Australian tech company Atlassian was famously started by Mike Cannon-Brookes and Scott Farquhar using $10,000 in credit card debt. The idea has since turned them into multi-billionaires.

The NASDAQ-listed venture recently celebrated its 20th anniversary and this week celebrates posting another annual net loss of more than US$600 million (A860m).

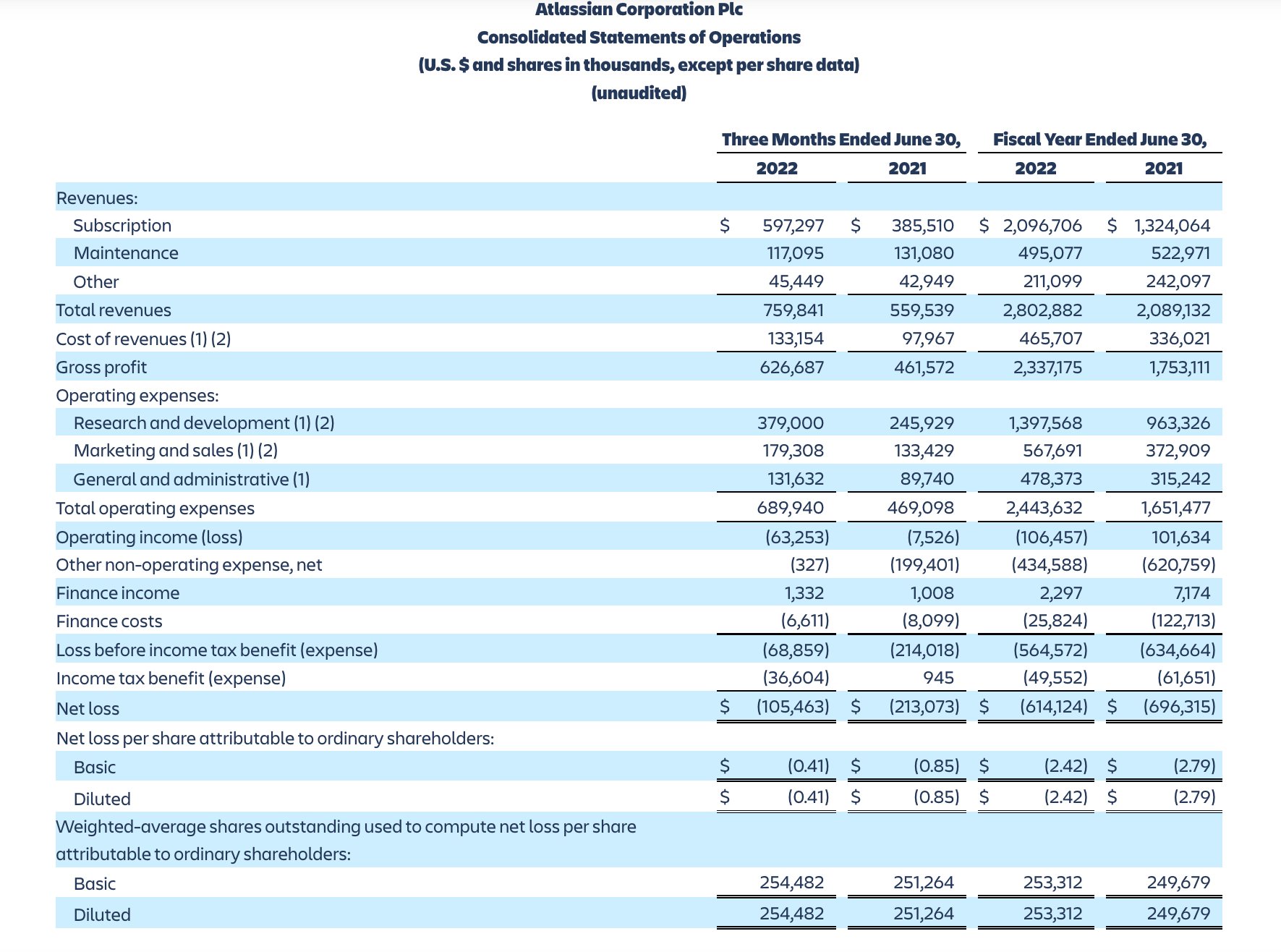

Atlassian (NASDAQ: TEAM) posted its fourth quarter and annual results today. Quarterly revenue is up 36% on 12 months ago to US$760 million. Subscription revenue grew by 55% to US$597 million.

Annual revenue was US$2.8 billion for FY2022, up 34% on FY21.

The company’s operating loss was US$63.3 million for Q4, compared to a loss of US$7.5m 12 months ago.

Operating loss was $106.5 million for fiscal year 2022, compared with operating income of $101.6 million for fiscal year 2021.

Net loss was $105.5 million for Q4, around half the $213.1 million for Q4 12 months ago.

The net loss was US$614.1 million (A$882m) for FY22, compared with net loss of US$696.3m ($1bn) in FY21.

“We capped off fiscal year 2022 with strong Q4 results, growing Cloud revenue 55% year-over-year,” Mike Cannon-Brookes said.

“While we can’t predict what the future holds at a macro level, we’re forging ahead with conviction and vigilance as we look to deepen our strategic position.”

Headcount grows

Atlassian ended Q4 with a total headcount of 8,813 employees, adding 634 net in the quarter and more than 2,300 during the year, with most of the new hires were in R&D.

The business added 8,048 net new customers during the quarter to top 242,000.

Atlassian’s share price has followed the broader tech market falls this year and after staging a small rally in the week ahead of the results, is now down a little over one-third for 2022. But it has halved from a peak of $458 in October 2020.

Atlassian’s share price in 2022.

In their emoji-sprinkled shareholder letter Cannon-Brookes and Farquhar, with chief revenue officer Cameron Deatsch, wrote that it was “another fiscal year chock-a-block with wins” amid a climate of widespread uncertainty.

“We capped off FY22 with strong Q4 results across our three markets: agile and DevOps, IT service management (ITSM), and work management,” they wrote.

“Not only did our customer base top 242,000 this quarter, but our headcount also grew by 634 with most new hires in R&D – a testament to our team’s ability to execute against ambitious hiring goals.”

The company flagged a continued ramped up of its operating costs alongside it revenues, with expenses up nearly 50% from US$1.651 billion in FY21 to $2.443 billion this financial year

Atlassian’s ongoing shift from organic word of mouth growth to a substantial marketing budget continued, with marketing sales costs up US$195 million to $567,691. R&D expenses grew by US$432 million to $1.397 billion.

“We firmly believe that Atlassian is uniquely positioned, having deep-seated momentum and a differentiated business mode,” the shareholder latter said.

“This gives us the confidence to make incremental investments – despite the current environment – that will fuel even more durable growth over the long term and deepen our strategic advantages. We know this is an unconventional choice right now.”

Atlassian’s Q4 and FY22 financial performance. Source: Atlassian

New CFO

Atlassian has appointed Microsoft veteran Joe Binz as its new Chief Financial Officer (CFO) and Principal Financial Officer, stepping into the role next month. He’s spend the last eight years as Corporate Vice President, Finance, at Microsoft.

The company predicts total revenue in Q1 FY23 in the range of US$795 million to $810 million, and the a next loss per share will nearly treble to around $US1.17, up from Q4’s $US0.41 a share loss.

Meanwhile, having floated Atlassian in December 2015 at US$21 per share, Farquhar and Cannon-Brookes remain firming in control of the business, holding more than 88% of the voting power, and around 43.08% of Atlassian’s outstanding Class B and Class A ordinary shares – just under 110 million shares in total.

As part of ongoing pre-arranged trading plans to sell off of their holdings, the co-CEOs looking to sell around 2% of that stake – up to 2.16 million Class B shares each, which at the current price, would gross then around US$980 million in total.

It’s now worth more than $100 billion by market cap, making its NSW-based co-founders Mike Cannon-Brookes and Scott Farquhar, extremely wealthy 20 years after they launched Atlassian after meeting at the University of NSW.

Forbes estimates their net worth at around US$14.4 billion in, down around $5.5 billion on six months ago, but still placing both 42-year-old Australians in the world’s top 125 richest people.

US move vote

The plan to relocate the parent company from the UK to the US, announced in February, will special shareholder meetings on August 22 for approval.

The workplace collaboration software business originally set up in the UK in 2014 ahead of its listing on the NASDAQ in 2015.

“We believe moving our parent entity to the United States will increase our access to a broader set of investors, support inclusion in additional stock indices, improve financial reporting comparability with our industry peers, streamline our corporate structure, and provide more flexibility in accessing capital,” the Atlassian co-CEOs wrote in their shareholder letter.

Trending

Daily startup news and insights, delivered to your inbox.