Welcome to Ignition Lane’s Weekly Wrap, where they cut through the noise to bring you their favourite insights from the technology and startup world. Ignition Lane works with ambitious business leaders to apply the Startup Mindset to their technology, product and commercialisation problems.

This wrap goes out free to subscribers every Saturday morning. Don’t forget you can catch Gavin Appel discussing the week on the Startup Daily show on Ausbiz. If you miss it, you can catch up on the week’s shows here.

Here’s their review of the week.

Welcome to the ANZ tech party

Canva flashes cash. Canva has acquired two European startups: Product mockup generator Smartmockups and visual AI platform Kaleido.ai, who make background removal tools remove.bg and Unscreen. Canva now has 50 million monthly active users – an increase of more than 25 million in the last 12 months.

TSG and Xplor cozy up with Clearent. Clearent, a US-based integrated payment solutions provider is merging with Transaction Services Group (TSG), which provides a range of business management software. TSG acquired Melbourne-based startup Xplor in early 2020 to join its portfolio as the marquee education product. The newly formed Clearent/TSG entity will rebrand as Xplor Technologies, targeting five industry verticals – Education, Health and Fitness, Boutique Wellness, Field Services and Personal Services.

Facebook does a backflip. News sites are back on the ‘Book. The government has agreed to amend the Draft Media Code so it doesn’t apply to Facebook if it can demonstrate it has signed enough deals with media outlets to pay them for content.

Allbirds turns vegan. Allbirds has invested US$2m in Natural Fiber Welding, whose products it will use in a vegan leather replacement option to be ready by December 2021.

Drones drop drugs. Swoop Aero will soon start delivering medicines via drones to customers in regional Queensland in partnership with Australian healthcare wholesaler Symbion and pharmacy retailer TerryWhite Chemmart. This follows Swoops’ success delivering medications in Vanuatu (video below), Mozambique, DRC, and Chikwawa in Southern Malawi. In Malawi, drone operations help the government health programs dealing with communicable diseases such as HIV/AIDS, malaria, and tuberculosis, and Covid-19.

What’s your favourite season?

ASX reporting season! Hat tip to Moira Rose for that terrible joke inspiration. Here’s a quick look at what’s happening in the ASX 1H21 tech/ecommerce land.

Great growth (mostly) for ASX freshies

MyDeal has grown all key metrics by 200%+ on the prior corresponding period (PCP). As at the end of December the marketplace had nearly 814k active customers.

Adore Beauty exceeded its prospectus forecasts, with revenue increasing 85% on PCP thanks to its 777k active customers who—given Adore’s NPS is 82 (anything above 60 is considered excellent in retail) and return customers made up 64% of the business—love the Adore experience.

Both MyDeal and Adore are ramping up their private label product offerings (much better margins).

Aussie Broadband also beat it prospectus forecasts, with revenue up 89% on PCP and EBITDA of $7.3m.

Ansarada Group revenue was down 9% to $15.8m, which is says was due to the impact of Covid-19 on M&A transactions. Following a merger with thedocyard last year, the group provides virtual data room and information governance software.

Revenues rise, share prices dive

Afterpay: Growing ecosystem, loss + CEOs selldown. Analysts had Afterpay pegged for a profit but it ended the period with a $79m loss. Revenue increased 112% to $374.2m, active customers grew by 80% to 13.1 million, and active merchants increased by 73% to 74,700. The value of transactions done through Afterpay rose to A$9.8 billion – twice that of the A$4.8 billion processed a year ago. It also raised $1.5 billion, partly to increase its interest in its US arm from 80% to ~93%, and is exploring a U.S. listing. The Co-CEOs have each sold ~$60 million worth of shares. And it has joined forces with Stripe. Lots going on. On Friday its share price dropped nearly 11% to A$119.

Kogan: Big growth, double dividend and first woman Director. Kogan achieved 1H21 gross sales of $638.2m, up 97% on last year. Revenue jumped by 89% to $414m. A 76.8% increase in Kogan active customers to 3 million (excluding Mighty Ape customers). Boost Juice founder Janine Allis and Vocus founder James Spenceley will join the board. A step in the right direction but, like many businesses, Kogan still a long way to go when it comes to diversity at the top. Share price down 10% to A$14.

Strange things happen when you google ‘Kogan woman director’️ Is there anything Kogan doesn’t sell?

Temple & Webster: EBITDA explodes. Revenue grew 118% to $161.6m, while EBITDA grew 556% to $14.8m. Part of the reason for that increase is the growth in its private label brand sales. It has 678k active customers, with a vaguely disclosed NPS of around 60. Its share price was down nearly 10% to A$9.29 in the two days following release of the results.

Meanwhile, Gamestop’s (NYSE) share price is back on the rise, increasing 18.6% on Thursday after surging 75% in the last hour of trading on Wednesday.

The content flywheel

It’s been a big week of product announcements by Twitter and Spotify. The new features are all under the guise of helping creators monetise content. Why? Creators make more content, the audience grows, the platforms sell more ads (or take a clip) and make more money.

Spotify’s new products centre around podcasts. We’ve been banging the ‘Spotify is building a podcast monopoly’ drum for some time now. It has invested a whopping US$970+m in podcast-related acquisitions in the last 24 months. Those included Anchor (podcast production) and Megaphone (podcast ad platform), amongst several mega content deals.

This week it announced it will launch the Spotify Audience Network, which will allow advertisers to target specific users instead of just targeting a show. It will also offer podcasts on its self-serve ad platform, Spotify Ad Studio, and open up its Streaming Ad Insertion (SAI) service—which provides Facebook-like targeting of ads of Spotify-exclusive content—to a broader market.

Source: Tableau

Twitter announced three long-term goals focused on user base and revenue growth, and a faster pace of shipping new features across its platform. It aims to “at least” double its total annual revenue from $3.7 billion in 2020 to $7.5 billion or more in 2023.

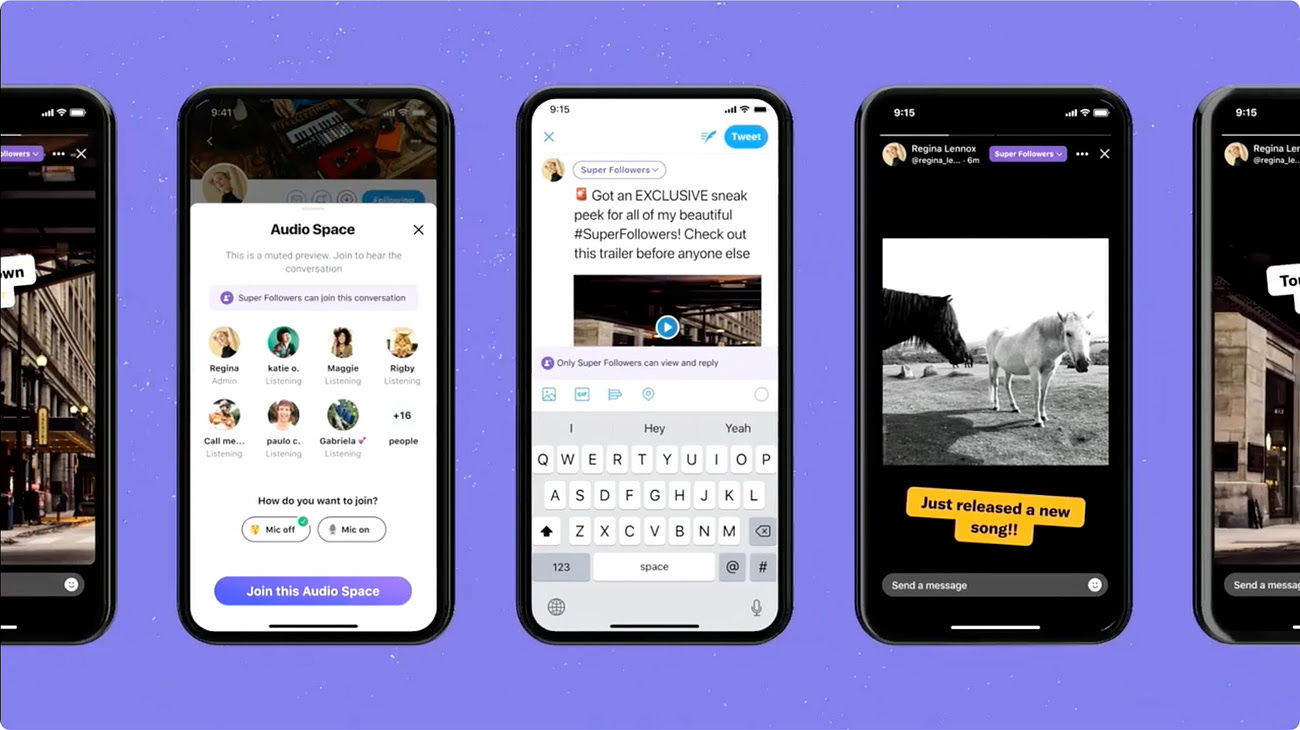

On Thursday, the company shared early details on new features. This includes its first audience paid offerings: tipping and Super Follow, essentially allowing creators to paywall tweets, fleets, spaces, deals/discounts and newsletters. OnlyFans, Substack, Patreon, Clubhouse, Snap all rolled into one.

From Twitter:

Exploring audience funding opportunities like Super Follows will allow creators and publishers to be directly supported by their audience and will incentivize them to continue creating content that their audience loves

Twitter’s share price hit an all time high of US$79 following the news.

Twitter is notoriously poor at making new products and features stick. Will this mark the end of that bad streak? Is it really what the people want?

I just want an edit button https://t.co/PtWWbQXA5r

— Cara Waters (@carawaters) February 25, 2021

Local raises

CDP Lexer raised A$33.5m led by Blackbird Ventures and King River Capital. Lexer is a tale of many pivots. It started life as a social media monitoring tool and evolved into customer insights, then has finally landed as a customer data platform (CDP) built for retail. The CDP landscape is a very busy space at the moment – ripe for consolidation. Of example of many: U.S.-based Blueshift also raised US$30m this week.

Employment Hero reportedly raised A$27m from SEEK, Airtree and OneVentures. Also rumours of Salesforce Ventures participating in the round.

Side note, Andrew Bassat is stepping down from his role as SEEK’s CEO after co-founding and leading the business for 23 years. Former Commbank boss Ian Narev is taking over the reigns. In addition to his Exec Chair role, Bassat will shift his focus to lead a newly formed venture arm, SEEK Investments, putting him somewhat in competition for early stage deals against his brother Paul Bassat (Square Peg).

Payments fintech Butn raised $12.5m “in pre-IPO funding”. Butn aims to free up cashflow in the B2B space, e.g. it has a partnership with food delivery platform Easi, to give drivers and riders the option to receive their pay through the platform on the same day.

Ordermentum raised A$5m. Ordermentum is a wholesale online order management system for the food and beverage industry. It’s been a while between raises – Ordermentum last raised $2.5m in 2017.

Thrive raised A$3m in a record crowdfunding campaign. Thrive is a fintech automating banking, accounting, tax and lending for SMEs.

Vampr raised US$750k in an oversubscribed crowdfunding round. Cofounded by Josh Simons, and songwriter/guitarist and entrepreneur, Baz Palmer, Vampr is a social music-tech platform allowing creatives to find people to collaborate with, create new music and monetize their work.

Esports startup GGWP raised A$350k from all-woman investors, including Eleanor Ventures, Working Theory Capital and Scale Investors, plus a further $75k from Startmate. The funding will allow the team to launch the GGWP Academy Influencer Marketplace, connecting esports influencers (yes, that’s a thing) with sponsors and other opportunities.

All a drop in the global ocean. Those figures all pale in comparison to some giant international rounds: Space X raised US$850m; Zomato raised $250m; and early-stage VC firm Bessemer Venture Partners closed two new funds totalling US$3.3 billion.

Shameless plugs

We launched a new website. Let us know what you think!

Clubhouse Tuesday 8.30am. Join in, raise a hand, ask a burning question.

Our PauseFest panel session is at 11.35am on Monday: ‘Putting the human into data’ with Nikki Brown (Partner, Ignition Lane) Kate Glazebrook (Founder, Applied), Mark Crispey (Chief Product and Data Officer, Carsales) and Tessa Herd-Court (Founder & CEO, IntelligenceBank).

A teaser: In times of change, data is a powerful asset. But in a tsunami of data, how do you separate the signal from the noise? Can you use data to make decisions if you can’t afford a data scientist? What about good old-fashioned gut feel? Bring out your inner data-nerd with this powerhouse panel session.

Math

Sad news about Daft Punk but some brilliant deductive reasoning in the Mail. pic.twitter.com/yMP6y1Lu4M

— Ian Maude (@IanMaude) February 23, 2021

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

Trending

Daily startup news and insights, delivered to your inbox.