Russia’s invasion of Ukraine and rising interest rates dampened merger & acquisition (M&A) deals in the first half of 2022, but even as company valuations fall, the size of transactions is growing according to William Buck’s annual Dealmaking Insights Report 2023.

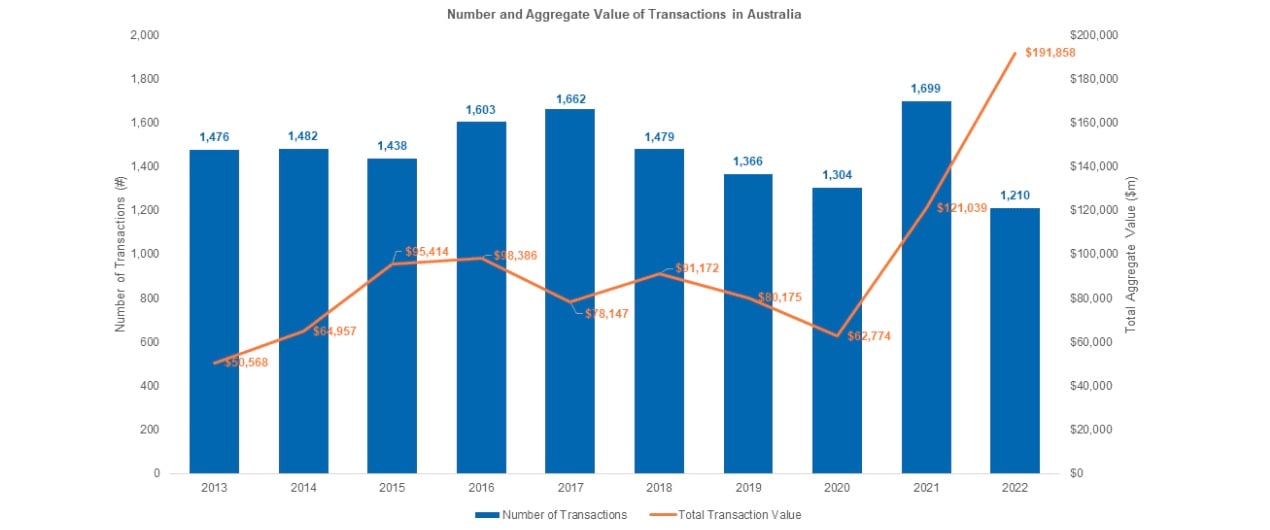

Australian M&A trends over the past decade. Source: William Buck

In 2022, the aggregate value of M&A deals in Australia increased 59% on 2021 to $191.9 billion, the largest value since 2007, despite volume decreasing 29%. The accountancy and advisory firm found, with more above $250 million. But that record came amid the lowest number of transactions, at 1210, recorded over the 10 years William Buck has been charting M&A activity.

Australian venture capital investment fell by 41% year-on-year to US$4.5 billion, despite deal volumes remaining consistent with 2021 levels.

Mark Calvetti, head of corporate finance at William Buck said the decline can be attributed to a difficult adjustment period as investors reset what they are prepared to pay for riskier companies in this macroeconomic environment.

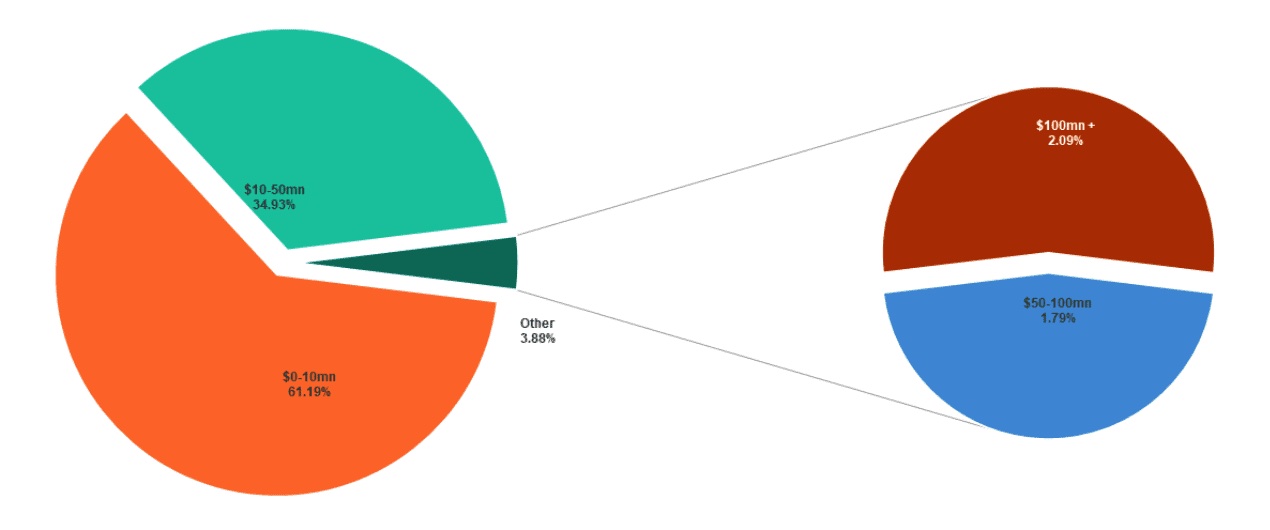

Of the 374 VC deals in Australia in 2022, 61% fell within the US$0-10m deal band, indicating early stage is becoming more favoured, as this area may perform better than other strategies, with longer incubation periods providing a longer runway until the exit environment picks up again. (

The strongest performing sector both in deal count and value was Information Technology which accounted for 47% of the deals and had an aggregate deal value of US$2.27 billion. IT far surpassed any other sector in both deal count and value.

Australian venture capital trends in 2022 – the number of deals by deal value band. Source: William Buck

While elevated volatility last year suppressed activity in the share and IPO markets, with only 79 IPOs completed and their aggregate value dropping a whopping 91% from 2021 levels to $1 billion. Weakened stock markets and the underwhelming performance of many 2021 listings also deterred investors.

While M&A activity slowed from a frenzied 2021, it was still above pre-pandemic levels – particularly in the first half of the year in which 87% of the aggregate value of transactions occurred.

Most of the action happened ahead of rising rates and war, with most of the deals already underway – Afterpay’s $39 billion acquisition by US fintech Square was the biggest, having been announced in late 2021.

William Buck’s Mark Calvetti said he expects the value of M&A transactions in Australia this year to decrease from the record levels achieved in previous years.

“As the cost of debt rises, the number of ‘mega deals’ with a value of $250m+ will decline, leading to a reduction in aggregate value,” he said.

“However, those transactions in the SME space with deal value up to $50m should remain steady and could even see a hike in volume, especially as many companies will rely on growth by acquisition to supplement softer organic growth.”

After companies hoping to list in 2022 instead popped the prospectus back in the bottom draw, Calvetti expects prospective IPO companies to wait for funding in a tight market and list in the second half of 2023.

“As a consequence of the frozen IPO activity experienced in 2022, there are many prospective companies waiting to enter the market and access funding,” he said.

“If conditions improve in the second half of 2023, IPO activity is anticipated to experience a positive swing.”

Conversely, he expects the private equity (PE) market, which saw several ‘mega deals’ above $250 million last year, to remain comparatively resilient as PE firms move to target distressed assets.

The full Dealmaking Insights Report is available here.

Trending

Daily startup news and insights, delivered to your inbox.