Friday at last!

Don’t forget to tune in for the Startup Daily show on Ausbiz.com.au every weekday, 2-2.45pm. Watch online, download the ausbiz app or via 7Plus.

And have a great weekend. See you Monday.

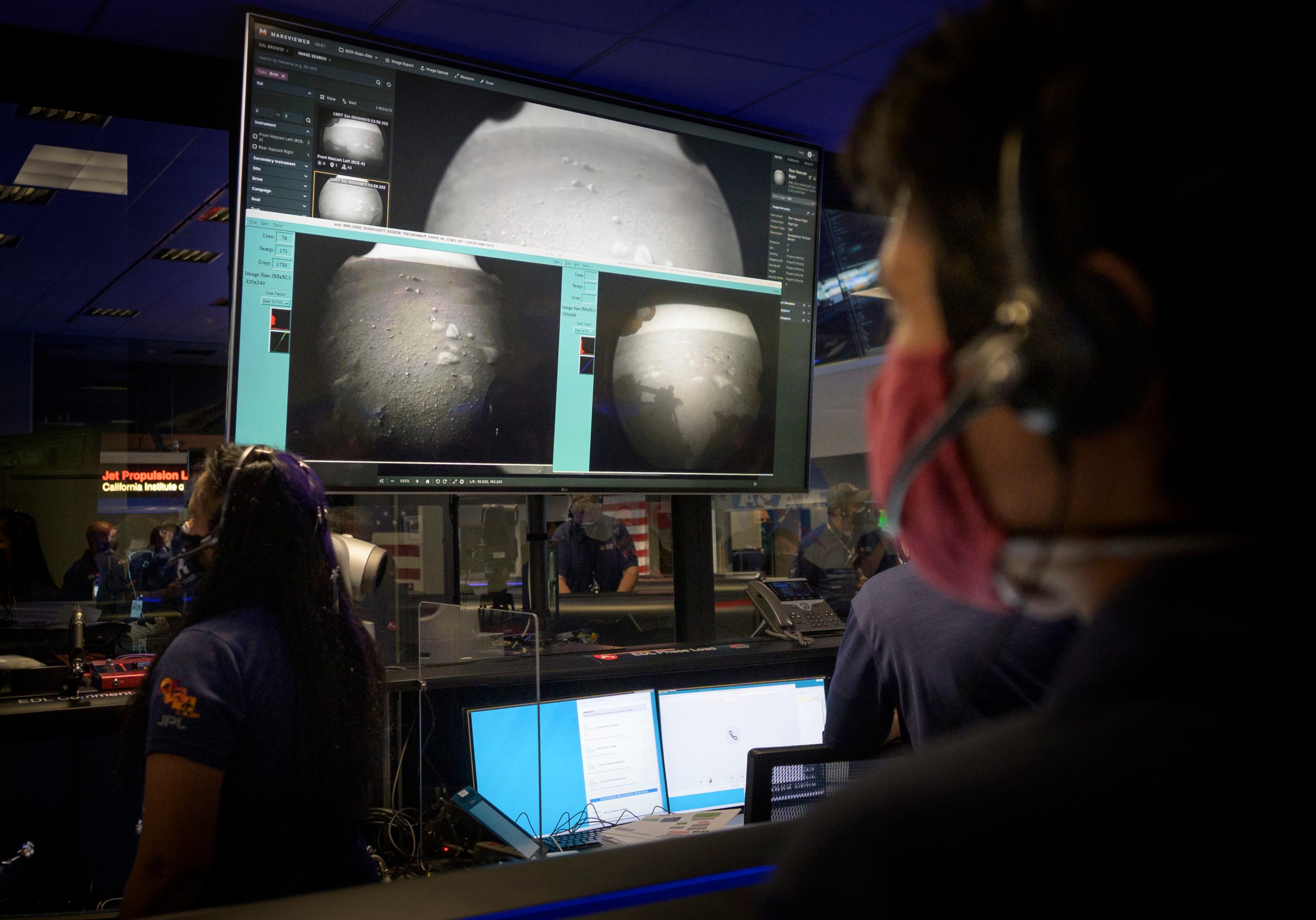

NASA perseveres

After 203 days and 472 million kilometres, NASA’s Mars rover, Perseverance, touched down on the red planet just before 8am, AEDT. Within a minute of landing it was sending images of the ground back to Earth.

The mission is an ambitious first step in the effort to collect Mars samples and return them to Earth and also includes Ingenuity Mars Helicopter.

Perseverance is car-sized, weighs 1,026kg and will undergo several weeks of testing before it begins its two-year science investigation of Mars’ 45km-wide Jezero Crater. The rover will investigate rock and sediment of the 3.5 billion-year-old lakebed and river delta, as part of its astrobiology mission, including the search for signs of ancient microbial life. There’s also a Mars Sample Return campaign, being planned by NASA and the European Space Agency.

It will also be a few months before Ingenuity potentially takes to the skies in an atmosphere 1/100th of the Earth’s.

Let’s hope it’s as successful as the previous rover, Opportunity, landed there on Jan 2004, and was expected to last for three months, but continued on for 14 years, travelling 45km before it ran out of power in June 2018 when a global dust storm blocked the solar panels.

Touchdown confirmed. The #CountdownToMars is complete, but the mission is just beginning. pic.twitter.com/UvOyXQhhN9

— NASA (@NASA) February 18, 2021

GameStop’s ‘Roaring Kitty’ sued

Keith Gill, known by his YouTube moniker “Roaring Kitty” was a key protagonist in the crazed WallStreetBets subreddit GameStop short squeeze, but turns out he wasn’t the amateur investor many believed and Bloomberg reports that he now being sued in a class action by other investors.

His lead nemesis, Christian Iovin sold $200,000 worth of call options on GameStop shares at below $100 and when it topped $400, he was forced to buy the calls back.

The suit claims Gill is a licensed securities professional who manipulated the market via social media for profit himself.

“Gill’s deceitful and manipulative conduct not only violated numerous industry regulations and rules, but also various securities laws by undermining the integrity of the market for GameStop shares,” the suit says.

“He caused enormous losses not only to those who bought option contracts, but also to those who fell for Gill’s act and bought GameStop stock during the market frenzy at greatly inflated prices.”

More here.

Humm’s SME BNPL

Humm Group (formerly Flexigroup) has launched a ‘Business Now Pay Later’ product, hummpro, for SME, which acts like a universal trade account, offering access to funds up to $30,000 for Australian and New Zealand SMEs.

Humm (ASX: HUM) says hummpro can be used anywhere Mastercard is accepted: online, in store and to pay supplier invoices, a clear differentiator to other BuNPL products that require suppliers to be onboarded and integrated into their network to accept payments.

Yodlee joins CDR

US data analytics platform Envestnet | Yodlee (NYSE: ENV) has become an Accredited Data Recipient as part of Australia’s Consumer Data Right (CDR) roll out, and the initial open banking scheme.

That makes Yodlee just the seventh accredited data recipient since CDR launched in July 2020. The others are Frollo, Intuit, Credit Simple, Ezidox, Illion and Regional Australia Bank, which has the rare double of also being one of the approved data holders alongside the big four banks.

Yodlee’s approval comes in the same week it launched an ANZ-specific responsible lending product, the Envestnet | Yodlee Credit Accelerator, which financial service providers can use to access consumer data to make lending decisions.

Regor’s $90m series B

Shanghai-based clinical stage biotech Regor Therapeutics, founded in 2018 by CEO Dr. Xiayang Qiu, has raised US$90 million in a Series B led by Lilly Asia Ventures, along with Loyal Valley Capital, Lanting Capital, TF Capital and Vertex Ventures China.

The venture uses the CARD – Computer Accelerated Rational Discovery – tech platform its built speed up testing of potential drugs and is looking to discover medicines to treat cancer, immune disorders and metabolic diseases.

Tweet of the Day

Hello, world. My first look at my forever home. #CountdownToMars pic.twitter.com/dkM9jE9I6X

— NASA's Perseverance Mars Rover (@NASAPersevere) February 18, 2021

Trending

Daily startup news and insights, delivered to your inbox.