ASX-listed online retailer Kogan.com has swooped on another distressed asset, acquiring failed furniture brand Brosa a week after it was placed in voluntary administration.

Administrators KordaMentha reached a deal with Kogan.com (ASX:KGN) to buy Brosa’s assets for $1.5 million after more than 30 parties expressed interest in the 48 hours after the business was placed in their hands last Wednesday.

Richard Tucker of KordaMentha said it was “a fantastic outcome for the creditors” of Brosa, as well as many customers, with the new owners offering to deliver furniture that has been made to customers who’ve paid for it.

“Kogan.com is a white knight for the business and particularly customers who are awaiting delivery of orders where the stock was held by Brosa,” he said.

“Unfortunately, the Administrators were unable to fulfil these orders due to challenges in the logistics network. Kogan.com is providing a great outcome for customers to get their product where possible and subject to commercial arrangements.”

Tucker said their priority now is to pay employees as soon as possible, also asking that Brosa customers to be patient as they complete the stock reconciliation and finalise arrangements to complete the sale. Customers will be contacted early in the New Year, and Kogan.com intends to offer delivery for those who have already paid.

It’s not the first time Kogan has swooped in to snap up a failed retailer. After the Dick Smith Group collapsed in January 2016, just two years after listing on the ASX with a market capitalisation of $520 million, Kogan.com, then a private company, bought the brand and its database from the liquidators for just $2.6 million.

When imitation designer furniture retailer Matt Blatt failed in March 2020, Kogan.com paid $4.4 million for the brand and goodwill, avoiding its liabilities and a trail of angry customers with unfulfilled orders.

Kogan.com’s $1.5 million play for Brosa follows a similar pattern, with the business taking on the intellectual property, goodwill and stock, but no leases and other liabilities, with a pledge of logistics support on thousands of undelivered orders.

The acquisition is being funded from Kogan.com’s cash reserves

The brand will continue online.

In a statement to the ASX, Kogan.com COO and CFO David Shafer said the acquisition will broaden the company’s online furniture offering.

“We are pleased to be able to offer a lifeline to Brosa customers, to be able to save the Brosa brand, and to relaunch Brosa.com.au very shortly,” he said.

“Following years of investment in brand-building and marketing, Brosa is a well known online furniture brand in Australia, and we are delighted to be able to bring the brand within the Kogan Group.”

The losers in the deal are Brosa’s venture capital backers, Airtree and ASX-listed Bailador Technology Investments, which sunk more than $7 million into the business.

Bailador still had its investment in Brosa valued at $4.5 million midway through the year before recently writing it down to $0.

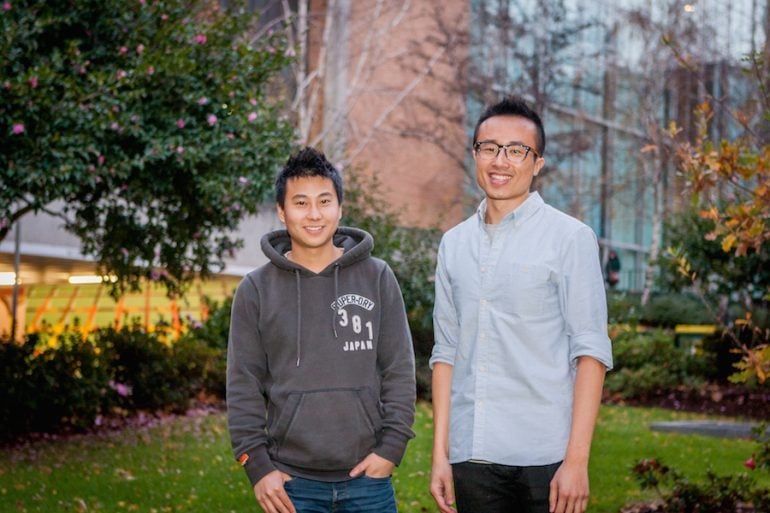

The Melbourne startup was founded by Ivan Lim and Richard Li in 2014. It raised $2 million from AirTree Ventures in 2015, then a further $5 million in a Series B in 2017, backed by AirTree, BMY Group, and Bailador.

Whether the deal begins a turnaround for Kogan.com’s fortunes in 2023 remains to be seen.

Kogan.com’s share price is down around 62% in this year, at $3.27, having started the year at $8.86.

The company posted a record net loss of $35.5 million after tax in FY 2022, with revenue also falling 8% to $718.5 million. Gross profit declined 9.3% to $184.4 million.

The business made similar mistakes to the previous year, when profits fell by 87% in FY21, amid ballooning inventory levels.

CEO and cofounder Ruslan Kogan commented on the results in August saying: “eCommerce did not continue to grow as anticipated. This led to us holding excess inventory, and an associated increase in variable costs and marketing costs to sell through the inventory.”

The 16-year-old retailer pledged to a be leaner business by “right-sizing inventory” and cutting operating costs.

Trending

Daily startup news and insights, delivered to your inbox.