BNPL market leader Afterpay (ASX:APT) posted a loss of $79.2 million in the second half of 2020, despite doubling revenue and sales, as well as its net transaction margin.

Some analysts were expecting (perhaps hoping?) for a maiden half year profit, but the $79.2m loss after tax came from a net loss on potential liabilities of $64.8 million associated with the valuation of its ClearPay UK venture.

The Melbourne-based global fintech’s shares are in a trading half after it also announced a $1.25 billion capital raise via a convertible notes issuance. It plans to increase its stake in Afterpay US from 80% to 93%.

The acquisition will cost $373 million, taking a 35% slice from the holding of US advisor Matrix, valued the subsidiary at $10.6 billion.

The half-yearly results to December 31, 2020 reveal Afterpay now generates a majority of its transactions offshore. International transactions as a share of total transactions rose from 34% on 12 months ago to 51%.

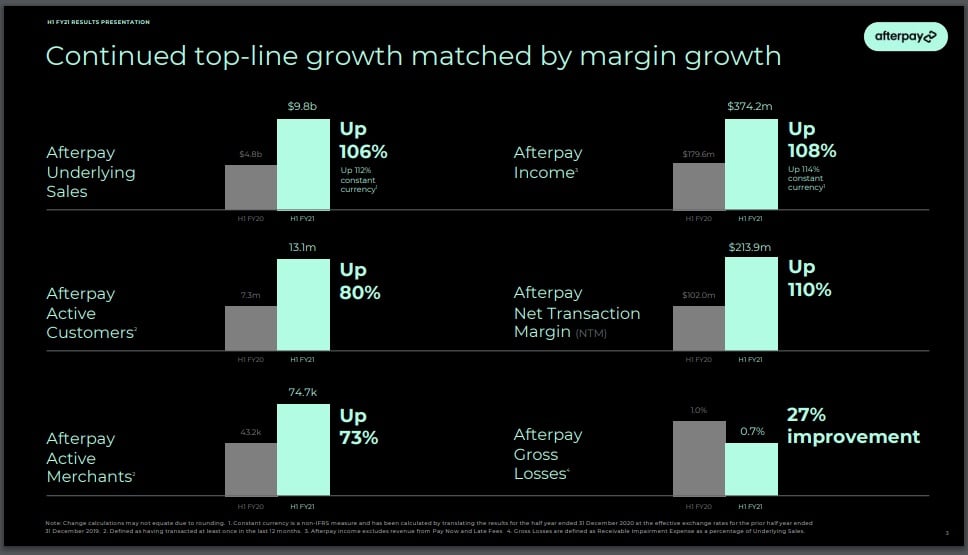

Underlying sales rose by 106% in H1 FY20 to $9.8 billion. On a constant currency basis, the sales were up 112% to $10.1 billion.

Income made a similar leap, up 108% to $374.2 million. Net transaction margin also increased 110% to $213.9 million.

Group total income was up 89% to $417.2m.

Net transaction loss as a percentage of underlying sales was steady at 0.5%, but one metric that also more than doubled was net transaction loss, rising 115% to $46.8m compared to the prior corresponding period.

The active customer base is up 80% to 13.1 million users, with North American delivering 8 million of that figure. Merchants grew by 73% to nearly 75,000.

The company says it expects regulatory approval for its acquisition of Spanish BNPL Pagantis will land in about mid-March and they are preparing to launch in Spain, France and Italy with a $1bn pipeline of merchants.

Afterpay is also turnings its attention to South East Asia following its takeover of EmpatKali last August, and now has a singapore base.

In Australia, it’s preparing to launch Afterpay Money app, with a pilot underway and pre-MVP testing slated for Q4 FY21 and official launch in Q1 FY22. The app customers will have a linked debit card, with salary able to be paid directly into the account.

The company’s billionaire co-founder CEOs, Anthony Eisen and Nick Molnar, are also turning their attention to philanthropy, announcing they’ll sell down up to 450,000 shares each as a cash contribution into a Private Ancillary Funds (PAF) for charitable

purposes. The duo intend to transfer approximately 950,000 $APT shares into their respective PAF from their personal shareholdings.

Afterpay did not offer any guidance for the rest of FY21.

Trending

Daily startup news and insights, delivered to your inbox.