Tech exports from New Zealand generated NZ$10.4 billion in export revenue in FY2021, up 14.4% on the previous year, according to the annual Technology Investment Network (TIN) Report.

The TIN Report, now in its 17th year, benchmarks the performance of New Zealand’s 200 largest globally-focused technology companies, categorised according to the primary sectors of biotech, ICT and high-tech manufacturing.

The TIN200 companies generated a combined revenue of NZ$14 billion, meaning nearly 75% of that figure came from export. The over annual growth rate of 11.5% for FY21 exceeded the 10.9% 5-year average. Those companies are now the second highest offshore revenue-earning sector in New Zealand, with the key markets of Australia, Asia, Europe and North America all recording double-digit growth.

TIN founder and managing director Greg Shanahan says that despite the challenges of COVID-19 over the past year, many TIN200 companies demonstrated resilience, creativity and innovation to achieve record growth.

“It’s been a truly defining year, characterised by upheaval, uncertainty and unprecedented challenges in many quarters,” he said.

“Against this backdrop, Aotearoa New Zealand’s overall tech export sector is still gaining speed, building critical mass, and attracting global investor attention, ahead of its long-term growth trajectory.

“This is hugely significant for our economy in terms of the increasing demand for skilled talent, growth in productivity and the major changes of capital flows into tech opportunities.”

Key TIN Report 2021 highlights include:

- $13.9B: TIN200 total revenue

- $1.4B: TIN200 total revenue growth

- $10.4B: Total TIN200 exports

- 57,000+: Number of TIN200 full-time staff

- 3,000+: new jobs created by TIN200 companies

- 5-year CAGR for TIN200 exports 10.9% (Dairy exports 7.2%, Meat exports 3.9%).

- High Tech Manufacturing growth: 13.9% or $907 million (63% of total TIN200 revenue growth)

- Healthcare largest and fastest-growing secondary sector, overtaking Fintech

- Europe growth of 19.6% or $300 million

- Central North Island strongest regional revenue growth of 18.4%

- Fisher & Paykel Healthcare #1 on TIN200 list for first time

- Laybuy recipient of TIN Rocket Award 2021 for biggest jump in TIN200 rank (climbed 48 places)

Hi-tech manufacturing and healthcare lead

The TIN report concluded that high-tech manufacturing is New Zealand’s largest tech sector and driver of growth, generating 63% of TIN revenue growth, with more than three quarters coming from Fisher & Paykel Healthcare.

ICT sector growth slowed this year; down from 13.0% in 2020 to 10.3%.

Healthcare was both the largest and fastest-growing secondary sector for the TIN200; contributing 49.1% of the total TIN200 revenue growth in 2021.

Despite the disruptions of the past year, the four fastest growing secondary sectors in the TIN200 – Healthcare, Fintech, Software Solutions and Communications Solutions — achieved double-digit growth rates. Communications solutions doubled its 5-year growth rate and grew its workforce by 30%.

Jobs growth and deals

The TIN200 companies employ more than 57,000 staff, with employment up by more than 3,000 people (+ 5.9%) vs 4,000 (+8.4%) in 2020. The report says the slowing growth can be partially attributed to border restrictions and domestic talent shortages.

Meanwhile, a record number of TIN200 companies were sold, revealing a global appetite for Kiwi tech firms, with 12 sold in late 2020 and 2021, with the scale and size surpassing previous years.

The size and scale of the deals also jumped with Seequent and Vend, sold for NZ$1.46 billion and NZ$455 million respectively, leading the way.

At the same time four of the TIN200 companies went public in a seven-year high. And Rocket Lab joined the Nasdaq in late August 2021, using a special purpose acquisition company (SPAC) at an initial market cap of US$5.2 billion.

TIN’s Greg Shanahan said New Zealand tech companies are increasingly raising capital in public markets and using it to drive global expansion and revenue growth.

Central North Island on the rise

The Central North Island region is home to 12 TIN200 companies, showed the largest revenue increase this year, rising 18.4% to NZ$273 million

Auckland is home to 120 of the cohort and continues to be the powerhouse of the NZ tech sector, generating 56.6% of overall TIN200 revenue at NZ$7.912 billion.

Purchase and download the TIN Report here.

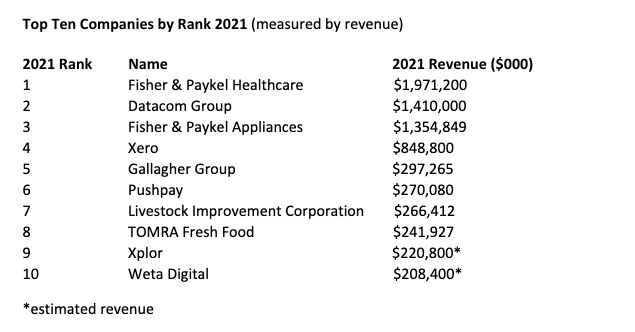

Here are the top 10 NZ tech companies by revenue

Source: TIN Report 2021

TIN Report’s top 10 companies to watch

Source: TIN Report 2021

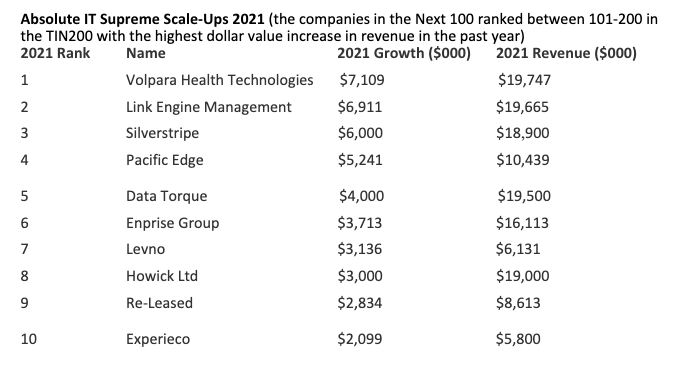

The top 10 IT scale-ups

Source: TIN Report 2021

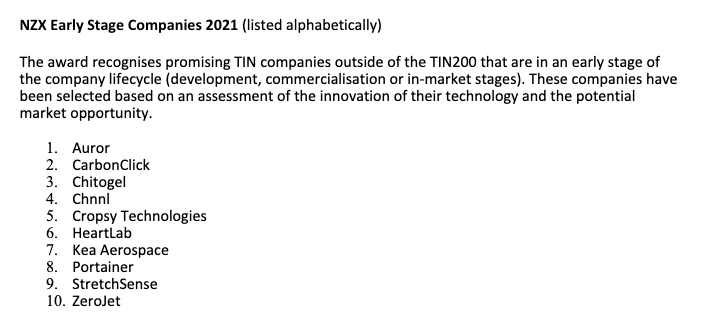

And top 10 early stage startups

Source: TIN Report 2021

Trending

Daily startup news and insights, delivered to your inbox.