We’ve seen a number of startups emerge in the last few years that help people manage their personal finances via their smartphones – a few notable examples include Mint, Pocketbook and Digit. Although Sydney-based startup MoneyBrilliant isn’t a new market entrant, it has undergone many iterations and is now one of best ones available because of its UI/UX as well as the volume and type of financial services accounts that can be integrated into the application.

In brief, MoneyBrilliant, described as a “virtual financial assistant”, brings people’s personal finances together under one digital umbrella. Users can connect the app, which is both web-based and mobile, to hundreds of Australian and international financial services accounts and automatically have their bills, spending and savings organised to see if they are tracking ‘in the green’ with each pay cycle.

“People have relationships with many different financial service providers; and as an individual it’s really difficult to stay on top of those different relationships,” said Jemma Enright, co-founder and CEO of MoneyBrilliant. “MoneyBrilliant gives members the opportunity to have great visibility on their full financial picture and then there’s a whole lot of functionality within the app that helps them pay their bills on time, set guardrails and stay within them, set some goals and start to sock away the savings towards goals. It’s a 360-degree view of your financial life.”

Founder Peter Lord added many Australians have little to no idea how much money they’ve spent, let alone what they’ve spent it on, and that MoneyBrilliant gives people the financial reality check they need.

“Cashflow management is being left out of most financial conversations, even with financial planners and bank managers. Unless the knowledge is coming from your parents, it’s not coming from anywhere,” Lord said. “A massive percentage of the Australian population is financially insecure. Even if they’re earning a lot of money, they don’t know where it’s going.”

Founded by Lord in 2011, MoneyBrilliant was inspired by the tough financial times experienced by his mother as she neared retirement. She was given the family home unencumbered, but she wasn’t in control of the family’s finances and was quite uncomfortable around money. Lord suggested that she see a financial planner, borrow against the value of the family home and invest in a unit trust. But she didn’t have the confidence to say yes. Lord said this cost his mother close to $300,000 when it came to retirement.

“We have an issue right now where my dad worries about where we’re going the next holiday and my mum worries about $8 bank fees,” Lord said.

He added that elderly women are especially vulnerable.

“When my grandfather died, my nan just had herself and she didn’t have the financial knowledge to really enjoy her golden years. Once I started digging a little deeper, it wasn’t just my mum I could help, but also my sister, my friends, my work colleagues. There’s a whole range of people who are financially insecure,” said Lord.

“I feel like there’s a real opportunity to help women … I believe the solution to the world’s problems with money has to start with helping women first.”

While the app was designed with women in mind, it’s not exclusively for women – in fact, its users are split 60-40, women to men. The reason MoneyBrilliant primarily targets women is not because women are financially incompetent, but because in some ways, women are disadvantaged, and they certainly face different challenges to men. An obvious example is the gender pay gap – in Australia, the gender pay gap is 17.9%, so women are paid $0.82 of every $1.00 men are paid. Yet Australia fares well compared to the US, where women are being paid $0.77 of every $1.00 men are paid.

Enright, who left her career in marketing and joined MoneyBrilliant a year after its founding to bring a more customer-focused approach to financial services, noted “Peter’s mum’s story is repeating itself … I think women are more [likely] to miss out on [financial] opportunities because of a host of reasons, like having children and unequal pay. The odds are stacked against women.”

“If we can do something that helps women [manage their finances] more effectively and efficiently, providing them with greater visibility around their own finances, then I think it’s a very worthy cause, and one we’re very passionate about.”

While MoneyBrilliant targets women through its social media activities and blog content, to ensure the product itself appeals to women visually, the team had to do a lot of design testing. What you see today isn’t overwhelmingly and stereotypically feminine; this is helped by the fact that the website displays images of women in fairly gender-neutral settings. The colours – a mix of coral-pink, dark blue, grey-green and yellow – are also balanced. As a result of various design choices, including its minimalistic appearance, the app doesn’t impose any standards on women or alienate men. The rebranding, which was finalised in March this year, also saw a surge in user uptake.

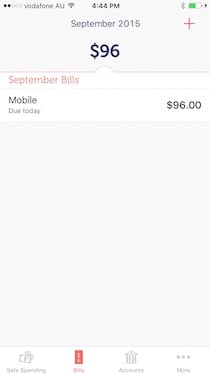

“It’s definitely not a case of strapping pink on things. It’s a route that we don’t intend to go down again. We’ve spoken to a lot of women about that and the first iteration of the MoneyBrilliant logo was pink and got pushed back. I think this is a great insight to women – they don’t necessarily like pink. And for us, it’s also about cleanness and simplicity. If you look at our app, it’s about getting people that one big number that counts instead of overloading them with a whole range of data. We had to think about how we could make the experience enjoyable so that it doesn’t feel like you’re looking at a spreadsheet, which is kind of masculine,” said Enright, who wasn’t trying to insinuate that women like ‘simple’ while men like ‘complex’, nor that women and men have different levels of intelligence.

“You’ll notice that in every screen in the app, there is one big number – it’s like the headline – and you can click to get more details [like an article]. It’s an experience that works for everyone – women and men. We’re not intending to be alienating towards any segment. All we’re doing is simply saying ‘here are a group of people who can be really well-served and get on top of their everyday financing’. We want to make sure we’re delivering an experience that works for them.”

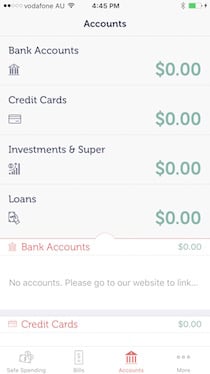

MoneyBrilliant’s core features include: aggregated balances and transactions for all bank, credit, loan, superannuation and investment accounts; instant categorisation of spending and trend reports; organisation of spending with the intelligence to remember user preferences; automatic bill finder and calendar; safe spending tracker for the user’s pay cycle; weekly money updates; and high levels of security using global banking technology company Yodlee.

At the moment, there are over 250 Australian-based institutions that can be connected to the platform, and hundreds more in nine different international markets.

Lord believes MoneyBrilliant’s ability to aggregate your superannuation data is its biggest point of difference. Australia’s superannuation funds are worth $1.94 trillion as of December 2014, yet most Australians have no clue of how much super they’ve accumulated.

“On the MoneyBrilliant app, you can easily see your super balance every day. I hope this helps people have more awareness around their super. Right now, to retire comfortably, you need about a $1 million in super, whereas the average super balance is close to $250,000. It’s even lower for women. It’s hard to live on a pension – it’s too small, so super is going to be the key thing for people,” said Lord.

“I think research shows that 70% people think they’re going to rely on super in retirement, but the percentage who actually do is closer to 25%.”

One thing the co-founders are adamant about is keeping customer data completely private. The co-founders confidently claim they won’t be monetising customer data or using it in any way other than to increase the value of MoneyBrilliant’s offering.

“We think there is a growing nervousness amongst consumers as to what the ulterior motives are with different companies who have access to data. As a business, we are trying to position ourselves as a consumer champion, if you like, starting from giving people the opportunity to view their full financial picture. We need to build that trust, and [that trust] does start to dilute if you’re using data in ways that [customers] haven’t consciously said okay to,” said Enright.

“In the future, I guess it would make sense for us to help people find the right product and service provider through our app to [enhance] their financial life … But the intent will be to do that in a way that is very transparent and completely independent.”

The startup has not yet monetised its offering, though the co-founders did say they’re steering towards a freemium model. This means basic features will be free, but power users will be able to upgrade to a premium version for a small monthly fee.

Enright said the startup is also working collaboratively with well-established businesses. Moving forward, the bigger companies will distribute MoneyBrilliant’s products to their customer base and there will be commercial terms around it.

In the early days, when MoneyBrilliant was called ‘Cha-Ching’, Lord had raised capital amongst family and friends. Late last year, the startup raised $1.5 million in funding from financial services company AMP. According to the startup, the partnership with AMP was brokered on a shared goal to make a positive impact on the financial well-being of Australians, with the startup approaching that challenge by focusing on the everyday – the basics of helping Australians pay bills, save and spend.

“We coined the phrase, the ‘Money Maslow’, to reflect our philosophy on financial well-being. If you don’t have the basic needs under control, like paying your bills and spending within your limits, you can’t have a conversation about goals and building wealth. You can’t get ahead,” Enright said.

The raised funds is being used primarily to recruit talent – MoneyBrilliant currently has a team of seven full-timers and casual workers – and is also being invested into marketing and other strategic customer acquisition activities.

“That money has allowed us to first and foremost bring the right talent into the business. Prior to that, our small founding team wore a lot of different hats. Post-investment, we’ve been able to grow our technology team, which is obviously a fundamental piece of our business. We have a great CTO, a great head of product and another talented developer, as well as a number of other roles,” said Enright.

The startup is currently experiencing about 50% month-on-month user growth. Though the co-founders did not disclose the number of users MoneyBrilliant has, Enright did say it’s “growing in the thousands each month” and that its users are based all over the world. Recently, Money Brilliant received requests from people in the US who are interested in using the product in full capacity.

At the moment, Facebook is proving to be the most effective channel for user acquisition and engagement.

“Facebook works really well for us, we found. Obviously, the nature of Facebook, it gives us more than user acquisition; it’s giving us incredible insight into how people are feeling about our service. We’re getting a lot of reviews on there. We’ve been blown away by how many people are actually sharing our ad!” said Enright.

MoneyBrilliant is gearing up for an aggressive rollout of product developments beyond the current cash management service to move customers towards longer term financial well-being and to help users maximise their savings.

Lord admitted it’s been a rocky four-year startup journey, however, the ‘thank you’ notes he gets from users make it all worthwhile.

“I couldn’t actually help my mum because she’s in retirement now, but we’re helping so many other Australians, taking away their stress. I love getting notes saying ‘thank you’,” said Lord.

Featured image (L to R): Jemma Enright, Co-Founder & CEO and Peter Lord, Founder, MoneyBrilliant. Source: Provided.

Trending

Daily startup news and insights, delivered to your inbox.