Welcome to Ignition Lane‘s Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

We work with ambitious business leaders to apply the Startup Mindset to their technology, product and commercialisation problems. So we make it our business to know everything about technology, startups and venture capital.

This wrap goes out free to subscribers every Saturday morning and from this week, we’re delighted to be also publishing it every weekend on Startup Daily.

OK, here’s our weekly wrap.

Grapple Apple’s value

Apple has done an incredible job at building vertically integrated services and revenue streams (Apple Pay, Apple Music, Apple TV+, and the App Store) off the back of its market leading hardware business.

This week it made history as the first company to achieve a market cap of over US$2 trillion.

Just how much is $2 trillion? Well, a trillion is a thousand billion and a billion is a thousand million. But if for you, like us, that feels a bit meaningless, here’s two trillion in the context of time: two million seconds is about 23 days. Two billion seconds is about 63 years. And two trillion seconds is around 63,419 years. So, lots.

Some of our favourite Apple-related facts:

- As at Jan 2020, there were 1.5 billion active iOS devices.

- Unit sales for iPhones peaked at 231 million in FY15. That’s about 440 per minute, every day of the year.

- Steve Jobs’ 2007 key note, which introduced the iPhone and a generational change in technology is the best keynote of all time:

- Berkshire Hathaway owns nearly 250 million Apple shares, representing more than 5% of Apple’s stock. That stock is now worth around US$117 billion, which is nearly a quarter of Berkshire’s entire market cap.

- You may have heard of the Steves (Jobs and Wozniak) but did you know there was a third co-founder, Ronald Wayne. The Steves met Wayne at Atari and founded Apple in 1976. Wayne took a 10% stake in the new company, but gave up his equity for $800 12 days later because of the risk involved. If that wasn’t enough of a kick in the financial guts, he also sold his original copy of the founding agreement for $500 in 1995. In 2011, sold at auction for nearly $1.6m.

- Remember when President Trump addressed Apple’s CEO Tim Cook as Tim Apple and later vehemently denied his mistake? Turns out, this wasn’t his first re-name rodeo. In 2018, he called Lockheed Martin’s CEO ‘Marillyn Lockheed’. Respect.

Google, Apple, Epic Battle

We touched on this in last week’s rapid fire section, but think it deserves a bit more explanation – Epic Games is in a battle against Apple and Google that centres around their App/Play Store monopolies.

Epic is the developer of Fortnite, one of the most popular games on the planet with over 350M registered players. Epic’s founder and CEO, Tim Sweeney, is part of a growing group of tech execs who are fed up with Apple’s and Google’s app store duopoly.

Over the last few months Sweeney’s criticisms escalated and, it seems, he decided to take matters into his own hands, rolling out a plan that forced the hand of Apple and Google, landing them in court.

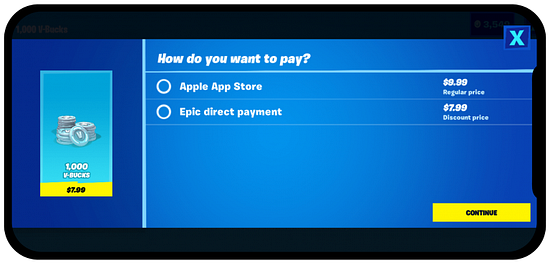

Last Thursday, Epic introduced a new way to pay for in-app currency, which bypassed Apple and Google’s 30% commission claws (if users paid direct they got a 20% discount). This, of course, violated Apple and Google’s terms of service. So they each delisted Fortnite from their stores.

Getting kicked out of the stores was all part of Epic’s grand plan. Immediately after being removed, Epic filed lawsuits against Apple and Google. Apple’s lawsuit was even accompanied by a parody of Apple’s famous Super Bowl 1984 ad (which was a reference to George Orwell’s Nineteen Eighty-Four — and IBM’s monopoly over the computer market).

Getting kicked out of the stores was all part of Epic’s grand plan. Immediately after being removed, Epic filed lawsuits against Apple and Google. Apple’s lawsuit was even accompanied by a parody of Apple’s famous Super Bowl 1984 ad (which was a reference to George Orwell’s Nineteen Eighty-Four — and IBM’s monopoly over the computer market).

The two lawsuits are slightly different because Android is open, so there are competing app stores like Samsung’s Galaxy Store. However on iPhones and iPads, developers have no other option than to use the Apple App Store to distribute apps. Remember that’s 1.5 billion devices.

Despite allowing competing app stores, Epic contends that Google’s practices mean there is no real alternative to the Play Store. It argues Google uses a myriad of “contractual and technical barriers,” like “intimidating messages and warnings” when users try to install apps from outside of its Play Store.

Then there’s Apple, which is a straight up monopoly. From the Apple lawsuit:

Fast forward to 2020, and Apple has become what it once railed against: the behemoth seeking to control markets, block competition, and stifle innovation. Apple is bigger, more powerful, more entrenched, and more pernicious than the monopolists of yesteryear. At a market cap of nearly $2 trillion, Apple’s size and reach far exceed that of any technology monopolist in history.

This is a great in-depth explanation of how Apple got into this position, which concludes:

Apple consistently acts like a company peeved it is not getting its fair share, somehow ignoring the fact it is worth nearly $2 trillion precisely because the iPhone matters more than anything… it is the foundation of modern life, which makes it all the more disappointing that Apple seems to care more about its short term bottom line than it does about the users and developers that used to share in its integration upside.

Epic wants Apple and Google to change their policies and open the ecosystem to truly allow competing app stores. But the answer may not be that straight forward.

Opening up the iOS ecosystem, in particular, is likely to come at a cost to consumers – security. One major benefit of iPhones and iPads being locked down is that they are super secure, which Apple argues is essential for the average user (who is not techy). Apple’s control over the App Store and payments helps keep credit card details secure and prevent dodgy apps corrupting iPhones.

Don’t wait with bated breath for a court decision on this anytime soon. Lawsuits are long and as each of the parties have deep pockets, none are likely to concede any time soon. Another class-action lawsuit against Apple’s App Store practices has been in the courts for a decade, with no resolution.

However that might not matter. The timing of these lawsuits coincide with increased public and political scrutiny over Big Tech’s monopolies, with the recent Congress hearing, EU Apple antitrust investigations, along with high-profile complaints and lawsuits from others in tech industry including Spotify, ClassPass, AirBnb and new email app, Hey.

Law makers are going to be forced to take action with all this momentum and noise. Whether their choice of regulation and remedy is logical, is a whole other question.

Google the bully; ACCC the questionable regulator

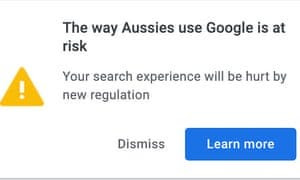

Google is playing hardball with the ACCC (and Aussie media) with a new campaign that displays warning messages (sound familiar?) to Google users – “your search experience will be hurt by new regulation”.

The campaign is in response to a draft code that would require Google and Facebook to pay media companies for their content. This is a world-first attempt. Arguably other countries would follow suit to enact a similar tax. So Google throwing all its weight at stopping the code from going through.

|

As we’ve written before, the proposed code isn’t the best solution to Google’s monopoly (or the loss of journalism jobs). There are lots of holes in it, and it won’t solve the real monopoly problem – it just pours cash into media’s coffers.

Relatedly, we enjoyed this excellent interview with the CEO of the New York Times on its 2012-2020 transformation strategy.

Rapid fire: News that caught our eye this week 🧐

- Big week of announcements in Australia:

- Carbon neutral courier service Sendle raised AU$19M off the back of the current eCommerce boom. It now has more than 500,000 customers across Australia and the United States, and that number will likely grow with its new Etsy integration.

- Continuous Integration and Continuous Deployment platform startup Buildkite raised AU$28M on a $200M valuation led by US VCs OpenView and General Catalyst. This is quite a feat – Buildkite has built an incredible business with only one $200k friends/family/fools captial raise to date. Sales fixes everything.

- MedTech See-Mode raised AU$9M Series A led by insurance company MassMutual and backed by existing investors, including Blackbird. See-mode uses machine learning to help clinicians better predict risk of strokes and vascular diseases.

- Superannuation and investing startup Spaceship raised AU$10 million from existing investors including from Atlassian billionaire Mike Cannon-Brookes’ family office (Grok Ventures).

- SaaSPay (a.k.a. AfterPay for digital transformation) launched. Is buy now play later all hype, or is this just the beginning?

- thedocyard (a deal management platform for lawyers/bankers) announced a merger with Ansarada (data room), subject to shareholder approval and a $45M capital raise.

- WiseTech shares jumped 34% after releasing solid FY20 results. WiseTech is part of Australia’s FAANG – WAAAX (WiseTech, Appen, Altium, Afterpay and Xero).

- It was only 2 years ago that online wine retailer, Vinomofo was hitting headlines for all the wrong reasons thanks to some analysis by Glaucus Research touting it as a flailing business. Well, this week it announced it is preparing to IPO, which could see it list with a value of AU$300+ million.

- Two shareholders and ex-employees have brought legal proceedings against self-driving car startup Zoox over its sale to Amazon. Zoox sold to Amazon in June for almost a third of its previous valuation. The lawsuit alleges that:

- the Amazon deal created disproportionate rewards for execs, board members and investors holding preferred shares at the expense of common shareholders; and

- members of the exec and the board (including Mike Cannon-Brookes) may have been conflicted in their role in progressing and approving the deal.

- Walmart’s US eCommerce sales grew 97% YoY in Q2 2021. Walmart is also about to step up competition against Amazon Prime with Walmart Plus, which is set to include same-day delivery of groceries and other merchandise sold by Walmart.

Source: Business Insider

- SpaceX raised a casual US$1.9B, making Elon Musk the fourth richest man in the world. Fun fact – Elon Musk didn’t found Tesla.

- AirBnb announced plans to go public. You’d think the pandemic would be a terrible time for a travel company to list, particularly after laying off nearly 2,000 workers, revenue dropping by 67% and raising expensive capital to survive. But, it’s 2020 and nothing really makes sense anymore, so maybe it’ll work?

- Everyone is going nuts over the new Flight Simulator X, which has been 14 years in the making. Check out this video that shows the evolution of Flight Simulator since the original 1982 version:

That’s a wrap! We hope you enjoyed it.

Gavin, Bex and the team at Ignition Lane

|

p.s. We love feedback – if you have any or want to continue the conversation, please reach out.

Trending

Daily startup news and insights, delivered to your inbox.