The world of cryptocurrency is weird and complicated.

In this four-part series, Casey Tonkin looks at the history of crypto, how you can get your hands on some, what you can do with it, and the Australian innovators looking to capitalise on this emerging technology.

Part II:

Now that you know a bit about bitcoin, its history, and how it works, you might be interested in buying your first piece of a bitcoin or other cryptocurrency.

First you need to find somewhere to buy cryptocurrency with your fiat money – an exchange.

Some exchanges act like any typical brick-and-mortar currency exchange you would find at an airport: they own a large pool of cryptocurrency and you buy it directly from them.

Others have in-built trading markets where you put in an order to buy or sell an amount of cryptocurrency at a certain price; once the exchange finds a matching order, it gets filled and you receive your cryptocurrency (with the exchange taking a cut).

Many exchanges will offer a combination of both services.

So how do you decide which exchange to use?

That’s entirely up to you. It’s not hard to find an exchange – in fact there’s so many vying for your attention that they’ve started advertising on bus stops.

If you’re feeling particularly parochial, you might want to look at supporting Australian exchanges like CoinSpot, Swyftx, or BTC Markets.

There are a lot of cryptocurrency exchanges to choose from.

Conversely, you could check out large international cryptocurrency exchanges like Binance or Huobi Global which may have smaller fees, access to larger markets, and different cryptocurrency products.

Binance, for example, has a host of decentralised finance (DeFi) products built in where customers can earn interest on their cryptocurrency, or even take out margin loans for spot trading and other activities.

Binance has more than double the 24-hour trading volume of its nearest competitor and operates its own cryptocurrency, Binance Coin, which has one of the largest market capitalisations for non-bitcoin cryptocurrencies.

Combined, these features make Binance something closer to a traditional bank than a currency exchange which, if you are interested in cryptocurrency because of Satoshi’s vision for a decentralised world free from central bank control, is something to consider.

Alt-coins: Ethereum, Tether, and Doge

As you’re clicking around on different exchange websites, you will see hundreds of different cryptocurrencies.

In the years since Satoshi Nakamoto minted the first bitcoin, developers have adapted the principles of bitcoin and blockchain to create their own cryptocurrencies.

Often these new coins serve a specific purpose like bitcoin’s main rival, Ethereum.

In 2013, Vitalik Buterin published a white paper for a protocol designed to facilitate smart contracts for decentralised applications.

The idea was to take the underlying blockchain technology of Bitcoin – programmable money – and turn it into something resembling a decentralised internet computer.

By hitching a ride on the Ethereum blockchain transactions, developers on Ethereum can create new applications to broaden the cryptocurrency financial world and help define Web 3.0.

Common features of cryptocurrency world today, like DeFi, non-fungible tokens (NFTs), and games are built either on the Ethereum blockchain or similar Ethereum-like smart contract blockchains like Binance Coin, Cardano, and EOS.

The Ethereum network is currently expensive to use because of high transaction fees which has opened space for developers to create those competing smart contract blockchains.

Another type of cryptocurrency to be aware of are stablecoins like Tether.

These are built to exactly mimic the price of fiat currency, most commonly the US dollar, giving cryptocurrency traders a place to park their value in what is otherwise an extremely volatile market.

And make no mistake: cryptocurrency is volatile. It has short boom and bust cycles that can be heavily dependent on speculative sentiment and the mood of a crowd.

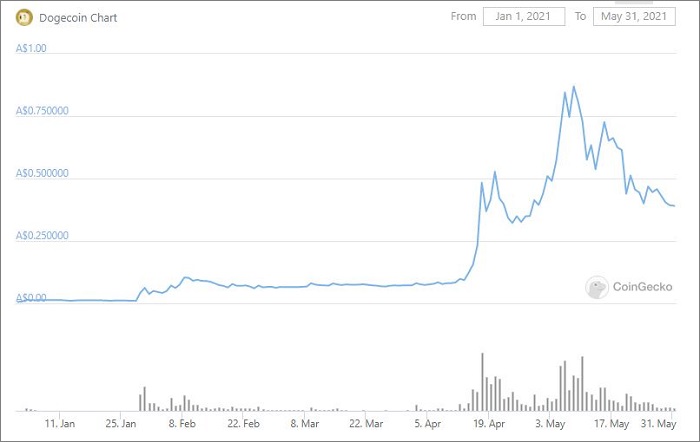

It’s been a wild year for Dogecoin. Image: CoinGecko

You can see this at play with Dogecoin, a meme currency literally built as a joke. With the blessing of Tesla CEO Elon Musk, the price of Dogecoin took off this year turning average people into millionaires overnight.

The memes on Musk’s Twitter feed were so instrumental to Dogecoin’s price that, in the days leading up to the billionaire’s appearance on famed US sketch show Saturday Night Live (SNL), market analyst Tammy Da Costa considered it “a potential major risk event”.

She was right – Musk referred to Dogecoin as a “hustle” during SNL and the Dogecoin price immediately started to slide.

Cryptocurrency is like that. Prices can be vulnerable to wild swings in public sentiment which means it’s very easy for your coins to suddenly be worth a lot less than what you paid for them.

Not your keys, not your coins

Okay, so now you have decided which cryptocurrency(s) you want to buy and what they do; you have picked an exchange to buy from; and you understand a bit about how volatile the cryptocurrency market can be. Congratulations!

Your next lesson is about cryptocurrency storage. As with picking exchanges, there’s not necessarily a right or wrong way to store cryptocurrency so long as you’re aware of the adage frequently chanted among cryptocurrency enthusiasts: not your keys, not your coins.

Let’s say you spent a sensible amount of Australian dollars on bitcoin through an exchange. That exchange then created what is known as a ‘custodial wallet’ in which your bitcoins now safely rest.

All wallets have a public address – a long string of numbers and letters used when sending someone bitcoin – and private keys that ‘unlock’ the wallet.

So long as you are logged into your account on the exchange, you should be able to send bitcoin to and from this wallet. Great!

But if the exchange controls the wallet’s private keys, there is a risk you could be locked out of your funds or lose your coin when a bad actor hacks the exchange. This isn’t hypothetical – both these things have happened before and will likely happen again.

The Mt Gox cryptocurrency exchange is probably the most famous example. One of the biggest bitcoin exchanges at the time, Mt Gox faced a string of security problems before it halted trading and collapsed in early 2014 leaving customers without access to their coins.

More recently, the founder of a Turkish exchange fled the country with billions of dollars in other people’s crypto following a government crackdown on cryptocurrency.

Nearly 400,000 people were locked out of their cryptocurrency when the exchange suddenly went offline in April.

Not your keys, not your coins.

Hot or cold

So, what do you do?

There’s two ways of looking at cryptocurrency storage: one is on devices connected to the internet (hot) and the other is completely offline (cold).

Hot storage has the advantage of being able to spend and move your coins easily but the disadvantage of being more accessible to hackers.

Cold storage is the opposite – it’s harder to spend the coins, but more securely stored.

In general, there are five types of wallets: online wallets (such as exchanges), desktop wallets, mobile wallets, hardware wallets, and paper wallets.

Desktop and mobile wallets are both software you install on your laptop, desktop, or mobile device and for which you are given the private keys.

If your device is connected to the internet, you can consider it a hot wallet.

Examples of these wallets are Exodus, Mycelium, and Bread but there are plenty more out there for you to try – just make sure to do your due diligence first.

Paper wallets are the purest form of cold wallet. It’s literally a piece of paper with the public and private keys printed on it.

Trezor is a hardware wallet designed to keep your cryptocurrency safe. Image: Trezor

No online capabilities mean hackers won’t be able to rob you with malware on your PC, but you’ll have to move funds in order to spend them, and you certainly don’t want to get a paper wallet wet.

For the best of both worlds, you might consider a hardware wallet. These small devices store your keys onboard and can be connected to a computer when you want to use your cryptocurrency.

You will be given a backup seed phrase to store – preferably offline somewhere safe – in case you lose and need to restore your device.

Trezor and Ledger are the leading producers of hardware wallets and a base model will set you back around $100 and $200 respectively.

Bitcoin.org has a useful tool for working out which wallet might be best suited to your needs and experience.

- In Part III of the series, we will look at some of the things you can do with cryptocurrency along with how it is treated by the Australian Tax Office.

- This story first appeared on Information Age. You can read the original here.

Trending

Daily startup news and insights, delivered to your inbox.