Welcome to Monday.

Here’s what we’ve spotted.

1. Opening the Gates to women

Melinda Gates has pledged US$50 million (AU$75m) towards helping women get into tech.

In a LinkedIn post last week, the woman who’s giving away US$1 billion in 10 years to improve the power and influence of women, observed that “women graduate with only 19% of computing degrees, hold only 26% of roles in computing-related fields, and leave the industry at rates twice as high as men… Last year, only 2.8% of venture capital funding in the US went to companies started by all-women founding teams.”

Her company, Pivotal Ventures, will develop tech hubs in three US cities over the next five years, starting with Chicago in mid 2020.

2. Amazon beats on revenue

Amazon released its fourth quarter results for December 2019 over the weekend with net sales up 21% to US$87.4 billion, $15 billion ahead of the same quarter 12 months ago. Operating cash flow increased 25% to $38.5 billion for the trailing twelve months, compared with $30.7 billion for the corresponding 2018 period

For the calendar year, 2019 net sales increased 20% to US$280.5 billion, compared with $232.9 billion in 2018. Operating income increased to $14.5 billion, compared with operating income of $12.4 billion in 2018.

While Amazon Web Services (AWS) is the standout, especially for the bulk of the quarter’s operating income, Amazon boss and founder Jeff Bezos attributed some of the increase to improvements in Prime membership, which now has 150 million paid members globally.

“We’ve made Prime delivery faster — the number of items delivered to U.S. customers with Prime’s free one-day and same-day delivery more than quadrupled this quarter compared to last year,” he said.

“Prime members watched double the hours of original movies and TV shows on Prime Video this quarter compared to last year.”

Despite that rosy picture, sales growth actually slowed in the quarter

The company’s share price just around 9.5% on the news to $2,047.55, pushing the retailer back into a $1 trillion market cap, before settling down around the $2000 mark.

3. Government takes pot shots

The Morrison Government is getting behind medicinal cannabis in a big way granting three production facilities across Victoria and South Australia Major Project Status to help fast-track their approval and construction.

Biotech startup LeafCann in Adelaide is spending $350 million for a cultivation and production facility to produce medicinal cannabis ingredients and medicines, which is expected to generate more than 1400 jobs, on top of 850 during development.

Melbourne’s PhytoGro’s is putting $140 million into a medicinal cannabis cultivation and medical device manufacturing facility in the inner west, creating around 300 new ongoing jobs. Cannatrek’s $160 million medicinal cannabis cultivation and manufacturing facility in Victoria’s Goulburn Valley region is expected to create 400 full-time positions.

Industry, Science and Technology minister Karen Andrews said six medicinal cannabis projects have been given Major Project Status since the government announced the Office of Drug Control’s would prioritise MPS licencing process

4. Telstra takes on call recording startup Dubber

Melbourne startup Dubber, which offers cloud-based call recording software, has signed a partnership deal with Testra that will give the telco’s customers access to the service.

The service will be offered to customers on the Telstra Liberate, Telstra IP Telephony (TIPT), and Telstra SIP Connect platforms giving them access to Dubber’s call recording and data capture platform for a fraction of the cost of a traditional call centre.

Dubber CEO Steve McGovern said: “this agreement with Telstra effectively ’democratises’ call recording, at cloud scale, beyond the traditional domain of contact centres, to any and all business users. We believe this agreement will usher in a whole new class of services for call recording, delivered via SaaS, for compliance, business insights and AI services that were never before possible.”

Dubber (ASX: DUB) listed on the ASX in 2015, following a $6 million angel funding round in 2013. The news did little to impress investors on Monday with Dubber shares closing down nearly 4% at $1.18.

5. Startmate Fellowships are back

The biannual, three-month program, run mostly online and outside work hours, is “like a startup MBA that connects you to a powerful network, creates new skills and ends with your dream job”, organiser Blackbird Ventures says. There’s a trip to San Fran if you want, and the chance to intern with leading Australian startups.

The next program kicks off March 23. Interested? Details from Blackbird Ventures here

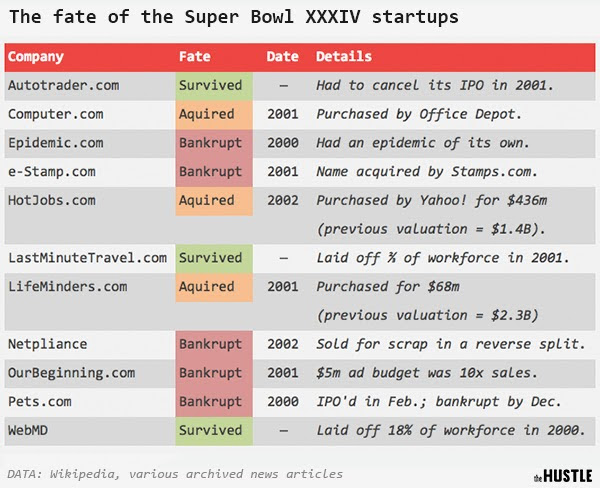

BONUS ITEM: Ads won’t save you. Check out this chart of what happened to the 11 startups that advertised during the 2000 Super Bowl. Most were gone within two years.

Chart: thehustle.co/

Trending

Daily startup news and insights, delivered to your inbox.