ASX-listed Afterpay is contemplating a US listing as global sales for the third quarter of FY21 continue to boom.

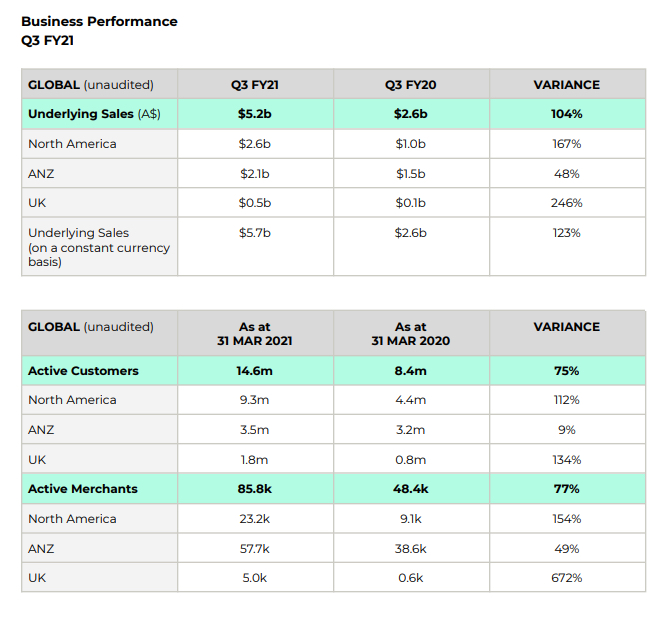

The buy-now-pay-later (BNPL) fintech (ASX:APT) beat market expectations, with underlying sales overall up 104% on 12 months ago, while underlying sales in the US and UK were up 167% and 246% respectively for Q3 FY21. Quarterly performance on a constant currency basis was 123% higher.

Q3 FY21 beat the December quarter, with the US becoming the first region to record more than A$1 billion in underlying sales in a single month. North America is now Afterpay’s biggest market, delivering $5.2bn in transactions for the quarter.

Active customers globally increased by 75% year-on-year to 14.6 million (from 8.4m in Q3 FY20), with North America and the UK reaching 9.3m and 1.8m active customers respectively.

The company said is working with external advisors “to explore options for a US listing given the US market is now the largest contributor to our business”.

The Melbourne-based global business plans to remain headquartered in Australia and did not set a time frame for any potential US float, nor reveal whether it was considering a dual listing or delist from the ASX.

“There is no timeline set for a Board decision on a US listing and any listing would be subject to market conditions, approval by a US exchange and satisfying a number of other customary listing prerequisites,” the company said.

The business expanded into Europe last month and is also planning a roll out in Asia.

Afterpay said gross losses 8 (unaudited) continued to remain below historical rates in all operating regions. Net Transaction Losses (unaudited) as a percentage of underlying sales likewise remained low for the quarter.

Afterpay’s Q3 FY21 sales results. Source: Afterpay

Trending

Daily startup news and insights, delivered to your inbox.