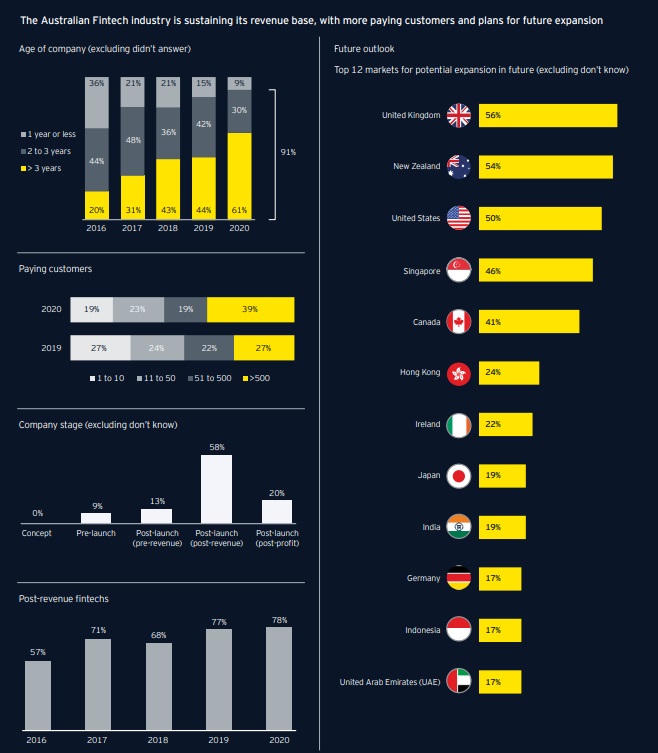

- 39% of local fintechs have more than 500 paying customers, up from just 27% in 2019

- 72% of fintechs say the COVID-19 pandemic had a negative impact on their capital raising ability

- Payments, wallets and supply chain (30%) and lending (20%) are now the top two types of fintech services

The Australian fintech sector is at record levels, attracting more customers and maintaining its revenue base, despite the impact of Covid-19 on the economy, according to the latest annual EY FinTech Australia Census.

The 2020 Census, the fifth edition, found the proportion of post-revenue fintechs with more than 500 paying customers was up by 12% in the last 12 months to 39%. The sector is also looking to take on the world with 88% of respondents intending to expand overseas in the future. The UK tops the list for international expansion (56%), closely followed by New Zealand (54%) and the US (50%).

Ernst & Young Australia Fintech Advisor Meredith Angwin said that as people adjusted to new ways of working and living during the pandemic, there was a significant increase in the use of digital payments and transactions.

“At the same time, the buy now pay later sector has expanded at pace, both here and overseas,” she said.

“This is reflected in a change in the top fintech categories identified in this year’s Census, with payments, wallets and supply chain (30%) now in the top spot, followed by lending (20%) and data and analytics (22%).”

Capital access a challenge

Angwin said it’s not all “smooth sailing” over the past year, especially when it comes to finding capital

“While the industry continues to face its usual headwinds of regulatory concerns and competitive pressure, it is now also contending with added difficulties emerging from the pandemic, such as the tightening of capital and concerns that consumers may return to the perceived safety of major incumbent institutions for their financial services needs in uncertain times,” she said.

More than a third (39%) of post revenue/profit fintechs reported not meeting their capital raising expectations, although they fared far better than the early stage (pre-revenue/launch) respondents, with more than half (54%) reporting their expectations were not met.

Overall, nearly three-quarters (72%) of respondents reported that the COVID-19 pandemic had worsened their capital raising situation.

Key stats from the 2020 fintech census. Source: EY

R&DTI changes welcome

Angwin said that over the last few years, policy and infrastructure initiatives to foster financial services innovation have gained momentum and supported the industry’s growth, with ministerial representation increasing the sector’s visibility as well as opening direct channel to key federal policymakers.

And despite the government backing down in the recent federal budget, and not cutting more than $2 billion from the research and development tax incentive (R&DTI) program, 93% of fintechs surveyed said making the R&DTI more accessible would be the most effective potential growth initiative.

And in a warning to policymakers keen to keep domestic jobs, four out of five fintechs said having access to the R&DTI increases the likelihood of keeping at least part of their business onshore.

FinTech Australia CEO Rebecca Schot-Guppy, CEO said that while she was pleased to see an increased R&D spend announced in the budget, the findings of the EY Census demonstrate that it’s crucial for the start date of the policy to be brought forward from the proposed July 1, 2021 start date.

“Raising capital is usually a lagging indicator of the health of the sector, so it is concerning to hear that the pandemic is already having an impact,” she said.

Open banking focus

With the consumer data right (CDR) beginning its initial roll out as open banking on July 1, the sector is looking to get into the game, with 48% of fintechs surveyed planning to become CDR accredited.

Of th0se, 31% are looking to become an accredited data recipient (ADR) within the next six months and 71% within a year.

More than quarter (28%) said they will connect through an intermediary when the rules allow.

Meredith Angwin said that many fintechs see the potential benefits of being part of the CDR.

“However, they also reported that they would like to see some streamlining of the complex and costly accreditation process, with a tiered system so those with scale can support smaller players,” she said The ability to access the scheme via a third-party intermediary was also viewed by many as a necessary step to support small and medium-sized fintechs participation in the system,” she said.

Other key findings:

- The Australian fintech industry continues to mature, with 78% of fintechs now post-revenue and 91% having been in operation for two or more years.

- Employment continues a gradual increase, with the median number of employees now at 10 full-time and two part-time.

- Hiring has slowed for now, but fintechs said that easier access to skilled migration would be an effective mechanism for growth jumped to 72% (from 66% in 2019).

- B2B fintechs dominate the sector, with 80% of respondents identifying as either B2B or B2B-2C.

- Fintechs have broadened their international expansion outlook to include new markets such as Ireland (22%), Germany (17%), Indonesia (17%) and the UAE (17%).

- 61% of fintechs have applied or are applying for the R&DTI, with 56% already successful.

- Other policy initiatives fintechs say would be the most effective to drive growth include:

- offering capital gains tax relief for tech start-ups first incorporated in Australia (89%);

- reducing taxes, such as payroll taxes, that apply when hiring employees (87%);

- and allowing access to Open Banking via an intermediary (86%).

- Fintechs are highly supportive of Australia adopting a Digital ID framework, similar to those already being implemented in Asia and Europe, with 59% of Census respondents believing it would deliver cost savings to their organisation, mostly in customer onboarding.

The full EY FinTech Australia 2020 Census is available for download here.

Trending

Daily startup news and insights, delivered to your inbox.