The Commonwealth Bank has launched a near-identical “no interest” credit card just a day after NAB announced it was launching its flat fee StraightUp Card on Thursday.

Aside from slightly different monthly fee rates, the only other key difference is that while NAB partnered with Visa, CBA’s “CommBank Neo” is a Mastercard product.

Like StraightUp, CommBank Neo is offered in three credit limits of $1,000, $2,000 and $3,000

It too has no annual or late payment fees, no interest charges, replaced by a monthly flat fee ranging from $11 a month for a $1000 credit limit to $18 for $2000 and $22 for $3000.

The fees are higher than the NAB offering, priced at $10/15/20 respectively. Another key difference is repayments. CBA will ask for a minimum repayment of $25 or 2% of the closing balance. The NAB card has a minimum monthly repayment of $35 on a $1000 card, $75 on $2000 and $110 on $3000.

Both cards will not offer cash advances, can’t be used to gamble and don’t charge the monthly fee is the card is not used and the balance is zero.

One advantage the CommBank Neo will have is access to the CommBank Rewards loyalty program, which has a cash back offer.

RateCity.com.au research director Sally Tindall said that with buy now, pay later services like Afterpay and Zip Pay attracting more than 5 million customers between them, the big banks have been forced to come up with a credit card to compete.

“These new cards signal it’s game on between the big banks and buy now, pay later,” she said.

“Hopefully this competition will bring more low cost, consumer-focused credit options to the table.”

Tindall said the main difference between the two cards was NAB asking customers to pay back more each month, which will see them clear it faster.

“The second difference is CBA offers shopping perks, but only if customers spend at certain stores,” she said.

“Customers should be wary: if they start buying things in a bid to claw back their monthly fee, then they’ve probably been had.

“Bank minds clearly think alike when it comes to tackling buy now, pay later. At this rate, Westpac and ANZ will have interest free cards on offer before the weekend’s out.”

The charge levied by the cards are similar to interest rates of between between 11% and 14% if the full credit limit is used.

And while that figure is below the 20% rate on many credit cards charge in a period of record low interest rates, the new cards have the potential to cost users even more than a traditional card with high interest rates.

For example, a user with a $3000 credit limit would still pay a $22 fee per month on an outstanding balance of $200 on the CBA card, meaning that if they paid the $25 minimum every month, they’d taken 5.5 years to pay off the $200 and pay $1,452 – effectively an annual “interest rate” of 132%.

Afterpay charges a $10 late payment and additional fees if users fail to meet the repayment deadlines within six weeks. BNPL rival Zip, changes a monthly account keeping fee of $6.

CBA investing heavily in Swedish BNPL Klarna, which launched in Australia earlier this year, paying US$300 million for a 5.5% stake.

The bank says the CommBank Neo will be available in late 2020.

CommBank Neo Business will be available in early 2021.

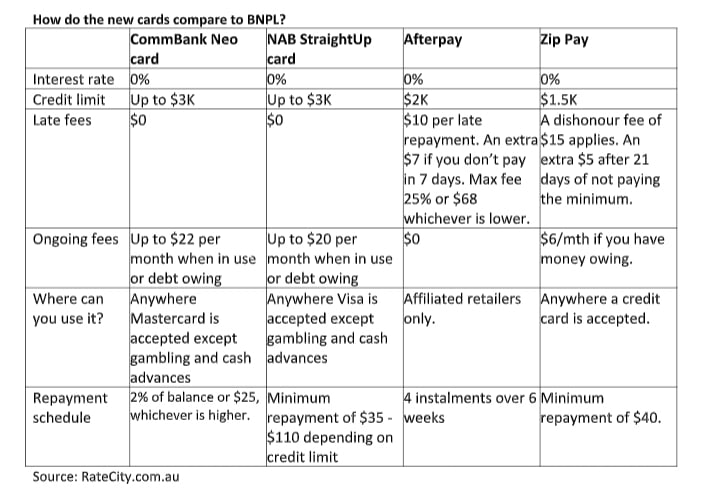

Here’s RateCity’s comparison between the two new bank credit cards and the BNPL market leaders, Afterpay and Zip.

Trending

Daily startup news and insights, delivered to your inbox.