Fintech is hot with venture capitalists globally, with investment in the sector hitting US$98 billion (A$133bn) in the first half of 2021 according to global advisory firm KPMG.

The company’s bi-annual Pulse of Fintech report on investment trends found a US$10.9bn jump in investment on H1 FY20, including M&A, private equity and VC. Australian fintech attracted more than A$1.2 billion in investment, most notably the NAB M&A deal with 86 400 for $220 million.

Global VC investment in fintech reached a record US$52.3 billion in H1 FY21 – more than doubling the US$22.5bn on the corresponding six months in 2020.

Fintech valuations remained very high in H1 FY21 with 163 unicorns created globally over that time.

Ian Pollari, Global Fintech Co-Lead, KPMG Australia. Photo: Business Wire

Corporates were also particularly active in venture deals, tipping in nearly US$21 billion in investment to nearly 600 deals globally, with many realising it’s quicker to do so by partnering with, investing in, or acquiring fintechs.

KPMG’s Australian-based global fintech co-lead Ian Pollari said that investors, particularly corporates and VCs, made big bets on market leaders in numerous jurisdictions and across almost all subsectors.

“Large funding rounds, high valuations and successful exits underscore the thesis that digital engagement of customers that accelerated during the pandemic is here to stay,” he said.

“There’s a lot happening in the fintech sector in Australia — between payments, digital banking, and banking-as-a-service solutions. Corporates were very active in H1’21, focusing on building out their capabilities and their offerings in order to provide a broader range of solutions to their clients, particularly SMEs and merchants.”

Australia had a solid start to the year, with more than A$1.2 billion (US$890m) in fintech investment, including NAB’s acquisition of neobank 86 400 and a A$130 million raise by Airwallex and A$100 million for renewable-focused credit and sales provider Brighte, as well as $90 million for Athena Home Loans.

Other H1 FY21 highlight singled out by KPMG include several big banks investing in ecosystem and vertical players in order to simplify and enhance the experience of SMEs and merchants, as well as CBA’s $20 million investment in Amber Energy.

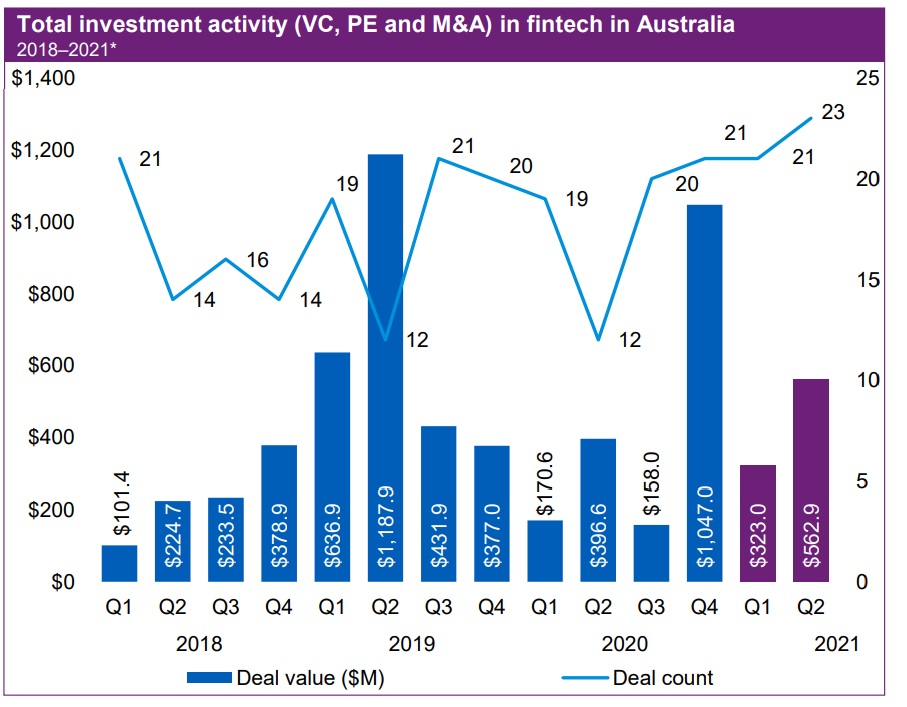

Australian fintech deals over the last 3 years. Image: KPMG

Pollari believes that in the second half of the year, the payments space is expected to remain a dominant driver of fintech investment globally, with revenue-based financing solutions, banking-as-a-service models, and B2B services are expected to attract increasing levels of investment.

A rise in digital transactions, and subsequent increase in cyberattacks and ransomware, will translate as cybersecurity solutions being high on the radar of investors.

Consolidation ahead

His fintech co-lead Anton Ruddenklau said they anticipate more consolidation, particularly in mature fintech areas as fintechs look to become the dominant market player either regionally or globally.

A notable example of that is Square’s plan to acquire local BNPL Afterpay in a $39 billion share swap.

The key global highlights identified by KMPG in H1 FY21 are:

- Global fintech investment reached US$98 billion across 2,456 deals in H1’21 – far outpacing last year’s annual total of $121.5 billion across 3,520 deals.

- M&A deals continued at a very healthy pace, accounting for $40.7 billion across 353 deals in H1’21, compared to $74 billion across 502 deals during all of 2020.

- Late-stage venture valuations more than doubled year-over-year, with global median pre-money valuations for late stage deals rising from $135 million in 2020 to $325 million at the end of H1’21.

- Corporate participation in VC investment in fintech was incredibly strong in H1’21, with US$20.8 billion of investment globally. Both the Americas (US$13 billion) and EMEA (US$5 billion) saw record levels of CVC-affiliated investment.

- Global investment in cybersecurity reached a new annual record at mid-year—rising from US$2.2 billion in 2020 to over US$3.7 billion in H1’21.

- Cross-border M&A deal value rose dramatically, from $10.3 billion during all of 2020 to $27.7 billion in H1’21 alone.

- PE firms embraced the fintech space in H1’21, contributing $5 billion in investment to fintech— surpassing the previous annual high of $4.7 billion seen in 2018.

- Total fintech investment in the Americas was very robust with over US$51 billion in investment across 1,188 deals.

- The EMEA region saw US$39.1 billion in fintech investment in H1’21, including a record US$15.1 billion in VC funding.

- Fintech investment in the Asia-Pacific region continued at a more moderate pace, reaching $7.5 billion across 467 deals, compared to $13.4 billion across 714 deals during all of 2020.

The full Pulse of Fintech report is available here.

Trending

Daily startup news and insights, delivered to your inbox.