.

The value of the decade-old VC firm’s investments has skyrocketed by a staggering 400% in the nine months to September this year. The firm’s good fortune has been led by its multiple rounds backing design powerhouse Canva.

Blackbird released the figures as the VC looks to get investors on board for a new $1 billion fifth fund in 2022 to back more companies.

By September 30 this year, Blackbird had invested in nearly 90 companies, with 25% of that cohort worth more than A$100 million and six topping a $1 billion valuation.

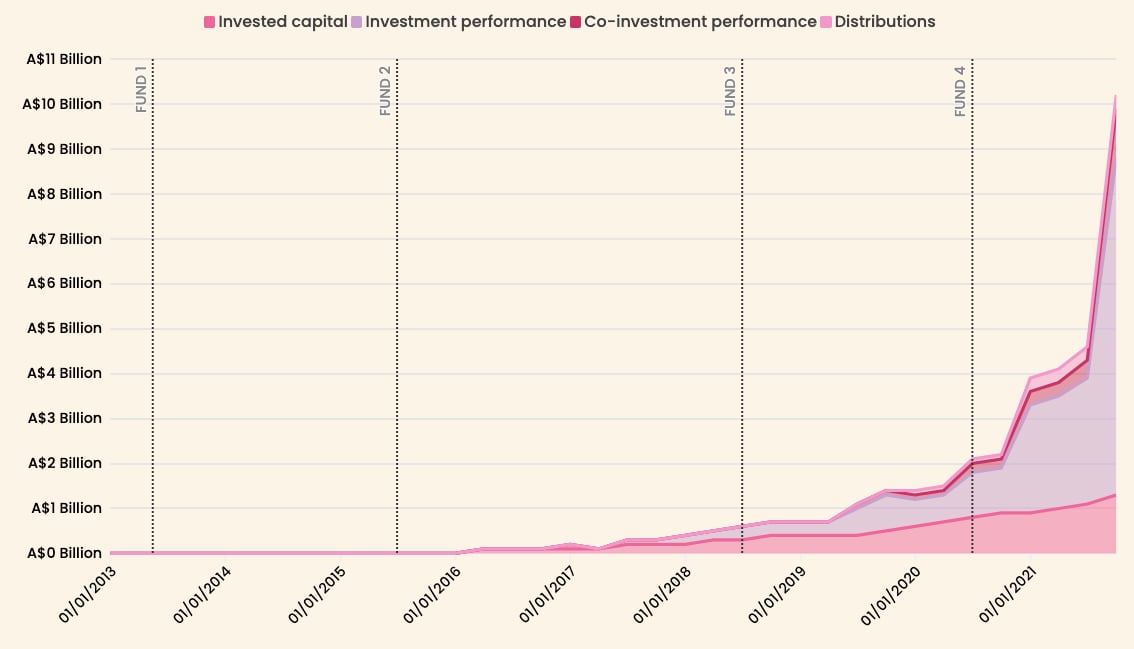

The VC has ploughed $1.3 billion into these startups since 2012. At the start of 2021, the portfolio was worth $2 billion, by September the VC valued it at $10 billion.

The value of Blackbird’s investment portfolio over the past decade. Source: Blackbird

Canva leads Blackbird’s unicorn pack, with its valuations growing by an incredible 500% in just 15 months since mid-2020. It’s not so much the wind beneath Blackbird’s wings as a massive tailwind. The value of Canva nearly trebled in less than six months in 2021.

Blackbird has a 15% stake in the 8-year-old privately-owned Sydney tech company, now worth more than $8.1 billion with the company valued at a gobsmacking $54.5 billion after a $273 million raise announced in mid-September. That a 175% increase on five months earlier when a $93 million raise in April valued Canva at A$20 billion. Those two surges in the valuation came after an $87 million raise in June 2020 that valued Canva at $8.7 billion.

It’s perhaps the nation’s most savvy investment since the Whitlam government paid $1.3 million for Jackson Pollock’s Blue Poles in 1973. Five years ago, the painting was valued at more than $350 million.

Blackbird has backed Canva in eight rounds, kicking off with $250,000 for a seed round in 2012.

The VC’s been on a similar investment journey over a similar time period with the employee engagement platform Culture Amp, which raised $135 million in a series F announced in July that doubled the company’s valuation to $2 billion in just two years.

Blackbird’s ‘unicorn’ investments. Source: Blackbird

Blackbird co-founder and partner Niki Scevak, writing on the company blog, said that back in 2012 the idea of a successful Australian VC firm was contrarian and that first fund took a long time to raise.

“That fund went on to invest in the first and follow-on rounds of companies like Canva, Culture Amp, Zoox, SafetyCulture, Propeller and Skedulo,” he said.

“The amazing founders and teams that we backed from this fund have turned our investors’ first $29M into over $1.3B billion, a net return of 47x. And there’s still lots of growth to come.”

“Now as we look towards the second decade at Blackbird, we hope to prove that it is also possible to build a generational investment firm outside of Silicon Valley, Wall Street or London.”

Trending

Daily startup news and insights, delivered to your inbox.