Buy-now-pay-later market leader Afterpay (ASX: APT) is getting into ibanking, launching an app-based no fee deposit account paying 1% interest.

The ASX-listed fintech has been granted an Australian Financial Services Licence (AFSL) by ASIC so it can provide general financial product advice and distribute basic deposit products and debit cards.

Called Money by Afterpay, the “money and lifestyle app” begins testing today as an Australian staff pilot, with plans to launch it to the BNPL’s 3 million-plus customers in October 2021.

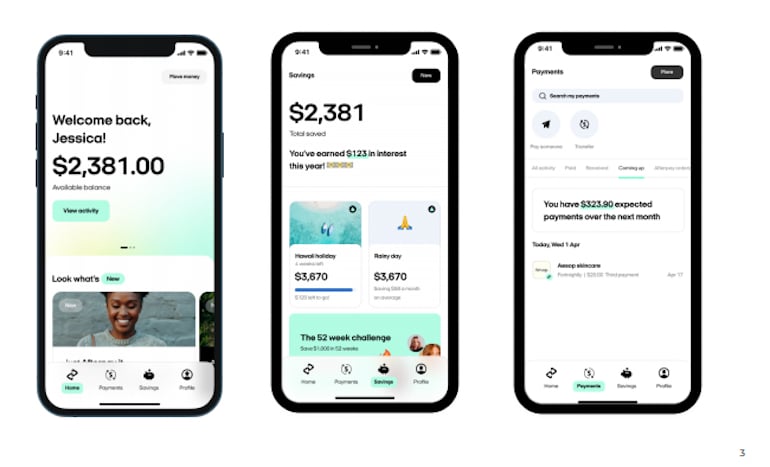

The app will display a user’s BNPL balance, upcoming orders and instalments alongside their daily spending and savings accounts. The app will offer up to 15 different accounts, paying 1% interest, which the company says will allow users to set different savings goals.

The Money app offers one daily account with a physical debit card, digital wallet offerings and the ability to easily make and receive real time payments via the New Payments Platform. Westpac will be behind the accounts and debit cards.

Afterpay, which currently charges merchants around 4% on transactions, will hopefully reduce the substantial cost hit it takes on credit card costs associated with its BNPL sales by shifting customers to direct payments through their Money apps account, as well as embedding the company and its data analytics deep within the spending habits of younger consumers.

Afterpay is targeting Gen Z and Millennial customers with the savings account, claiming they “don’t trust their own money behaviours, and therefore lack confidence in using or committing to other apps on the market”.

Images of the planned Money by Afterpay app.

The BNPL’s Executive Vice President, New Platforms, Lee Hatton said they’d used the trust those generations placed in the brand to develop an app designed for them.

“Combining money management with the BNPL offering will allow us to help customers spend, save and play just by using Money as their primary app,” she said.

“The first release in July is just the beginning for us. We will deliver new and unique features to customers consistently throughout the year and we’ll be nimble enough to quickly act on feedback in near real-time. We can’t wait to share this with Australians.”

As testing with employees continues. Hatton said the feedback and insights from the closed group will help refine the content, experience and features, with a series of feature drops planned for the weeks leading up to October’s public launch

Trending

Daily startup news and insights, delivered to your inbox.