Welcome to Ignition Lane’s Weekly Wrap, where they cut through the noise to bring you their favourite insights from the technology and startup world.

Ignition Lane works with ambitious business leaders to apply the Startup Mindset to their technology, product and commercialisation problems.

This wrap goes out free to subscribers every Saturday morning. Don’t forget that every Monday at 2.05pm you can catch Gavin Appel discussing the week on the Startup Daily show on Ausbiz. If you miss it, you can catch up on the week’s shows here.

OK, here’s the week that was.

Like a bat out of hell

Back in May—when virtual quiz nights ran rampant, Covid-themed playlists plagued Spotify and lockdown was finite—we pitted the top video conferencing tools head-to-head.

Zoom was the winner. Here’s a snippet:

The team at Zoom have nailed their stand alone solution. Eric Yuan left Cisco WebEx in 2011 (taking more than 35 other WebEx engineers with him) to found Zoom after being frustrated that Cisco wasn’t moving fast enough. The team have one focus: build one great video conferencing product.

Zoom’s GTM approach hasn’t really changed since its launch in 2013 and it is a great example of the freemium model done well. Freemium works for Zoom because it is an exceptional, viral product. As a result, Zoom has become a verb used in households worldwide – “let’s Zoom”.

April numbers: 300+ million daily meeting participants – a huge jump from 10 million back in December (also increasing Eric Yuan’s net worth by over $4B).

At the time Zoom’s share price ($ZM, not to be confused with $ZOOM) was $174 and climbing steadily.

On Monday Zoom released its results for the second quarter. To say that it exceeded everyone’s expectations (ours included) is a giant understatement. The results sent its share price sky rocketing over 40% on Tuesday, adding “an eBay worth of market cap” ($37B), and peaking at $478.

|

Zoom’s quarterly growth metrics are astounding for a nine-year-old company, even by SaaS standards. What’s most impressive about these results is that growth hasn’t come at a cost to profitability:

- Quarterly revenue was $663.5m – up 355% YoY. It also raised its full-year revenue guidance by $590m to $2.37-$2.39b.

- Net income grew from just $5.5m in the year-ago period to $185.7m in the most recent quarter.

- Operating cash flow grew to $401.3m, up from $31.2m in the year-ago quarter.

Zoom grew 355% YoY in Q2. There is literally no playbook for these kind of numbers at this scale. Unbelievable.

— Aaron Levie (@levie) August 31, 2020

With one “simple” product, Zoom has been able to surpass the valuation of 109-year-old IBM and etch closer and closer to the market cap of its 36-year-old arch-nemesis, Cisco.

Yes, Zoom was in the right place at the right time to benefit from Covid tailwinds. But let’s not forget that the team had been busy building great business bones long before the world took notice. Recognising Zoom’s strategy and execution back in 2019, prolific investor and SaaStr founder Jason Lemkin called Zoom’s CEO “one of the greatest SaaS CEOs and founders of all times.”

There are a couple of elements that make Zoom a unique growth beast:

- Virality and capital efficiency Zoom was the first tool to allow users to initiate a video call by simply sharing a link without requiring the other user to have a Zoom account. While it can be argued that this growth strategy comes at a cost to true network effects, it has had a profound effect on capital efficiency.Zoom’s cash burn has been tightly managed from the earliest days of the business. In the years leading up to IPO in 2019—years when a company would usually be burning through cash to scale—Zoom’s burn remained close to $0. To achieve this, Jason Lemkin suggests the team were given a precise burn rate budget – good practice for any startup.

- All the customers Zoom has been able to create what is, quite possibly, the most diversified customer base on the planet. Usually this strategy is a big no-no for startups. Chasing a broad set of customers is expensive and distracting – different segments require different product functionality, marketing tactics and sales strategies. But thanks to the nature of the video conferencing product, coupled with the company’s viral growth tactics, Zoom is able to service all markets efficiently and effectively.It now has around 370,200 paying customers with more than 10 employees (up 458% YoY) with 988 of those paying more than $100,000 per year. What’s more, the value of those customers continues to increase. It achieved a trailing 12-month net dollar expansion rate above 130% for the 9th consecutive quarter. Land, retain, expand. Kaboom.

So now the question on everyone’s mind is, will Zoom be able to retain its spot as #1 video conferencing tool?

Currently Zoom’s superior experience (UI, responsiveness, speed, sound) is its only defensibility. Some argue that’s no moat. However Microsoft, Goole, Slack and Cisco’s mature products each illustrate how difficult it is to clone Zoom’s comparatively exceptional experience. And with a smart CEO who is as dedicated to customer experience as Yuan, that might just be enough.

Hi Abtin, I am the CEO of Zoom. Our NPS score is 72 and we have tons of very happy users. If you can share me in detail, then I can write the code to fix the issue this long weekend. Cheers and have a great weekend.

— Eric S. Yuan (@ericsyuan) May 25, 2019

Minding your own business

We’ve now been dealing with a pandemic for 6+ months. The novelty of working from home has long passed, exhaustion has settled in, and anxiety and emotions are high.

The good news is that the stigma around mental health is decreasing and there are plenty of startups working on alleviating the mental health problem – helping us calm our minds and connect with experts through these complex times.

According to the latest CB Insights report, venture funding for mental health startups is at a record high (where there’s a problem, there’s opportunity). In the first half of 2020 startups saw 106 rounds totalling over US$1b, so we’re likely to see some great progress in this space in the years to come.

The cheques flowing into mental health are by no means small:

- Mindstrong, a platform that provides virtual therapy and psychiatric care, raised $100m round in May

- Heal, a platform that offers telepsychology services, raised $100m in July

- Meditation and mindfulness startup, Headspace raised $100.7m equity and $40m debt this year

- Sleep and meditation app, Calm raised $115m Series B last year

Here in Australia, Smiling Mind is working hard to help us build positive mental health. In partnership with conversational experience agency VERSA, its meditation app was recently added to Google Assistant, enabling us to access a meditation without having to look at a screen.

Equally, it has been awesome to see local startups like Who Gives A Crap and Elevio lead the way by supporting their teams with additional paid leave during lockdown. Parents with young kids at home will find this time-lapse video by Jodi Geddes, co-founder of Melbourne-based startup Circle In, all too relatable.

If you’re in search of simple tactics to weave into everyday life, check out First Round Review’s feature this week – 6 Small Steps for Handling the Emotional Ups and Downs at Work. Some of our favourites:

- Reflect on one thing you’re too hard on yourself about. Forgive yourself.

- Think of one small thing someone could do to support you this week. Ask for it.

- To get friends, family or colleagues to open up more, ask them scaling questions about how they’re feeling, e.g. How stressed are you feeling on a scale from one to 10? What could move you from 8 to 7? When was the last time the score felt good? What was different about that time? How can we apply that today?

Rapid fire: News that caught our eye this week 🧐

Australia and NZ

- Redbubble hit Aussie unicorn status (AU$1b market cap) this week with founder Martin Hosking back at the wheel as CEO. An “overnight success”, the marketplace for print-on-demand products was founded in Melbourne in 2006 and listed in 2016.

And of course I am talking about visual artists, as we all know that is all Redbubble works with, not musicians, performers, writers etc who have other revenue sources.

— Martin Hosking (@Martin_Hosking) August 15, 2020

This is an awesome milestone for one of Australia’s most iconic tech companies, which recently found a new fan in Ricky Gervais. However Redbubble doesn’t have time to take its eye off the ball. Competition is hot on its heels with TikTok and Teespring partnering to enable creators to easily sell merch via TikTok.

- Rod Dury is the latest founder to cash in as listed tech stocks hit new highs, selling down $200m of his Xero shares. This follows Kogan CEO and CFO’s options conversion and $163m share sell down in August and Afterpay co-Founder $250m sell down in July.

- Aconex alumni launched a new secondary fund – SecondQuarter. This is exciting news for Aussie startups and investors who will be able to get some of their hard-earned cash out before having to wait for a full liquidity event such as an IPO or trade sale. Equiem and Athena Home Loans are the first in its portfolio.

While this is a wonderful sign that the startup ecosystem is maturing, SecondQuarter’s homogeneous founding team serves as a reminder that the ecosystem still has a long way to go when it comes to diversity.

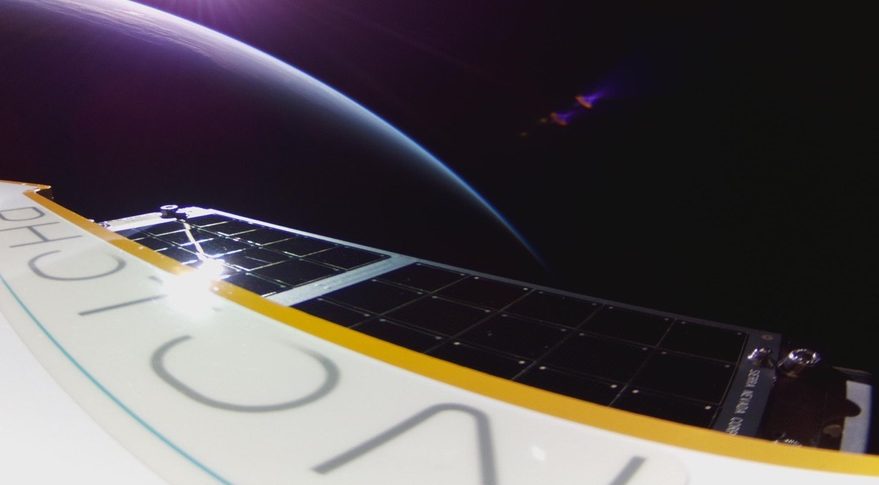

- It’s been a big week for NZ-founded Rocket Lab, who announced that it secretly launched its own company-made satellite into space. It did so by turning part of a rocket into a satellite, which then remained in orbit around Earth! It also gained clearance from the U.S. FAA that should see it launch from its facility in Virginia soon.

More views from First Light, Rocket Lab's first Photon satellite in orbit. pic.twitter.com/GB9f2IBx9J

— Rocket Lab (@RocketLab) September 3, 2020

- NZ EdTech startup Kami is kicking goals in U.S. public schools (a notoriously difficult market to crack). The number of school districts using Kami doubled between March and July and sales grew over 2,000%.

Around the world:

- Virtual London Tech Week is on 7-11th September 2020. Register free here. Be warned: this is quite possibly the worst registration form in history.

- Mulberry raised US$10m Series A, demonstrating there’s a host of opportunity around the current eCommerce boom. Mulberry enables eCommerce businesses to offer extended warranties. It was founded by Nigerian-born Chinedu Eleanya. The serial entrepreneur moved to New York at 11 when his family won the green card lottery, went to Cornell at 16 and graduated early to cofound his first FinTech company. Amazing. The round was led by Pace Capital along with strategic angels Jack Chou (former CPO at Affirm and Pinterest) and Jeff Weinstein (Product Lead at Stripe).

Pace x Mulberry https://t.co/nRwvKQh5sd

— Jordan Cooper (@jordancooper) September 3, 2020

- Indonesian-based insurance startup, PasarPolis has closed a $54m Series B. The insurance penetration rate in the ASEAN region was just 3.6% as at 2017. PasarPolis’s strategy is to reach uninsured people in Indonesia, Thailand and Vietnam and offer them inexpensive “micro-policies” that cover things like broken device screens.

- Southeast Asia’s leading property listing company PropertyGuru raised US$220m this week, after pulling its plan to list on the ASX last year. The Square Peg-backed company operates real estate portals in Singapore, Thailand, Vietnam, Indonesia and Malaysia that are used by 24.5m property seekers each month.

- One of the most popular eCommerce platforms in the world, Wish filed to go public. This is a great article explaining how Wish has built an $11b empire by supplying humans with $20 smart watches and useless crap we never knew we needed, like this:

- Windows 95 launched 25 year ago. We felt it important to surface this video:

- The launch ad transports us back to a simpler time.

- We’ve been enjoying watching Microsoft troll itself on the tweets (more here).

Mentally, we're here. pic.twitter.com/uRLR2yh8cW

— Microsoft (@Microsoft) August 31, 2020

That’s a wrap! We hope you enjoyed it.

Gavin, Bex and the team at Ignition Lane

p.s. Happy Fathers Day.

p.p.s. We love feedback – if you have any or want to continue the conversation, please reach out.

* The team at Ignition Lane believe the most successful Australian businesses will be the ones who think and operate like world-class technology companies. To help businesses thrive in this new era, Ignition Lane works with business leaders to apply the Startup Mindset to their biggest technology, product and commercialisation challenges.Its customers include Carsales, Metricon Homes, Pentana, AusNet and Moose Toys.

Trending

Daily startup news and insights, delivered to your inbox.