When we tell the community our mandate is to support B2B tech companies scaling up into the UK and US, we know this is a mouthful and sounds like an oddly specific mandate.

The comment we hear most from founders is, “we reached out to you because you help founders expand into the UK and US, and that’s the bit we need help with”. And the comment we most hear from investors is, “why only B2B tech?”

We’ve written about the first part – how we help founders – so this blog is about why we love and focus on B2B.

We know B2B

Firstly, all the founding team have experience and track record in investing in and building tech-driven B2B companies. Across our various careers, one of the other things we have in common, which is true if you have spent any time in business, is that we have all had great successes and devastating failures that we bounced back from.

We use all this experience to help our portfolio companies avoid making the mistakes we have, and we help supercharge their success by leveraging what we know works. This helps to create an information asymmetry, which helps to reduce the risk of investment.

The best investors invest in what they know. Their expertise and networks help reduce friction in the portfolio companies and see around corners better.

The supply/demand dynamics are better for B2B

There are a few other tailwinds that help to support our focus on B2B. 10 years ago, B2B was relatively unloved compared to B2C.

There are some good reasons why – it’s harder – the sales cycle tends to be longer, so it takes longer to see traction, but this also means it’s stickier, and there is less churn, so companies are spending less time having to replenish their lost customers with new ones.

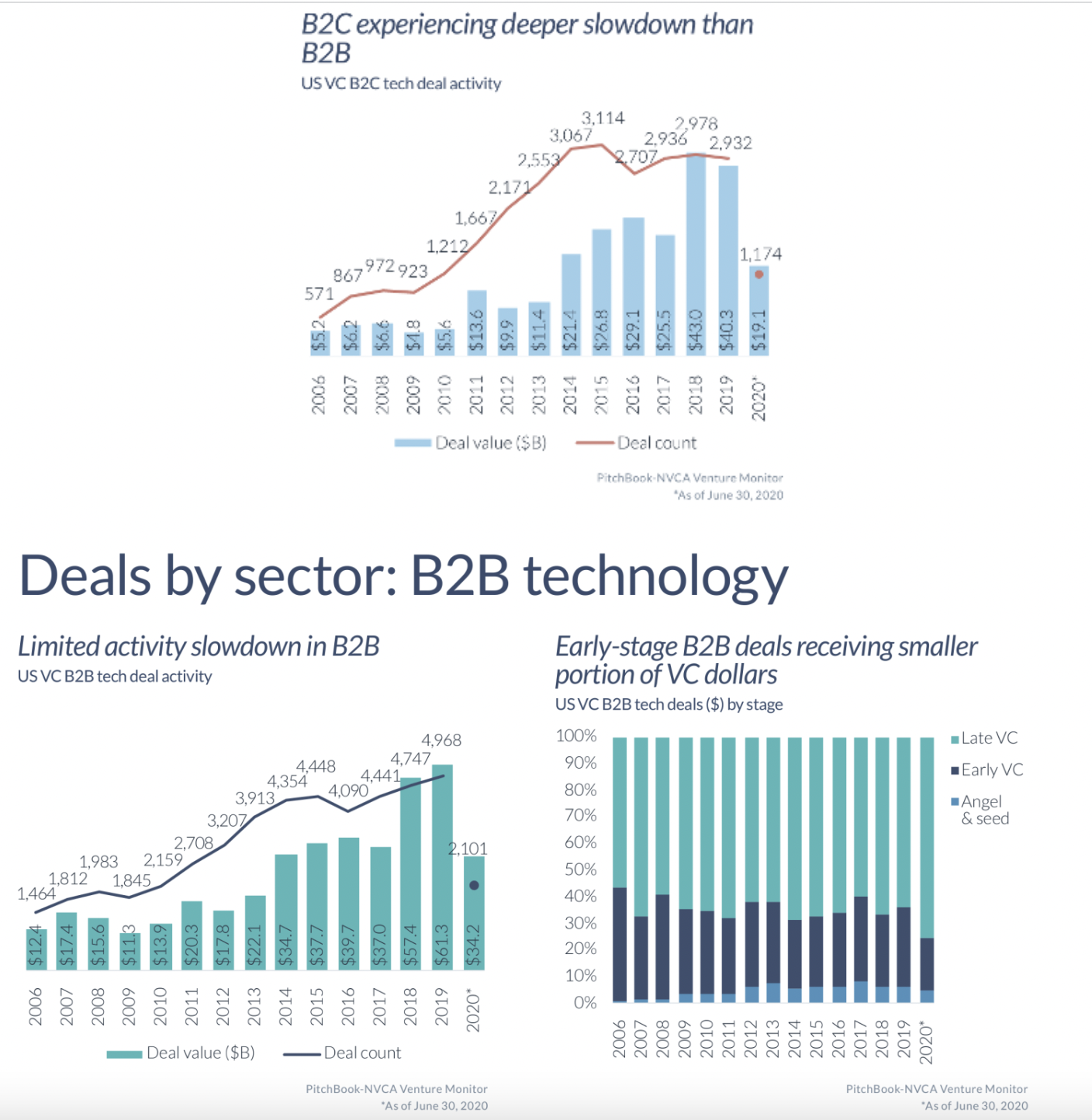

However, now we see investment into B2B outpace B2C by about 4 to 1, particularly at the later stages.

In the recent post-pandemic market correction, we’ve witnessed B2B activity contract at a lower rate than other verticals, so it’s been more resilient.

B2B isn’t sexy but it has a great personality

Many B2B businesses aren’t ‘sexy’. You don’t often hear people talking breathlessly about their enterprise software at a dinner party.

However, this also means B2B is less susceptible to fads. B2B is the dad bod of VC sectors – not the flashiest, but it’s dependable and still passes for attractive in a good suit. In our mind if there was ever an area for the patient capital that venture represents, B2B is it.

B2B is often less price sensitive than B2C, businesses are about return on what they are spending, and therefore B2B companies that can deliver high value can maintain high margins. It’s also less discretionary, so less susceptible to being culled in tighter economic conditions.

Lastly, B2B companies can often generate revenue from the get-go, which is advantageous compared to B2C companies, who often must build scale before learning to monetise it.

There is still an opportunity for value

The increasing relative amounts of capital for B2B is a double-edged sword – it’s terrible if the capital availability drives up competition and valuations, but I’ll get to that in a second. More importantly, in venture one of the ways great companies can still wilt on the vine and fail is if they don’t have enough capital in the market to support their later stages.

Greater capital at later stages means that there is a ready pool of follow-on capital to invest in companies we help expand. This also helps to reduce risk.

And with the recent market corrections, we didn’t see competition driving up prices. In fact, we are seeing a correction below the median. So if you believe there is likely to be a correction back towards the median, then we have some opportunity for value investing or value arbitrage.

The exit landscape is better

Delivering good exits is as much part of outsized returns as making good investments.

We believe the exit strategy for B2B businesses are more straightforward with a greater universe of acquirers and less reliance on how wide open the IPO market is, which we also believe helps to reduce the risk for investors.

What we see is that the M&A environment remains strong for B2B, which again helps mitigate risk.

For all the reasons above, we think that a clear focus on B2B helps us provide our investors with a strategy that can bias returns for investors by taking advantage of market tailwinds, providing access to quality deal flow, adding value because we have seen the movie play out many, many times before, and creating pathways to exit.

For the foreseeable future, we see this arc of relevance is long for B2B. But we have also been around long enough to know that things change, and we must be ready for it. We operate with a ‘strong opinions loosely held’ mantra.

Meaning that as we read the tea leaves of both the macro and micro environment, we reserve the right to change our mind and pivot to ensure our investor’s returns are prioritised.

This isn’t because we don’t have conviction, it’s because our other mantra is to prioritise the preservation of our investor’s capital over a dogmatic approach within an ever-changing market.

- Elaine Stead is the Chief Investment Officer & cofounder of Tribe Global Ventures.

Trending

Daily startup news and insights, delivered to your inbox.