Ecommerce retailer Kogan.com saw its shares fall nearly 16% after the company reported an 87% drop in net profit after tax in the 2021 financial years to just $3.5 million.

Kogan shares (ASX: KGN) lost $2.07 to close at $11.06, after the company reduced margins and ramped up marketing to shift an excess of stock.

The shares fell below $9 in May after the company slashed its FY21 earnings forecasts before an improved update last month. They sit at around have the value of August last year, Kogan.com co-founders Ruslan Kogan and CFO David Shafer sold a 6.9% stake in the business, worth around $160 million, following the FY20 results, offloading 7.3 million shares at between $21.60 and $22.25.

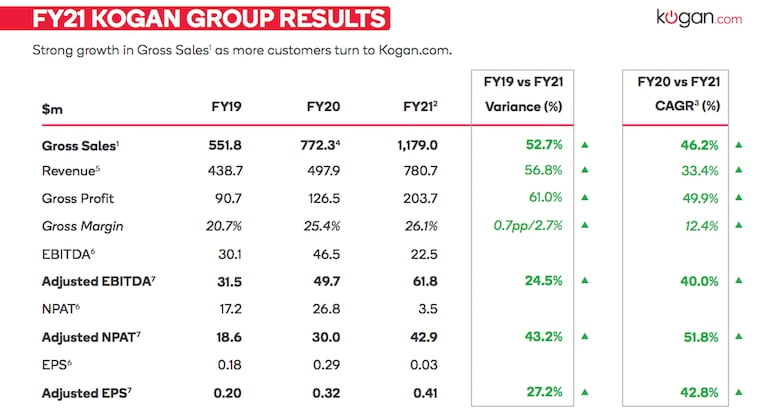

The increased marketing paid off, with gross sales jumping 52.7% on FY20 to hit $1.179 billion alongside 3 million active customers.

It’s the first time in the 15 years since launching that sales have passed the billion-dollar mark.

But the hit to the company’s bottom line saw the Kogan board decide to conserve cash “for business investment and growth purposes” with no final divident for FT21 declared.

The business blamed the hit to its results on increased storage costs and marketing to sell the excess stock, $7.7 million from Covid-related warehousing and supply chain interruptions, as well as $12.8 million towards the final two payments for the acquisition of New Zealand online retailer Mighty Ape. There was also $15.6 million in equity-based compensation expenses for options awarded to Ruslan Kogan and David Shafer late last year.

Marketing costs more than doubled (112%) to $58.7 million for the year.

Net revenue increased by 56.8% to $780.7 million.

The newly acquired Mighty Ape recorded revenue of $80.2 million for the seven months to 30 June, 2021.

EBITDA (earnings before interest, tax, depreciation and amortisation) dropped 51.6% to $22.5 million, with Mighty Ape contributing $7.1 million

Adjusted EBITDA, which excludes one-off costs and the equity-based compensation to the co-founders, actually rose 40% to $61.8 million, a small beat on the company forecast of $61.1 million, which was tweaked in July after being downgraded in May.

CEO Ruslan Kogan sought to paint a rosy picture from the results.

“I’m proud that our team remained focused through difficult Covid-impacted operating conditions and found ways to support our customers when they needed our help most,” he said.

“While we recently celebrated our 15th birthday, we feel like we’re just getting started. Over the next year we’ll be rolling out new and exciting projects to further support our loyal Kogan Community with Kogan First membership rewards, new and improved delivery solutions, and further enhancements to the online shopping experience.

“Over the past 18 months we have witnessed a massive swing towards the eCommerce retail revolution, one Kogan.com has been ready and waiting for, for well over a decade.”

But the difference in 12 months was stark in the July trading update.

Inventory levels fell by $12.5 million to $215.4 million between the end of June and July, but that figure is still nearly double the size of stock levels 12 months ago

Kogan.com ended the financial year with $12.8 million in net cash, prompting the board to suspend dividends to preserve funds.

Kogan FY21 results. Source: Kogan

Trending

Daily startup news and insights, delivered to your inbox.