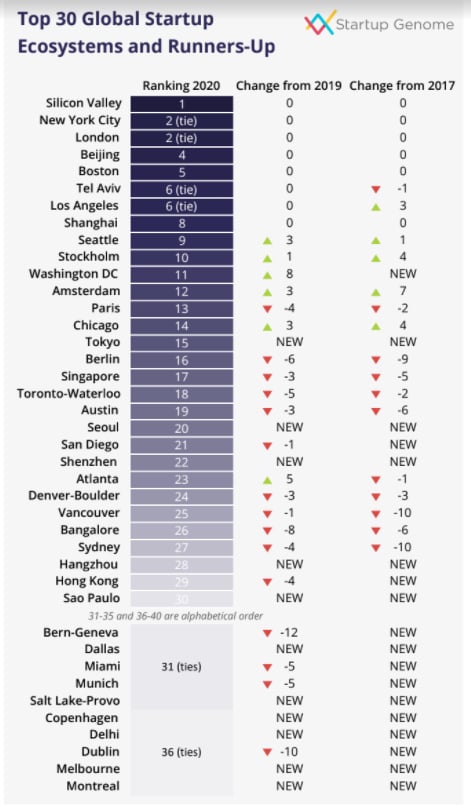

Sydney’s ongoing slide as one of the world’s best cities for startups has continued, falling another four places to 27th in the annual global rankings by US-based Startup Genome.

The NSW capital has now slipped from 17th in 2018 to 23rd last year as the report notes the rise of Asia, with Tokyo (15), Seoul (20) and Shenzen (22) making the top 30 for the first time, while Atlanta (23) in the US also leapfrogged Sydney. Hangzhou, home to Alibaba, sits just behind the Emerald City at 28.

Source: The Global Startup Ecosystem Report 2020

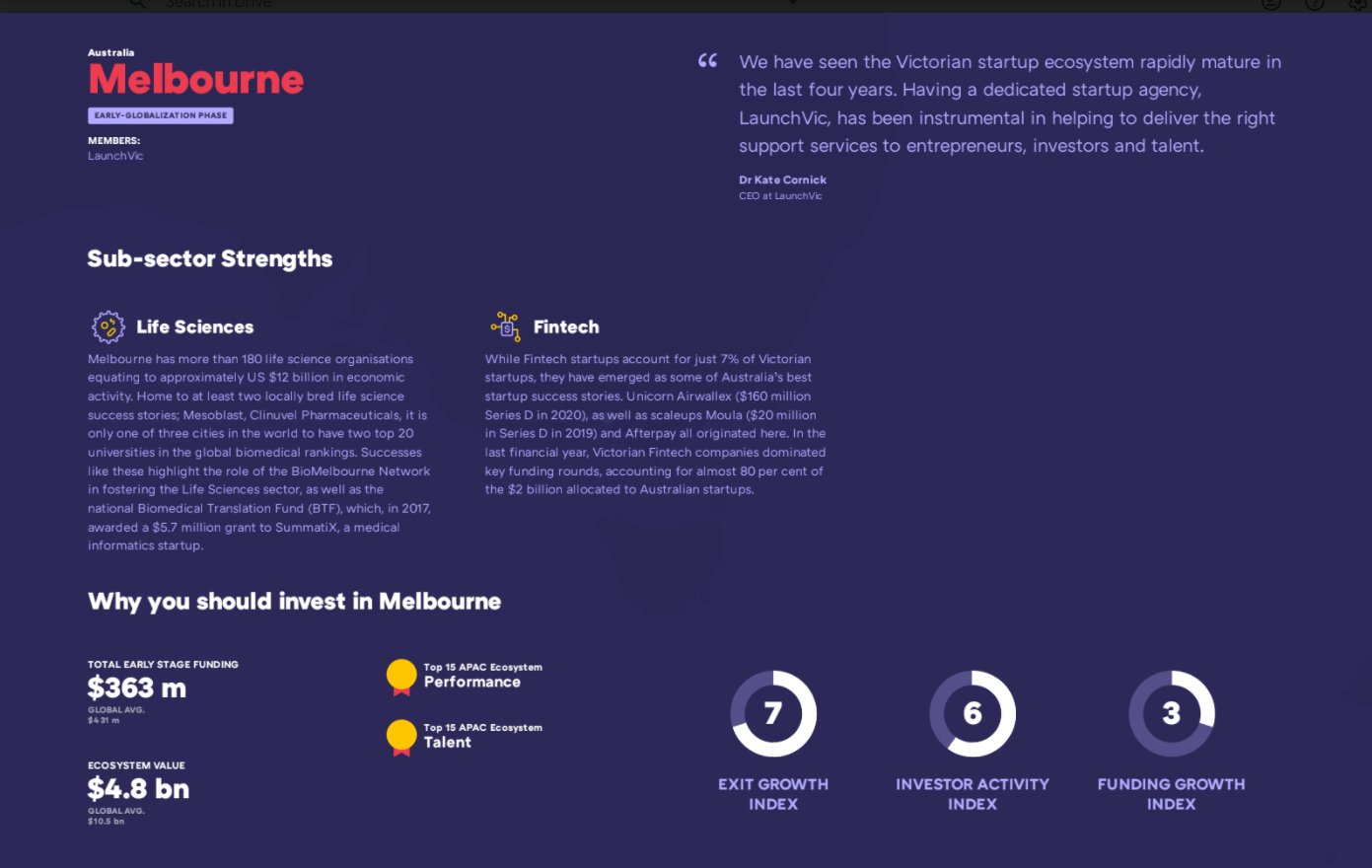

Melbourne’s star appears to be on the rise. The city was one of 10 “runner up” ecosystems, listed at equal 36th place.

“Melbourne joins the select group of top global eco-systems as a runner-up, getting closer in performance with Sydney over the years. While Sydney is still ahead of Melbourne, in some key metrics Melbourne is catching up. For example, Sydney was the first city in Australia to have a unicorn, but now Melbourne has two: Airwallex and Judo Capital,” the report says.

Melbourne’s startup ecosystem value has grown by more US$2 billion in just the past 12 months, and is currently valued at US$4.8 billion exceeding the growth expectations outlined in previous reports from Startup Genome.

It’s one of 70 cities were the ecosystem’s value exceeds US$4 billion, with strengths in the Life Sciences and Fintech sub-sectors, alongside positive diversity and inclusion statistics. It’s one of 80 cities to produce unicorns – startups worth more than US$1 billion, led by fintech Airwallex.

LaunchVic CEO, Dr Kate Cornick said the result highlights the importance of the startups to the broader economy.

“In 2018, Start Genome predicted the Melbourne ecosystem would be worth over $4 billion in a few years but have achieved this in just two years. These results show how fast our sector is developing and that it is a key contributor to the Victorian economy,” she said.

“With continued support, we expect the sector to continue to grow, create next-generation jobs and generate economic returns locally and for Australia.”

The report’s praise for Melbourne’s strength in fintech and life sciences

Brisbane features in the 71-80 band of the top 100 emerging ecosystems in the report.

Source: The Global Startup Ecosystem Report 2020

The bigger picture

For a second year, the top seven ecosystems remained the same, with Silicon Valley topping the list, and London improving to be equal second alongside New York. Beijing is 4th and Boston, 5th. London is the only city not in the top 5 in the last 5 years.

Combined the have the same value as Apple – US$1.5 trillion, 1.7 times the remaining top ecosystems.

Tel Aviv-Jerusalem and Los Angeles both sit at 6.

The 2020 State of the Global Startup Economy (GSER2020) frames the year into pre-covid and beyond, with things generally positive up to December 2019.

Once coronavirus hit, startups faced a double-whammy of capital shock and falling demand that the report warns could lead to “a mass extinction event for startups globally” with fundraising process dramatically disrupted.

“Even for startups that already had term sheets from investors before the crisis, signed or unsigned, three out of every four startups have had the fundraising process disrupted. A dramatic 18% of those startups with term sheets have had a funding round cancelled by the investor, and 54% have had their funding round delayed or the lead investor become unresponsive,” the report says.

Total VC funding has dropped dramatically across every continent and globally, it is down by 20% in the three months of 2020. China, the first country hit by the crisis, had funding drop by over 50% relative to the rest of the world. While the country is experiencing a rebound in investments in March, it still faces lower activity than in December 2019.

About 72% of startups saw their revenue drop since the beginning of the crisis, with the average startup experiencing a decline of 32%. Almost 40% of companies saw their revenue drop by 40% or more, and only about 12% are experiencing significant growth.

More than 60% of startups have laid off employees or reduced salaries. For startups reducing FTEs, an average of 33% of jobs were cut. The number of employees laid off identified in crowdsourced lists grew by a factor of 5 times between March and May 2020.

The report found that 71% of startups have reduced their expenses, with an average cost cutting of 22%.

Government intervention needed

On the policy front GSER2020 says policymakers should be focused on helping startup companies get through COVID-19 intact.

“Startups need help now and if policymakers don’t work to support them, the economic effects will be dire. Global venture capital funding has dropped roughly 20% since the onset of the pandemic in December 2019, creating ripple effects throughout startup ecosystems,” the report says.

The report argues that governments stand to make money by injecting at least 6 months worth of cash into technology startups.

“Even with a negative 10% return on equity, the cost per job saved is 41% lower for startups than for SMBs, respectively costing $14,766 or $24,928 per job saved. It simply costs less to save a job in a startup than elsewhere” it says, add that without startups, there’s less innovation at larger corporations and at SMEs as well.

And while governments are taking action, they aren’t doing enough to assist startups because relief programs “typically have strict eligibility rules and emphasise companies with revenue, profitability, and collateral” the report says, adding 43% of startups globally are not receiving assistance and/or don’t expect support.

“The first major goal of governments should be to inject capital quickly to save at least 80% of startups that are at risk of folding in 2020,” the report argues.

“The second goal should be to inject capital to increase the rate of new seed and Series A investments over the next two years, to ensure these types of investments do not drop as dramatically as they did during the 2008 recession.

“Policymakers can step into help with the development of government-led innovation procurement programs. Startups can help with addressing problems rising from the COVID-19 crisis especially startups in healthcare, social services, and online services. ”

The full 2020 Global Startup Ecosystem Report is available here.

Trending

Daily startup news and insights, delivered to your inbox.