Welcome to Ignition Lane’s Weekly Wrap, where they cut through the noise to bring you their favourite insights from the technology and startup world. Ignition Lane works with ambitious business leaders to apply the Startup Mindset to their technology, product and commercialisation problems.

This wrap goes out free to subscribers every Saturday morning. Don’t forget you can catch Gavin Appel discussing the week on the Startup Daily show on Ausbiz. If you miss it, you can catch up on the week’s shows here.

Here’s their review of the week.

That’s hot: The creator economy

In November, Charli D’Amelio became the first TikToker to surpass 100 million followers. At age 16, she’s estimated to be worth more than $4 million. She’s been in J Lo’s music videos, has her own clothing line, was the youngest person on Fortune’s 40 Under 40 list in 2020, published a book, appeared in a Super Bowl commercial, the list goes on. Even more impressive – she started on TikTok less than 2 years ago.

This is the creator economy.

The perfect storm has been brewing for internet-powered entrepreneurship to explode:

- Technological progression: Global social platforms (TikTok, Instagram, YouTube, Snapchat, etc) allow creators to build and connect with their audience, anywhere. Plus, a host of other macro advancements are enabling the creator economy – video, cross-border payments and smartphone adoption are just a few examples.

- Barriers to entry lowered: Anyone can easily launch their own business quite cheaply. Creator-specific technology such as Substack (newsletters), Anchor (podcasts), Twitch and Roblox (gaming), YouTube (entertainment/anything), Patreon (monetisation) and now Clubhouse (audio) further lower the cost to create and monetize content.

- A shift in consumer sentiment: No matter how frequently Zuckerberg denies that Instagram listens to verbal conversations, we all have stories of very-coincidental, very-specific ads appearing for things only a listening phone could know. We’re becoming tired of the ad model, and we understand the price paid for free products (privacy invasion). Trust is shifting away from institutions towards individuals (particularly true for younger consumers). The result? Consumers are willing to pay creators for the value they provide.

Enter, the pandemic. Fuel was added to the fire. We’ve been stuck inside, craving creativity and connection. Individuals from all sorts of industries—chefs, fitness instructors, educators—have had to adapt to the online world to earn a living and/or stay sane.

VCs and celebrities have taken note. They can’t pour money in fast enough.

Patreon has tripled its valuation to $4B. Clubhouse is likely to be valued the same. MasterClass (courses by celebs & pros including Spike Lee, Christina Aguilera, Serena Williams, Gordon Ramsay) is reportedly raising new funding at $2.5B valuation. Cameo became a unicorn in March. Not far behind, Substack raised $65M at a $650M valuation. Roblox is valued at $44B, and OnlyFans is projecting $1 billion in revenue for 2021.

As if that’s not enough, newer players are appearing too. PearPop, a marketplace for social collaborations where you can pay Snoop Dogg $5k to appear along side you on TikTok, raised $16M this week from Hollywood celebs, along with Alexis Ohanian’s Seven Seven Six venture firm and BVP.

Locally we’re also seeing a rise in the number of startups pop up in this space. Adash (helping chefs and cooks monetize recipes and videos) and FlashFomo (influencer merch) are just two examples of early stage startups to cross our desk this week.

Oh, and we haven’t even touched on Paris Hilton’s favourite creator economy investment – NFTs.

‘Straya

17915% growth (not a typo). One in five companies in Deloitte’s 2020 Asia Pacific Technology Fast 500 list are Australian! China dominates the top 10, and Chinese-based Terminus Technologies took out the top spot. Terminus is becoming a leading force behind the intelligent transformation of global cities with its AI and IoT tech. The startup grew 17915% last year and has raised AU$750M to date. The highest ranked Australian company was FinTech Verrency at #15. No kiwi companies *sadface*.

Menulog will trial an employment model, offering its delivery workers a full suite of employee entitlements. This follows a shift in attitudes and laws around the world. California, New York, New Jersey, Illinois, and Washington have made moves to essentially outlaw gig work. The Supreme Court in the UK recently ruled that Uber drivers are entitled to worker rights. As a consumer, we’d personally give weight to a platform that pays its workers fairly. Surely gig workers would do the same.

BNPL & loyalty – mutually exclusive? ANZ’s venture arm announced it will not be joining the BNPL bandwagon, which it says is “[not] sustainable in the long term”. Instead it will focus on customer loyalty and rewards. Meanwhile, Flybuys has partnered with Klarna to expand its audience exposure and customer loyalty further.

Square is launching SME lending in Australia – its first international market outside of the US.

Top Maggots. Goterra featured as a Top 5 global startup in Robotic Recycling Solutions. The startup applies robotic technology to enhance maggots’ food processing abilities, turning food waste into insect protein and frass. Its robotic technology automates the process, making it faster and more efficient.

AirTree shuffles. Gill Findlay has been appointed as a new Operating Partner at AirTree, while Daniel Petre is stepping down from his operational role, moving to a Chair position. Petre has been (and still is) instrumental for the creation and growth of the Australian startup ecosystem over the last 30 years. The move is reflective of AirTree thinking for the long term – to build a VC that will last generations, there needs to be room for successors to step in and lead. Like his old boss Bill Gates, Petre now wants to spend more time focussing on philanthropy – he considers the rich aren’t giving back at the levels they should.

Had my old boss over for dinner. He seems to know a bit about software . pic.twitter.com/jC2VUjg8HR

— Daniel Petre (@dpetre) November 30, 2016

- Roughly 20% of all funded startups in Australia between 2015 and 2020 would have passed Giant Leap’s impact screen. This means every dollar of revenue generated is inherently linked to the generation of measurable positive social or environmental impact.

- 46% of Australian impact startups reviewed are tackling issues of sustainability, in particular in the energy, food, and waste sectors.

- There are at least 67 support organisations (funders, accelerators, coworking spaces etc) for impact startups in Australia. Family offices outnumber the amount of Australian VC firms dedicated to supporting impact businesses.

- Women-led businesses are well represented. 50-60% of VC-ready impact startups have at least one woman founder (far higher than the market average of around 20%).

Inspiring more First Nations entrepreneurs. Just 46% of all working age Indigenous Australians are employed. Minderoo Foundation is committed to closing the employment gap with and for Indigenous Australians and aim to have 250k people in work by 2040. To that end, Minderoo are holding a Dream Venture Masterclasses across Sydney, Melbourne, and Brisbane in mid-2021, designed to address barriers for Indigenous Australians looking to raise or deploy capital. Applications are open. Spread the word and get in touch to partner.

Startmate held its S21 demo day. Recording here.

Local investings

Tanarra Capital is taking a majority stake in Health Metrics. Health Metrics makes technology for aged and social care, and is estimated to already service about 25% of Australia’s aged care market and 40% in New Zealand. Its core product, eCase, features a Single Client Record Architecture (SCRA™) which allows clients’ records to move with them across various modes of care and enables providers to make data-driven decisions. Founders Steven Strange and Lisa Papettas will continue to lead the business and hold a significant stake. Tanarra has over $1.7B in funds under management across PE, VC and other investments, with 30 employees across Australia, Auckland, Tokyo and Hong Kong.

Payable raised $1M from CBA’s x15 Ventures following a $150k investment in December. Payable wants to help people pay their bills on time. This is the first startup in which X15 has taken a minority investment.

DiviPay raised a further $1.7M led by ANZ’s VC arm ANZi. DiviPay is a corporate expense management platform that has issued more than 20,000 virtual cards to 7000-plus users and more than 650 customers.

Arli raised $2.5M led by Folklore Ventures (investment notes). Arli is a platform to help people battle addiction.

Marketplacer raised $5M from Salesforce Ventures, extending its November $20M round. Aptly named Marketplacer is the tech behind marketplaces including Myer, BikeExchange, Surfstitch, Petstock, Providoor and Bob Jane T-Marts.

Shorthand raised $10M from Fortitude Investment Partners. Shorthand’s no-code platform allows publishers and brands to create multimedia stories.

Superhero raised $25M at a $100M+ valuation. Not bad for a product that only launched in September. The share trading platform offers $5 ASX share trades and free ETF trades. Superhero gets Bex’s tick of approval. #notanad

Around the world

Outsized returns. Coinbase listed on the NYSE. On the first day of trading, its market cap peaked at $100B+ and closed at $86B, up 31% from its reference price of $250/share. The winners from the direct listing? Initialized’s $1.3M is worth $680M (523x). Union Square Ventures’ $14-$18M is worth $5.2B (371x). Andreessen Horowitz’s $200M is worth $11.2B (56x). The original Coinbase YCombinator pitch:

8/ Here’s @paulg helping me practice my first demo day pitch to investors at YCombinator https://t.co/A6LbgYxUb2

— Brian Armstrong (@brian_armstrong) April 14, 2021

Relatedly, Bitcoin hit AU$83k on Tuesday, and a new report found that Bitcoin mining emissions in China will hit 130 million tonnes by 2024.

Dell is spinning out VMware. Dell owns around 81% of VMware, which it acquired as part of its $58B EMC acquisition in 2015. The spin out is expected to generate $9B – much needed cash for Dell.

Microsoft made a $19.7B purchase. Who was the lucky target? It wasn’t any of the big-name social media platforms (Discord, TikTok or Pinterest), as has been rumoured over the last few months. Instead, it will acquire Nuance Communications to increase its presence in the healthcare vertical. Nuance is known for its speech recognition, chat bots and natural language processing products.

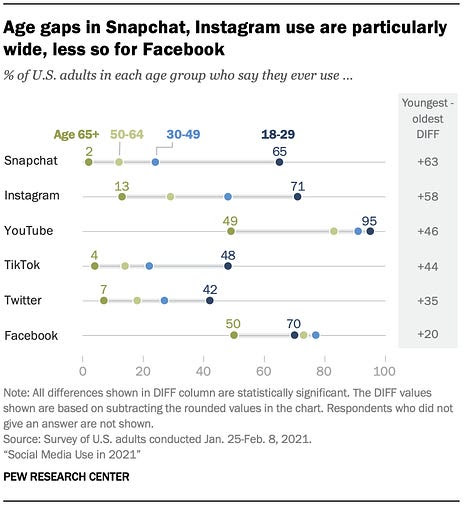

Addicted to the ‘tube. Pew Research Centre released its report on Adult Social Media Use in 2021 (USA). The results aren’t surprising: Facebook’s growth has levelled off but 7/10 users say they use the site daily; YouTube is the most commonly used platform – usage grew from 73% of US adults in 2019 to 81% of US adults in 2021; Reddit grew from 11% of US adults in 2019 to 18% in 2021; people under 30 favour Instagram, Snapchat and TikTok; and over 50s favour Facebook and YouTube. Perhaps the best part of the report is this graph, which wins our award for ‘The Worst (most confusing) Graph of 2021’:

The axis is % adoption for each age group, the coloured dots represent each age group, e.g. so top left dark green “2” means 2% of 65+ use Snapchat, while 65% of people aged 18-29 use it.

Chinese regulators pay day. In February, China issued new anti-monopoly guidelines targeting internet platforms. On Saturday, regulators fined Alibaba a record AU$3.7B for penalising merchants who list items on other ecommerce sites (a practice known as “two-choose-one”). Then on Tuesday, the regulator added a further AU$400k fine for engaging in false advertising, and warned Tencent, ByteDance and JD.com to check their processes.

Are you ok? Researchers have developed a blood test for depression and bipolar disorder:

composed of RNA biomarkers, that can distinguish how severe a patient’s depression is, the risk of them developing severe depression in the future, and the risk of future bipolar disorder (manic-depressive illness). The test also informs tailored medication choices for patients.

Index has a new US$200M seed fund to play with.

Grab is SPACing, valuing the company at US$39.6 billion – the biggest-ever deal with a SPAC. More than 310 SPACs have been launched in 2021.

Humans, not robots. Bezos penned his final letter to shareholders. A big chunk focussed on Amazon’s employees and defending accusations that its workers are “desperate souls and treated as robots”:

Employees are able to take informal breaks throughout their shifts to stretch, get water, use the rest room, or talk to a manager, all without impacting their performance.

Woah, woah, woah dont be too generous!

That’s a wrap! We hope you enjoyed it.

Join us on Clubhouse, 8.30am Tuesday.

Bex, Gavin and the team at Ignition Lane

Trending

Daily startup news and insights, delivered to your inbox.