Part 1

At Airtree Ventures, I’ve been lucky enough to meet hundreds of companies across many different verticals, business models, and stages. While questions on pricing do come up on occasion, it’s surprising how often it’s overlooked given its direct impact on the success of any business. While a huge amount of effort is poured into product and sales and marketing, there is much less focus on pricing despite the magnitude of difference it can make.

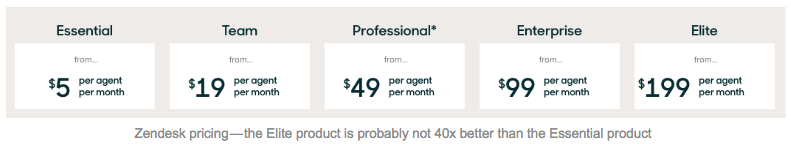

One of my favourite examples of the power of pricing is when Zendesk were bringing their enterprise product to market and initially found little success. They decided to experiment by increasing pricing and began to see real traction as larger customers started to take them seriously — purely based on higher prices. Their high-end enterprise product is now 40x their basic package.

Given its importance, the need to continuously iterate, and the fact that founders consistently underprice, I wanted to run through a framework for various strategies and look at the impact of some of these decisions. It brings in some of the learnings from discussions with founders as well as pricing consultancy work I’ve done in the past.

Given its importance, the need to continuously iterate, and the fact that founders consistently underprice, I wanted to run through a framework for various strategies and look at the impact of some of these decisions. It brings in some of the learnings from discussions with founders as well as pricing consultancy work I’ve done in the past.

The first part of this pricing series will aim to help answer how much you should be charging. Later posts will run through other areas, including what mechanisms can be used to implement the price, force certain behaviours and get customers to pay up. This is designed for founders across all stages and while written with SaaS businesses in mind, many of these themes are applicable to other business models.

Part 1 — how much should I be charging?

Starting at first principles, there are three main pricing strategies for any business to choose from, with the first two most applicable to startups:

– Maximization: maximising the price the customer will pay

– Penetration: pricing low to win market-share

– Skimming: charging higher prices for early customers and lowering prices over time to expand the target market

Maximisation

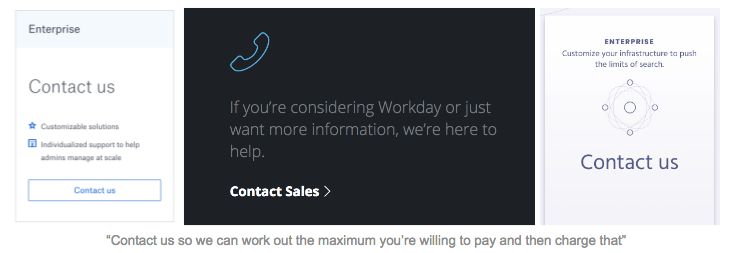

Maximisation is when you charge each customer the highest price you are able to. This means prices frequently vary per customer. Maximisation works best when the immediate focus is on growing revenue. It is often used in enterprise sales when sales processes are long and costly. Companies like Salesforce, Hubspot, Workday, Algolia and many more SaaS companies use price maximisation.

Examples of this can be seen most explicitly when pricing pages state “contact us” — it is usually means the company is trying to work out the maximum the customer is willing to pay. Below are pricing examples from storage provider Dropbox, search company Algolia, and HR platform Workday.

Penetration pricing

Penetration pricing

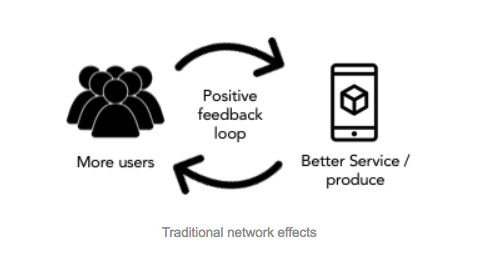

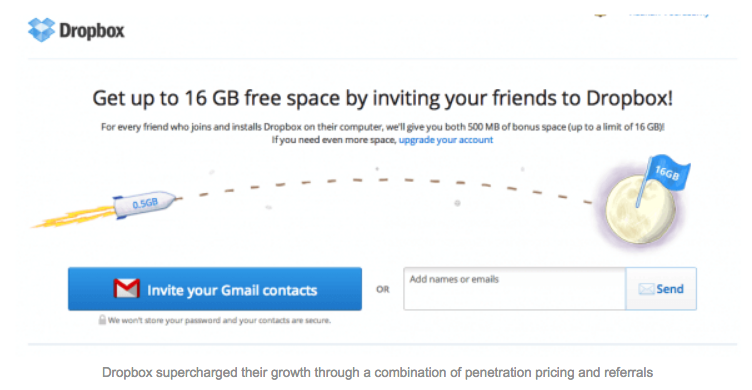

Penetration pricing involves pricing low to achieve a large user base early. It’s most effective when there are strong network effects— i.e. adding more users makes the product better. Penetration models often come in the form of free / freemium pricing.

It works well when bringing a product to market that doesn’t already exist. Competing purely on price to undercut the market without product differentiation rarely tends to play out well in the long term.

This famously worked very well for Dropbox. The company initially gave out free storage because additional user adoption drove value in the product i.e. it was better when your friends / work team used it to share files too.

Another example is when Uber starts out in a new city: it aggressively promotes free rides and high driver commissions to build an initial supply of both riders and drivers. With more drivers on the platform, users have to wait less time for a ride, and with more users, drivers can get more fares in a day. This drives value in the product, lowers the cost to acquire new users, and creates defensibility.

Skimming

Skimming is an alternative strategy, where initial customers are charged more than subsequent customers. Apple uses skimming by adding huge premiums on the latest iPhone while reducing older models to affordable levels. This is typically used when the business needs to expand out of their early customer base and is less relevant for businesses in early stages.

Determining the price

One of the great advantages to creating a new product is the ability to define the price. So whether you’re using maximisation or penetration pricing , what’s the best way to go about doing this?

Customer personas

The first step is identifying the target customer. While crucial in product development, it’s also critical to think about the various types of customers when it comes to pricing too.

These customer types should be split into anywhere between 1–4 buyer personas which can be done by grouping similar traits, and crucially:

– The features of the product they use

– The value they derive from using these features

– Their willingness to pay

– The size of budgets they have to pay for the product

Characteristics like size and industry are helpful for adding details to buyer personas and working out where new customers fit, but are really proxies to the above criteria. This information only comes from speaking to lots of existing / potential customers and trying to find out as much information as possible.

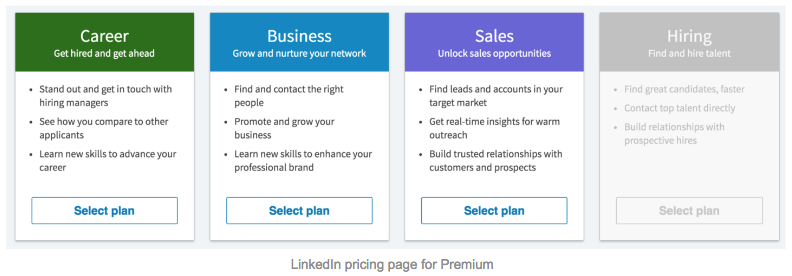

Frequently a startup will only have one buyer persona when first starting out, but over time more are added and pricing should be optimised for each one. LinkedIn is a great example of spelling out the buyer personas for its premium product:

Each one of these options will offer a slightly different product experience but will have big differences in pricing. “Career” for example is tailored to those finding a job, while “Sales” is used by those looking for new leads, and “Hiring” for recruiters. “Hiring” is priced much higher than “Career” as it provides greater value and recruiters have access to larger budgets than individuals.

Customer value

Once we have the buyer persona(s), we can narrow down the value that each persona gets from the product. We’re focusing on value-based pricing here as it tends to be the most relevant. Customers generally don’t care how much it costs to make something (cost-based pricing), but how much value they’re going to get from it (value-based pricing). Apple can get away with a gross margin of over 60 percent on the iPhone X because it’s delivering value to customers.

There are are few methods we can use to work out the value each persona gets from the product:

- Ask the customer

- Estimate the monetary value to the business

- Increase prices until customers stop buying

If using penetration pricing, value-based pricing is a good starting point from which a good discount can be applied.

Asking the customer

Getting feedback from potential customers on how much they would pay is an absolute must. But it can be difficult to get a direct answer — particularly if it’s something they haven’t seen before. If this is proving hard, a couple of useful methods are 1) the van Westendorp Price Sensitivity Meter 2) asking comparative questions.

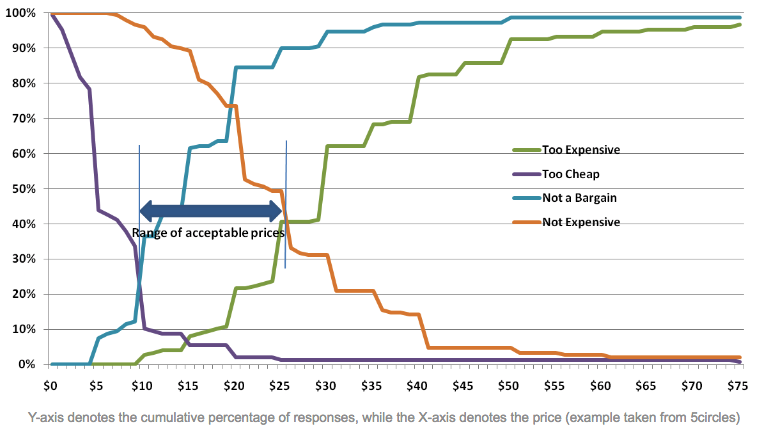

Van Westendorp Price Sensitivity Meter — This method involves asking a set of questions and plotting the results to determine the optimal pricing range. When using this it’s important to gather sufficient data to find a meaningful result and make sure the customer understands the product and the features they would use.

– At what price would you think the product is a bargain?

– At what price would you begin to think the product is getting expensive?

– At what price would you begin to think the product is too expensive?

– At what price would you begin to think product is so inexpensive such that the quality is in doubt?

Plotting the results of these surveys we can reach a pricing range. Note that “Not a bargain” and “Not expensive” are inverted vs. the way the question is asked in the survey.

Comparative questions — It’s often quite difficult for someone to put a price on something they haven’t seen or used before. If they can compare it to something similar, this becomes a little easier. For example, if I’ve never seen a Surface Pro before (Windows line of laptops that features a removable keyboard), comparing this to a regular laptop, an iPad or a Android tablet would make it much easier for me to determine a price. An example question would be “how much more would it be worth to you, if existing product X could do Y”.

Estimating the monetary value to the business

At the end of the day, customers are buying a product because it can either increase revenue or make cost savings, and occasionally both. Cost reduction in particular can come in many indirect forms such as reducing capex, making employees more efficient, or reducing risk.

If we understand, for example, that revenue has been increased by 10 percent, we can start to quantify the value of the product and work out a sensible percentage of the net benefit to charge (c.20–40 percent depending on budget and willingness to purchase).

When looking at cost savings, this often comes in the form of lower capex, employee salary savings, or employee-hour savings. For example if I can save an employee c.5 hours in a week, at an average salary of $100k, working 10-hour days, I know my product is worth c.$10k a year per employee. If my customer has 15 of these employees, then this is worth c.$150k to them and I could probably charge $30–60k for my product for the year.

Increase prices until customers stop buying

As a general rule, if there haven’t been any customers that have been lost on price, the price is too low. Experimenting with this level is useful to find the real maximum value for the different buyer personas.

This is easiest when it’s possible to have 1–1 conversations through an outbound sales model vs. a high-velocity self-service model. When pricing is displayed on the website, it is worth noting that frequent pricing changes can confuse the market so this should be done cautiously.

Additional considerations

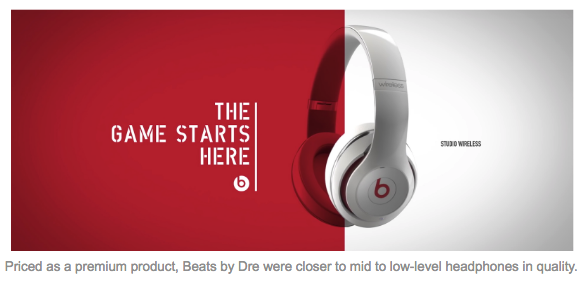

Positioning in the market

Pricing can often be an important part of branding. For psychological reasons we expect to pay more for premium goods. Pricing should be aligned with the product branding, whether it’s a premium enterprise-grade solution, or a cost-efficient SME alternative. Prices that are too low can often put off some customers as they question the quality.

Unit economics

Unit economics

At a fundamental level, to build a sustainable business each customer must be profitable on some reasonable time-frame. While this may seem obvious, much-loved companies such as YikYak, Sprig and HomeJoy failed because they couldn’t find sustainable unit economics.

I won’t go into detail here about unit economics, but when doing analysis such as CAC / LTV or payback periods, it is useful to consider the impact of changes in pricing. There are some great blog posts out there on the topic and I will go into more depth on this in future posts.

Impact on revenue and sales teams

When a business is just starting out, capital is scarce and revenue can provide much needed run-way. It is worth considering pricing your product at a level that avoids long processes with procurement or becoming stuck with senior management. Long sales cycles will reduce short-term revenue as well as reduce the ability to demonstrate traction, critical if raising external capital.

Very high price points can also decrease sales velocity and increase sales volatility i.e. “elephant hunting”. This impacts predictability of revenue, making it difficult to build a business with inflexible monthly costs.

Increasing prices

Prices can and should be increased over time. This can be done through explaining to early customers they are getting a discounted price, selling more units (e.g. seats) but also when the product is substantially better than before through the addition of new features.

Amazon Prime in the US is an excellent example of increasing prices over time as the perceived value goes up. Amazon continues to add to its Prime offering, adding more content to Prime Video, discounts to Whole-Foods, free 2-hour delivery on select items, online photo storage and many more benefits.

Price anchoring

Price anchoring

Caution should be taken when building purely on other platforms (e.g. Slack, Xero or the App store), as it’s hard to raise prices above the platform price or far higher than the average price of other apps / add-ons. We can try to get around this by:

– Focusing on additional value provided on top of platform

– Operating across multiple platforms

Examples include Netflix — provides high value entertainment across many platforms (from browsers to App stores and TVs) and X.ai, the virtual assistant that operates across any email account and multiple messaging platforms.

Cost-based pricing

Cost-based pricing can be of use in rare occasions. It is calculated by adding a set margin onto the cost needed to provide the service. This is usually used in commoditised markets where the price of something is well-established. It is mostly relevant for infrastructure products such as AWS / Azure or Twilio (the cloud communications platform). It can also be used when charging for one-off customisations.

Final thoughts

I believe half the battle in addressing pricing is finding the conviction to increase prices, while the other half is having the discipline to spend time to assess. Pricing should be continuously monitored and by increasing the number of data-points (e.g. from reviewing past sales), it can be optimised over time — it’s very unlikely to be perfect first try.

Founders frequently shy away from charging more as they remember the days when the product was in its infancy, and at the same time know how far away it is from their idea of perfection. By following some of these steps, I hope it convinces a few to have the confidence to so. And to end with a quote from Marc Andreessen “When in doubt, double prices. 🙂”.

Let me know your thoughts and any areas you’d like me to cover in future posts!

Adam Cook is an investment associate at AirTree Ventures. You can sign up to AirTree’s newsletter, or follow the team on Twitter, YouTube and LinkedIn.

Image source: Girl Geek Academy.

Trending

Daily startup news and insights, delivered to your inbox.